Stock Analysis

Investors Aren't Entirely Convinced By Pan Malaysia Corporation Berhad's (KLSE:PMCORP) Revenues

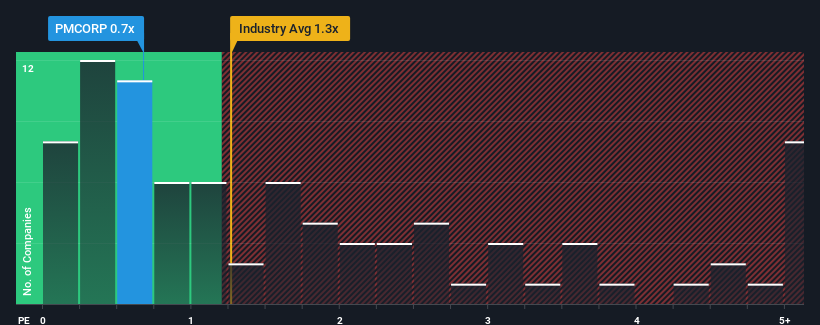

When you see that almost half of the companies in the Food industry in Malaysia have price-to-sales ratios (or "P/S") above 1.3x, Pan Malaysia Corporation Berhad (KLSE:PMCORP) looks to be giving off some buy signals with its 0.7x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for Pan Malaysia Corporation Berhad

How Pan Malaysia Corporation Berhad Has Been Performing

With revenue growth that's exceedingly strong of late, Pan Malaysia Corporation Berhad has been doing very well. Perhaps the market is expecting future revenue performance to dwindle, which has kept the P/S suppressed. Those who are bullish on Pan Malaysia Corporation Berhad will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Pan Malaysia Corporation Berhad's earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For Pan Malaysia Corporation Berhad?

In order to justify its P/S ratio, Pan Malaysia Corporation Berhad would need to produce sluggish growth that's trailing the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 132%. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 2.9% shows it's noticeably more attractive.

In light of this, it's peculiar that Pan Malaysia Corporation Berhad's P/S sits below the majority of other companies. It looks like most investors are not convinced the company can maintain its recent growth rates.

The Key Takeaway

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Pan Malaysia Corporation Berhad revealed its three-year revenue trends aren't boosting its P/S anywhere near as much as we would have predicted, given they look better than current industry expectations. When we see strong revenue with faster-than-industry growth, we assume there are some significant underlying risks to the company's ability to make money which is applying downwards pressure on the P/S ratio. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to perceive a likelihood of revenue fluctuations in the future.

Before you take the next step, you should know about the 1 warning sign for Pan Malaysia Corporation Berhad that we have uncovered.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're helping make it simple.

Find out whether Pan Malaysia Corporation Berhad is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:PMCORP

Pan Malaysia Corporation Berhad

An investment holding company, engages in the manufacturing, marketing, and distribution of Cocoa based, confectionery, and other food products in Malaysia and rest of Asia.

Adequate balance sheet unattractive dividend payer.