Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies Prolexus Berhad (KLSE:PRLEXUS) makes use of debt. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Prolexus Berhad

How Much Debt Does Prolexus Berhad Carry?

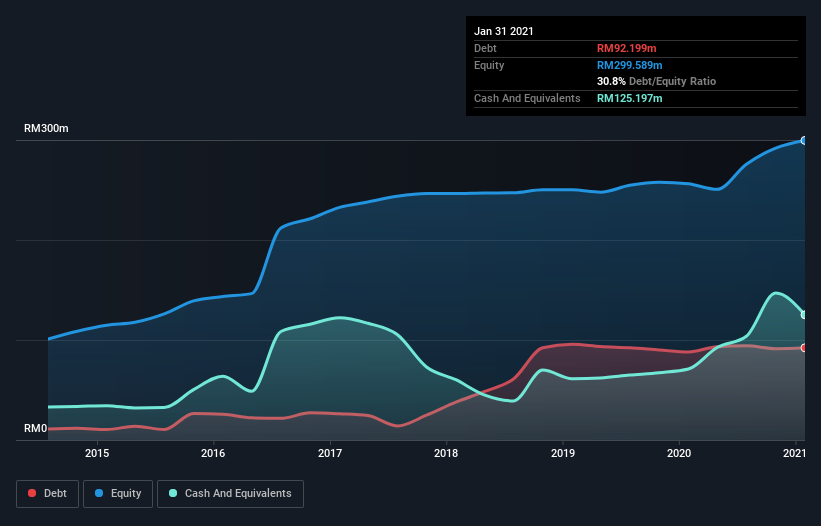

You can click the graphic below for the historical numbers, but it shows that as of January 2021 Prolexus Berhad had RM92.2m of debt, an increase on RM88.0m, over one year. However, its balance sheet shows it holds RM125.2m in cash, so it actually has RM33.0m net cash.

How Healthy Is Prolexus Berhad's Balance Sheet?

According to the last reported balance sheet, Prolexus Berhad had liabilities of RM75.2m due within 12 months, and liabilities of RM60.5m due beyond 12 months. On the other hand, it had cash of RM125.2m and RM68.1m worth of receivables due within a year. So it actually has RM57.6m more liquid assets than total liabilities.

This surplus liquidity suggests that Prolexus Berhad's balance sheet could take a hit just as well as Homer Simpson's head can take a punch. On this view, lenders should feel as safe as the beloved of a black-belt karate master. Succinctly put, Prolexus Berhad boasts net cash, so it's fair to say it does not have a heavy debt load!

Better yet, Prolexus Berhad grew its EBIT by 235% last year, which is an impressive improvement. That boost will make it even easier to pay down debt going forward. When analysing debt levels, the balance sheet is the obvious place to start. But it is Prolexus Berhad's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. Prolexus Berhad may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. In the last three years, Prolexus Berhad's free cash flow amounted to 48% of its EBIT, less than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.

Summing up

While we empathize with investors who find debt concerning, you should keep in mind that Prolexus Berhad has net cash of RM33.0m, as well as more liquid assets than liabilities. And it impressed us with its EBIT growth of 235% over the last year. So we don't think Prolexus Berhad's use of debt is risky. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. These risks can be hard to spot. Every company has them, and we've spotted 2 warning signs for Prolexus Berhad (of which 1 is a bit concerning!) you should know about.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Techbase Industries Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:TECHBASE

Techbase Industries Berhad

An investment holding company, operates in apparel business in Malaysia, the United States, Europe, Asia, and internationally.

Excellent balance sheet with low risk.

Market Insights

Community Narratives