- Malaysia

- /

- Energy Services

- /

- KLSE:T7GLOBAL

T7 Global Berhad (KLSE:T7GLOBAL) Shareholders Have Enjoyed A 28% Share Price Gain

Stock pickers are generally looking for stocks that will outperform the broader market. And while active stock picking involves risks (and requires diversification) it can also provide excess returns. For example, the T7 Global Berhad (KLSE:T7GLOBAL) share price is up 28% in the last 5 years, clearly besting the market decline of around 5.4% (ignoring dividends).

View our latest analysis for T7 Global Berhad

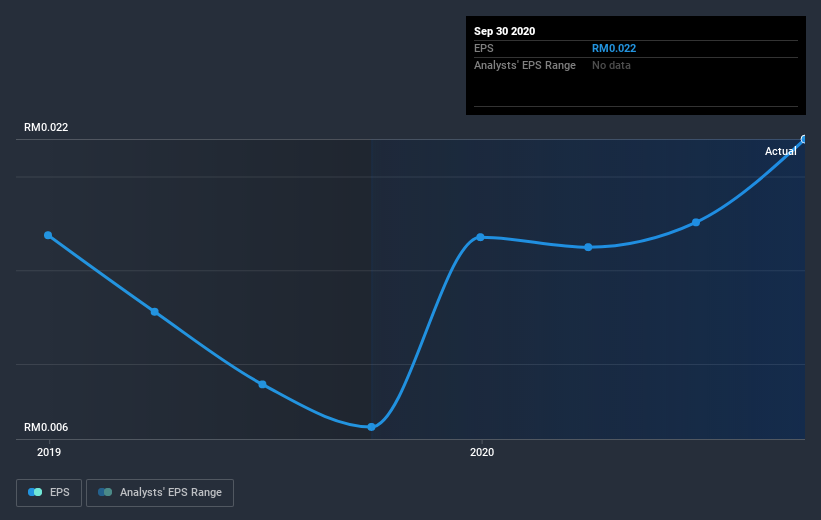

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the five years of share price growth, T7 Global Berhad moved from a loss to profitability. That would generally be considered a positive, so we'd expect the share price to be up.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

It might be well worthwhile taking a look at our free report on T7 Global Berhad's earnings, revenue and cash flow.

A Different Perspective

T7 Global Berhad shareholders are down 4.4% for the year, but the market itself is up 5.9%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Longer term investors wouldn't be so upset, since they would have made 5%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 2 warning signs for T7 Global Berhad you should be aware of.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on MY exchanges.

If you decide to trade T7 Global Berhad, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if T7 Global Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:T7GLOBAL

T7 Global Berhad

Provides integrated services to the oil and gas, and related industries in Malaysia, the United Arab Emirates, Thailand, and rest of Southeast Asia.

Fair value with moderate growth potential.

Market Insights

Community Narratives