- Malaysia

- /

- Food and Staples Retail

- /

- KLSE:99SMART

99 Speed Mart Retail Holdings Berhad (KLSE:99SMART) Is About To Go Ex-Dividend, And It Pays A 2.4% Yield

It looks like 99 Speed Mart Retail Holdings Berhad (KLSE:99SMART) is about to go ex-dividend in the next 4 days. The ex-dividend date is commonly two business days before the record date, which is the cut-off date for shareholders to be present on the company's books to be eligible for a dividend payment. The ex-dividend date is important as the process of settlement involves at least two full business days. So if you miss that date, you would not show up on the company's books on the record date. This means that investors who purchase 99 Speed Mart Retail Holdings Berhad's shares on or after the 1st of December will not receive the dividend, which will be paid on the 12th of December.

The company's next dividend payment will be RM00.0225 per share. Last year, in total, the company distributed RM0.08 to shareholders. Looking at the last 12 months of distributions, 99 Speed Mart Retail Holdings Berhad has a trailing yield of approximately 2.4% on its current stock price of RM03.35. We love seeing companies pay a dividend, but it's also important to be sure that laying the golden eggs isn't going to kill our golden goose! As a result, readers should always check whether 99 Speed Mart Retail Holdings Berhad has been able to grow its dividends, or if the dividend might be cut.

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned in profit, then the dividend could be unsustainable. Fortunately 99 Speed Mart Retail Holdings Berhad's payout ratio is modest, at just 43% of profit. Yet cash flow is typically more important than profit for assessing dividend sustainability, so we should always check if the company generated enough cash to afford its dividend. What's good is that dividends were well covered by free cash flow, with the company paying out 22% of its cash flow last year.

It's encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously.

View our latest analysis for 99 Speed Mart Retail Holdings Berhad

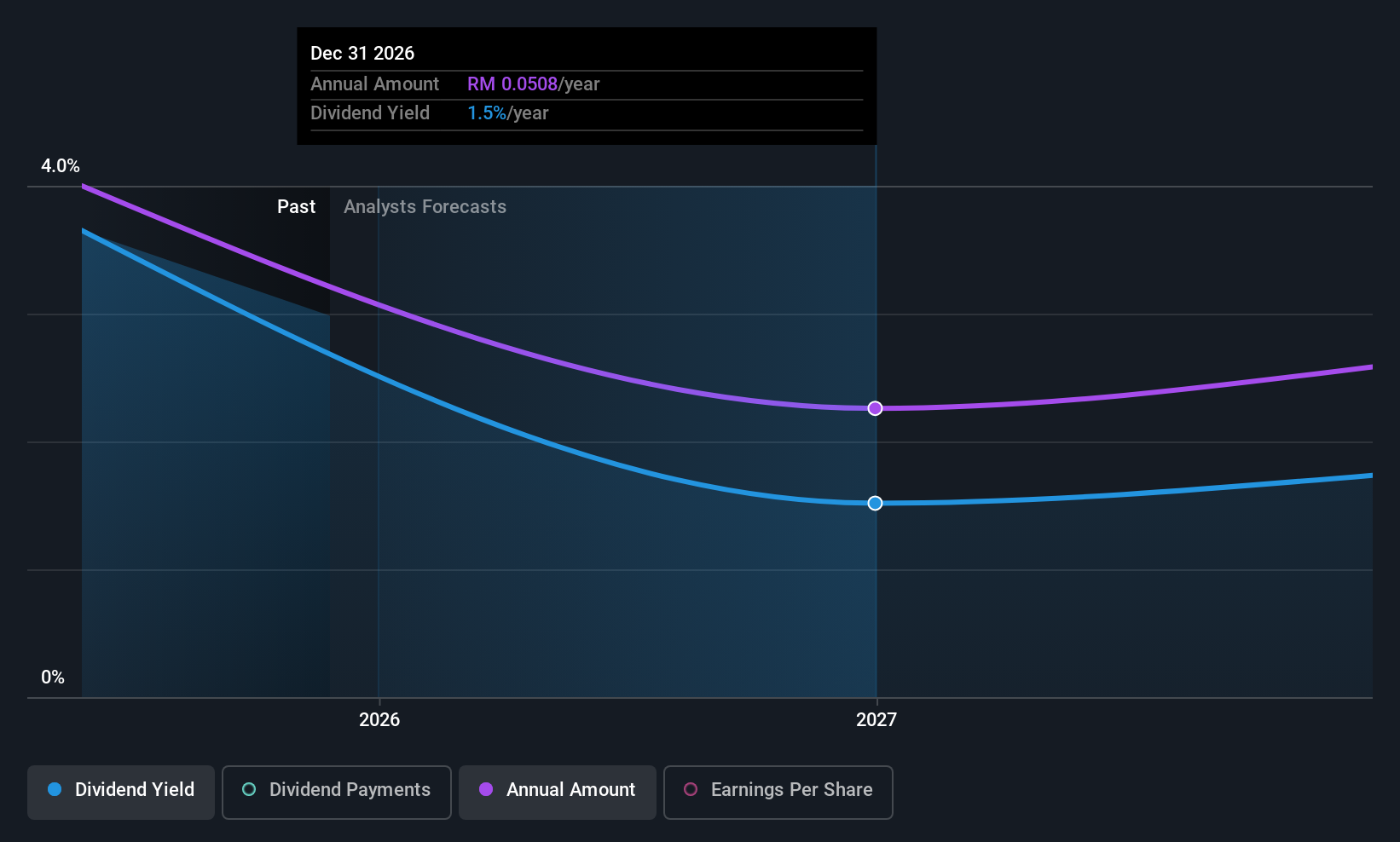

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

When earnings decline, dividend companies become much harder to analyse and own safely. If business enters a downturn and the dividend is cut, the company could see its value fall precipitously. 99 Speed Mart Retail Holdings Berhad's earnings have collapsed faster than Wile E Coyote's schemes to trap the Road Runner; down a tremendous 56% a year over the past five years.

Unfortunately 99 Speed Mart Retail Holdings Berhad has only been paying a dividend for a year or so, so there's not much of a history to draw insight from.

Final Takeaway

From a dividend perspective, should investors buy or avoid 99 Speed Mart Retail Holdings Berhad? Earnings per share are down meaningfully, although at least the company is paying out a low and conservative percentage of both its earnings and cash flow. It's definitely not great to see earnings falling, but at least there may be some buffer before the dividend needs to be cut. All things considered, we are not particularly enthused about 99 Speed Mart Retail Holdings Berhad from a dividend perspective.

Curious what other investors think of 99 Speed Mart Retail Holdings Berhad? See what analysts are forecasting, with this visualisation of its historical and future estimated earnings and cash flow.

If you're in the market for strong dividend payers, we recommend checking our selection of top dividend stocks.

Valuation is complex, but we're here to simplify it.

Discover if 99 Speed Mart Retail Holdings Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:99SMART

99 Speed Mart Retail Holdings Berhad

An investment holding company, operates mini supermarkets in Malaysia.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success