Saudee Group Berhad (KLSE:SAUDEE) Not Doing Enough For Some Investors As Its Shares Slump 33%

Saudee Group Berhad (KLSE:SAUDEE) shareholders that were waiting for something to happen have been dealt a blow with a 33% share price drop in the last month. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 50% loss during that time.

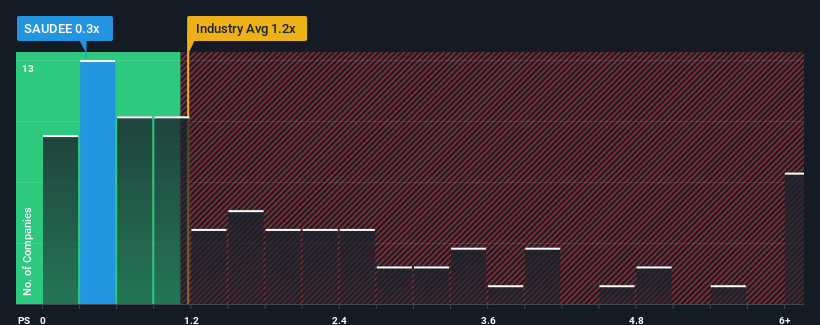

Following the heavy fall in price, considering around half the companies operating in Malaysia's Food industry have price-to-sales ratios (or "P/S") above 1.2x, you may consider Saudee Group Berhad as an solid investment opportunity with its 0.3x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Saudee Group Berhad

What Does Saudee Group Berhad's P/S Mean For Shareholders?

As an illustration, revenue has deteriorated at Saudee Group Berhad over the last year, which is not ideal at all. Perhaps the market believes the recent revenue performance isn't good enough to keep up the industry, causing the P/S ratio to suffer. Those who are bullish on Saudee Group Berhad will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Saudee Group Berhad's earnings, revenue and cash flow.Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as low as Saudee Group Berhad's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a frustrating 9.6% decrease to the company's top line. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 14% in total. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

This is in contrast to the rest of the industry, which is expected to grow by 6.9% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this information, we can see why Saudee Group Berhad is trading at a P/S lower than the industry. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

The Final Word

Saudee Group Berhad's recently weak share price has pulled its P/S back below other Food companies. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

In line with expectations, Saudee Group Berhad maintains its low P/S on the weakness of its recent three-year growth being lower than the wider industry forecast. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Before you take the next step, you should know about the 3 warning signs for Saudee Group Berhad (2 are concerning!) that we have uncovered.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:SG

SaudiGold Group Berhad

An investment holding company, produces and sells processed poultry, beef products, frozen food, and bakery products in Malaysia.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives