- Malaysia

- /

- Construction

- /

- KLSE:ZELAN

We Think Zelan Berhad (KLSE:ZELAN) Is Taking Some Risk With Its Debt

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. As with many other companies Zelan Berhad (KLSE:ZELAN) makes use of debt. But the real question is whether this debt is making the company risky.

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Zelan Berhad

How Much Debt Does Zelan Berhad Carry?

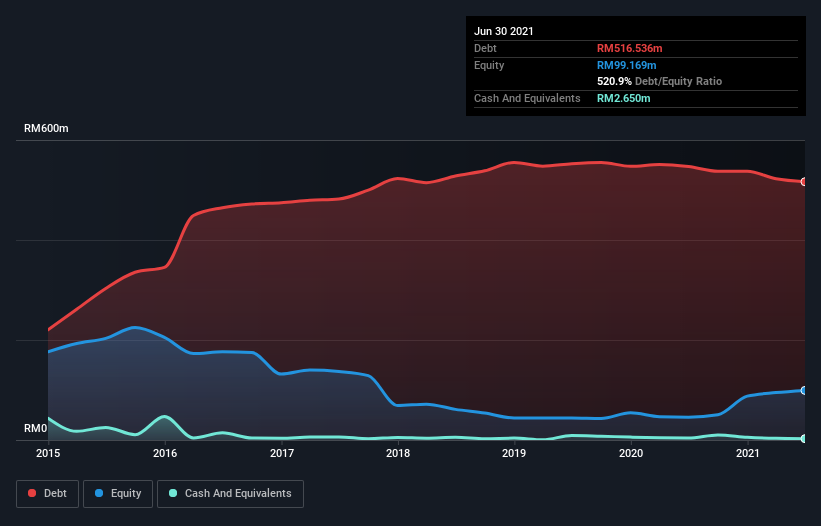

You can click the graphic below for the historical numbers, but it shows that Zelan Berhad had RM516.5m of debt in June 2021, down from RM546.9m, one year before. Net debt is about the same, since the it doesn't have much cash.

A Look At Zelan Berhad's Liabilities

Zooming in on the latest balance sheet data, we can see that Zelan Berhad had liabilities of RM272.9m due within 12 months and liabilities of RM485.1m due beyond that. Offsetting this, it had RM2.65m in cash and RM97.8m in receivables that were due within 12 months. So it has liabilities totalling RM657.4m more than its cash and near-term receivables, combined.

The deficiency here weighs heavily on the RM88.7m company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we definitely think shareholders need to watch this one closely. At the end of the day, Zelan Berhad would probably need a major re-capitalization if its creditors were to demand repayment.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

While Zelan Berhad's debt to EBITDA ratio of 9.5 suggests a heavy debt load, its interest coverage of 9.8 implies it services that debt with ease. Our best guess is that the company does indeed have significant debt obligations. Notably, Zelan Berhad's EBIT launched higher than Elon Musk, gaining a whopping 225% on last year. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Zelan Berhad's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Over the last three years, Zelan Berhad actually produced more free cash flow than EBIT. That sort of strong cash generation warms our hearts like a puppy in a bumblebee suit.

Our View

While Zelan Berhad's level of total liabilities has us nervous. For example, its conversion of EBIT to free cash flow and EBIT growth rate give us some confidence in its ability to manage its debt. Looking at all the angles mentioned above, it does seem to us that Zelan Berhad is a somewhat risky investment as a result of its debt. Not all risk is bad, as it can boost share price returns if it pays off, but this debt risk is worth keeping in mind. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. For example, we've discovered 3 warning signs for Zelan Berhad (1 can't be ignored!) that you should be aware of before investing here.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

Valuation is complex, but we're here to simplify it.

Discover if Zelan Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:ZELAN

Zelan Berhad

An investment holding company, engages in the engineering and construction in Malaysia, Indonesia, the United Arab Emirates, and the Kingdom of Saudi Arabia.

Good value with slight risk.

Market Insights

Community Narratives