- Malaysia

- /

- Healthcare Services

- /

- KLSE:G3

G3 Global Berhad (KLSE:G3) Screens Well But There Might Be A Catch

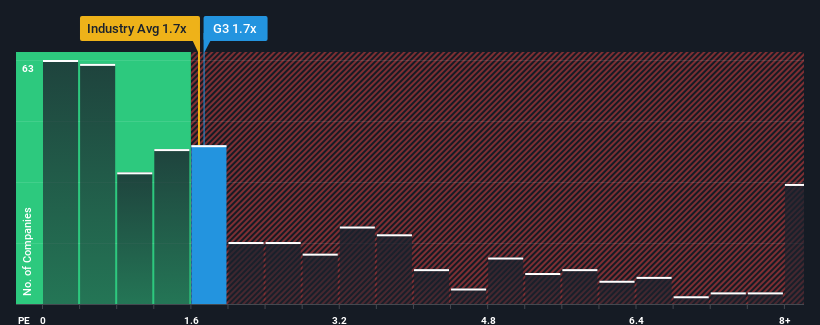

G3 Global Berhad's (KLSE:G3) price-to-sales (or "P/S") ratio of 1.7x may look like a pretty appealing investment opportunity when you consider close to half the companies in the Healthcare industry in Malaysia have P/S ratios greater than 3.2x. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for G3 Global Berhad

What Does G3 Global Berhad's P/S Mean For Shareholders?

Recent times have been quite advantageous for G3 Global Berhad as its revenue has been rising very briskly. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the P/S ratio. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on G3 Global Berhad will help you shine a light on its historical performance.Is There Any Revenue Growth Forecasted For G3 Global Berhad?

In order to justify its P/S ratio, G3 Global Berhad would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered an explosive gain to the company's top line. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

This is in contrast to the rest of the industry, which is expected to grow by 5.8% over the next year, materially lower than the company's recent medium-term annualised growth rates.

In light of this, it's peculiar that G3 Global Berhad's P/S sits below the majority of other companies. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

What Does G3 Global Berhad's P/S Mean For Investors?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of G3 Global Berhad revealed its three-year revenue trends aren't boosting its P/S anywhere near as much as we would have predicted, given they look better than current industry expectations. Potential investors that are sceptical over continued revenue performance may be preventing the P/S ratio from matching previous strong performance. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to perceive a likelihood of revenue fluctuations in the future.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for G3 Global Berhad (2 don't sit too well with us) you should be aware of.

If you're unsure about the strength of G3 Global Berhad's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KLSE:G3

G3 Global Berhad

An investment holding company, provides information and communication technology services in Malaysia.

Flawless balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives