- Malaysia

- /

- Construction

- /

- KLSE:WIDAD

Widad Group Berhad's (KLSE:WIDAD) Shares Leap 33% Yet They're Still Not Telling The Full Story

Widad Group Berhad (KLSE:WIDAD) shareholders have had their patience rewarded with a 33% share price jump in the last month. But the last month did very little to improve the 87% share price decline over the last year.

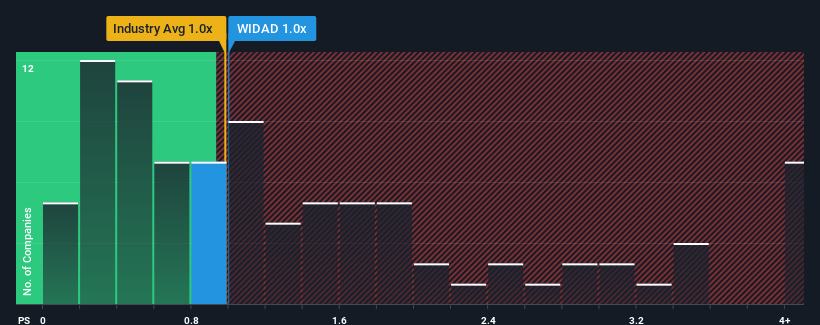

Although its price has surged higher, there still wouldn't be many who think Widad Group Berhad's price-to-sales (or "P/S") ratio of 1x is worth a mention when it essentially matches the median P/S in Malaysia's Construction industry. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Widad Group Berhad

How Has Widad Group Berhad Performed Recently?

Revenue has risen firmly for Widad Group Berhad recently, which is pleasing to see. One possibility is that the P/S is moderate because investors think this respectable revenue growth might not be enough to outperform the broader industry in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Although there are no analyst estimates available for Widad Group Berhad, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The P/S?

Widad Group Berhad's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered an exceptional 22% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 91% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

This is in contrast to the rest of the industry, which is expected to grow by 20% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we find it interesting that Widad Group Berhad is trading at a fairly similar P/S compared to the industry. It may be that most investors are not convinced the company can maintain its recent growth rates.

What We Can Learn From Widad Group Berhad's P/S?

Widad Group Berhad appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

To our surprise, Widad Group Berhad revealed its three-year revenue trends aren't contributing to its P/S as much as we would have predicted, given they look better than current industry expectations. There could be some unobserved threats to revenue preventing the P/S ratio from matching this positive performance. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to see the likelihood of revenue fluctuations in the future.

Before you take the next step, you should know about the 4 warning signs for Widad Group Berhad (3 don't sit too well with us!) that we have uncovered.

If you're unsure about the strength of Widad Group Berhad's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Widad Group Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:WIDAD

Widad Group Berhad

An investment holding company, engages in the construction and integrated facilities management activities in Malaysia.

Good value with slight risk.

Similar Companies

Market Insights

Community Narratives