With EPS Growth And More, Guan Chong Berhad (KLSE:GCB) Makes An Interesting Case

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Guan Chong Berhad (KLSE:GCB). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Guan Chong Berhad with the means to add long-term value to shareholders.

View our latest analysis for Guan Chong Berhad

Guan Chong Berhad's Earnings Per Share Are Growing

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. That makes EPS growth an attractive quality for any company. Over the last three years, Guan Chong Berhad has grown EPS by 10% per year. That growth rate is fairly good, assuming the company can keep it up.

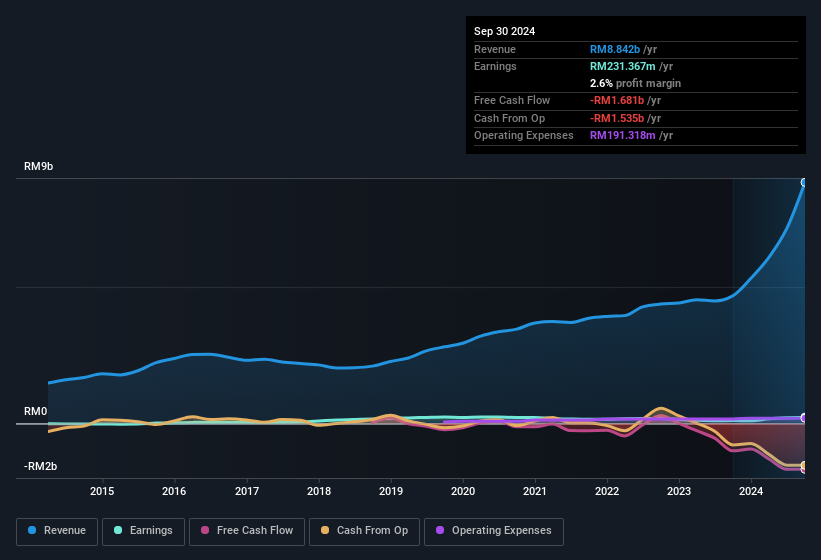

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. On the one hand, Guan Chong Berhad's EBIT margins fell over the last year, but on the other hand, revenue grew. So it seems the future may hold further growth, especially if EBIT margins can remain steady.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Guan Chong Berhad's future profits.

Are Guan Chong Berhad Insiders Aligned With All Shareholders?

It's a necessity that company leaders act in the best interest of shareholders and so insider investment always comes as a reassurance to the market. Guan Chong Berhad followers will find comfort in knowing that insiders have a significant amount of capital that aligns their best interests with the wider shareholder group. We note that their impressive stake in the company is worth RM927m. This totals to 20% of shares in the company. Enough to lead management's decision making process down a path that brings the most benefit to shareholders. Looking very optimistic for investors.

Does Guan Chong Berhad Deserve A Spot On Your Watchlist?

One positive for Guan Chong Berhad is that it is growing EPS. That's nice to see. If that's not enough on its own, there is also the rather notable levels of insider ownership. That combination is very appealing. So yes, we do think the stock is worth keeping an eye on. It is worth noting though that we have found 3 warning signs for Guan Chong Berhad (2 make us uncomfortable!) that you need to take into consideration.

Although Guan Chong Berhad certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with more skin in the game, then check out this handpicked selection of Malaysian companies that not only boast of strong growth but have strong insider backing.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:GCB

Guan Chong Berhad

An investment holding company, produces, processes, markets, and sells cocoa-derived food ingredients and cocoa products in Malaysia, Singapore, Indonesia, Germany, and internationally.

Fair value with acceptable track record.

Market Insights

Community Narratives