- Malaysia

- /

- Oil and Gas

- /

- KLSE:EATECH

Despite shrinking by RM46m in the past week, E.A. Technique (M) Berhad (KLSE:EATECH) shareholders are still up 253% over 3 years

E.A. Technique (M) Berhad (KLSE:EATECH) shareholders have seen the share price descend 12% over the month. In contrast, the return over three years has been impressive. Indeed, the share price is up a very strong 253% in that time. To some, the recent share price pullback wouldn't be surprising after such a good run. The fundamental business performance will ultimately dictate whether the top is in, or if this is a stellar buying opportunity.

While this past week has detracted from the company's three-year return, let's look at the recent trends of the underlying business and see if the gains have been in alignment.

View our latest analysis for E.A. Technique (M) Berhad

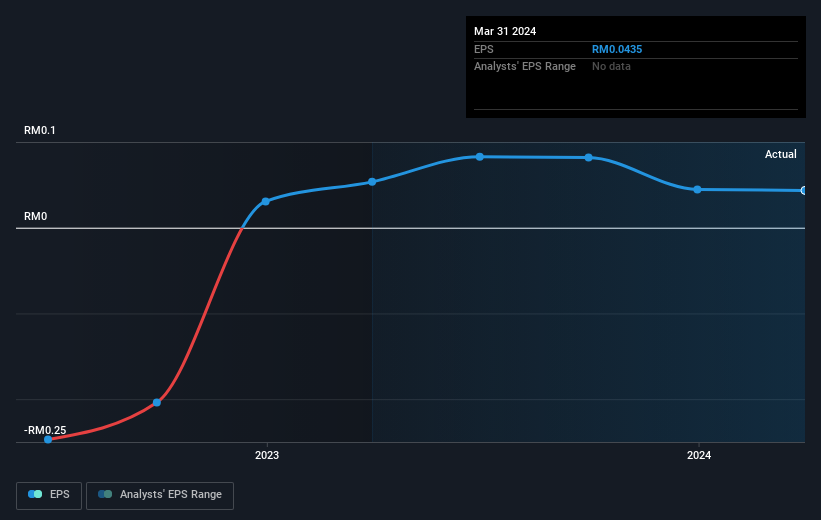

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

E.A. Technique (M) Berhad became profitable within the last three years. Given the importance of this milestone, it's not overly surprising that the share price has increased strongly.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

Dive deeper into E.A. Technique (M) Berhad's key metrics by checking this interactive graph of E.A. Technique (M) Berhad's earnings, revenue and cash flow.

A Different Perspective

It's good to see that E.A. Technique (M) Berhad has rewarded shareholders with a total shareholder return of 46% in the last twelve months. There's no doubt those recent returns are much better than the TSR loss of 4% per year over five years. This makes us a little wary, but the business might have turned around its fortunes. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 4 warning signs for E.A. Technique (M) Berhad (1 doesn't sit too well with us) that you should be aware of.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Malaysian exchanges.

Valuation is complex, but we're here to simplify it.

Discover if E.A. Technique (M) Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:EATECH

E.A. Technique (M) Berhad

Owns and operates marine vessels for the transportation and offshore storage of oil and gas in Malaysia.

Slight and slightly overvalued.