- Malaysia

- /

- Energy Services

- /

- KLSE:WASCO

Why The 24% Return On Capital At Wasco Berhad (KLSE:WASCO) Should Have Your Attention

If you're not sure where to start when looking for the next multi-bagger, there are a few key trends you should keep an eye out for. In a perfect world, we'd like to see a company investing more capital into its business and ideally the returns earned from that capital are also increasing. Ultimately, this demonstrates that it's a business that is reinvesting profits at increasing rates of return. And in light of that, the trends we're seeing at Wasco Berhad's (KLSE:WASCO) look very promising so lets take a look.

Understanding Return On Capital Employed (ROCE)

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. Analysts use this formula to calculate it for Wasco Berhad:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.24 = RM297m ÷ (RM2.6b - RM1.4b) (Based on the trailing twelve months to September 2024).

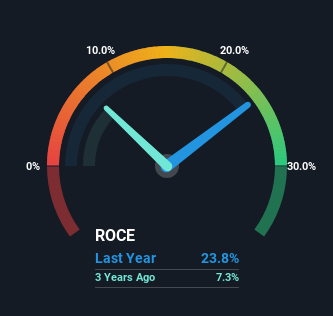

Therefore, Wasco Berhad has an ROCE of 24%. In absolute terms that's a great return and it's even better than the Energy Services industry average of 13%.

See our latest analysis for Wasco Berhad

In the above chart we have measured Wasco Berhad's prior ROCE against its prior performance, but the future is arguably more important. If you'd like, you can check out the forecasts from the analysts covering Wasco Berhad for free.

The Trend Of ROCE

Wasco Berhad's ROCE growth is quite impressive. Looking at the data, we can see that even though capital employed in the business has remained relatively flat, the ROCE generated has risen by 203% over the last five years. So it's likely that the business is now reaping the full benefits of its past investments, since the capital employed hasn't changed considerably. The company is doing well in that sense, and it's worth investigating what the management team has planned for long term growth prospects.

Another thing to note, Wasco Berhad has a high ratio of current liabilities to total assets of 53%. This can bring about some risks because the company is basically operating with a rather large reliance on its suppliers or other sorts of short-term creditors. Ideally we'd like to see this reduce as that would mean fewer obligations bearing risks.

The Key Takeaway

In summary, we're delighted to see that Wasco Berhad has been able to increase efficiencies and earn higher rates of return on the same amount of capital. And since the stock has fallen 13% over the last five years, there might be an opportunity here. With that in mind, we believe the promising trends warrant this stock for further investigation.

One more thing to note, we've identified 1 warning sign with Wasco Berhad and understanding this should be part of your investment process.

If you'd like to see other companies earning high returns, check out our free list of companies earning high returns with solid balance sheets here.

Valuation is complex, but we're here to simplify it.

Discover if Wasco Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:WASCO

Flawless balance sheet and undervalued.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026