Stock Analysis

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, Genting Plantations Berhad (KLSE:GENP) does carry debt. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Genting Plantations Berhad

How Much Debt Does Genting Plantations Berhad Carry?

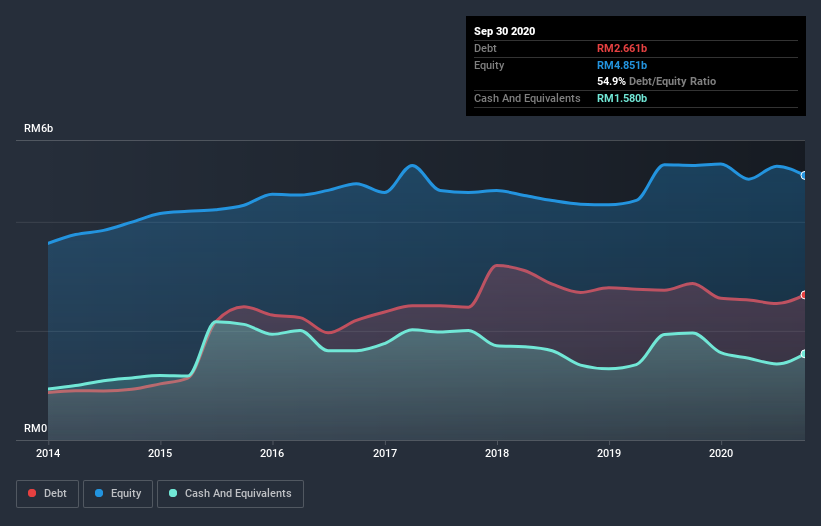

The image below, which you can click on for greater detail, shows that Genting Plantations Berhad had debt of RM2.66b at the end of September 2020, a reduction from RM2.87b over a year. However, it also had RM1.58b in cash, and so its net debt is RM1.08b.

A Look At Genting Plantations Berhad's Liabilities

The latest balance sheet data shows that Genting Plantations Berhad had liabilities of RM733.7m due within a year, and liabilities of RM2.72b falling due after that. Offsetting these obligations, it had cash of RM1.58b as well as receivables valued at RM608.5m due within 12 months. So it has liabilities totalling RM1.27b more than its cash and near-term receivables, combined.

Of course, Genting Plantations Berhad has a market capitalization of RM8.95b, so these liabilities are probably manageable. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Genting Plantations Berhad has net debt worth 2.0 times EBITDA, which isn't too much, but its interest cover looks a bit on the low side, with EBIT at only 5.2 times the interest expense. While that doesn't worry us too much, it does suggest the interest payments are somewhat of a burden. Pleasingly, Genting Plantations Berhad is growing its EBIT faster than former Australian PM Bob Hawke downs a yard glass, boasting a 102% gain in the last twelve months. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Genting Plantations Berhad's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. In the last three years, Genting Plantations Berhad created free cash flow amounting to 9.8% of its EBIT, an uninspiring performance. For us, cash conversion that low sparks a little paranoia about is ability to extinguish debt.

Our View

When it comes to the balance sheet, the standout positive for Genting Plantations Berhad was the fact that it seems able to grow its EBIT confidently. But the other factors we noted above weren't so encouraging. For instance it seems like it has to struggle a bit to convert EBIT to free cash flow. Considering this range of data points, we think Genting Plantations Berhad is in a good position to manage its debt levels. But a word of caution: we think debt levels are high enough to justify ongoing monitoring. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. Like risks, for instance. Every company has them, and we've spotted 2 warning signs for Genting Plantations Berhad (of which 1 is concerning!) you should know about.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If you decide to trade Genting Plantations Berhad, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're helping make it simple.

Find out whether Genting Plantations Berhad is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:GENP

Genting Plantations Berhad

Engages in the oil palm plantation, property development and investment, genomics research and development, and downstream manufacturing activities in Malaysia and Indonesia.

Excellent balance sheet second-rate dividend payer.