- Malaysia

- /

- Construction

- /

- KLSE:VINVEST

Is Vivocom Intl Holdings Berhad (KLSE:VIVOCOM) A Risky Investment?

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that Vivocom Intl Holdings Berhad (KLSE:VIVOCOM) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Vivocom Intl Holdings Berhad

What Is Vivocom Intl Holdings Berhad's Net Debt?

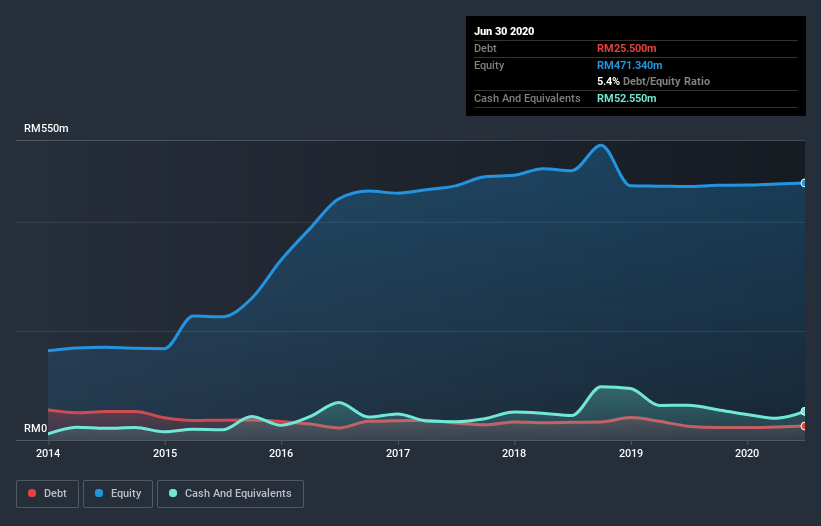

The chart below, which you can click on for greater detail, shows that Vivocom Intl Holdings Berhad had RM25.5m in debt in June 2020; about the same as the year before. But on the other hand it also has RM52.6m in cash, leading to a RM27.1m net cash position.

How Strong Is Vivocom Intl Holdings Berhad's Balance Sheet?

According to the last reported balance sheet, Vivocom Intl Holdings Berhad had liabilities of RM41.1m due within 12 months, and liabilities of RM10.3m due beyond 12 months. On the other hand, it had cash of RM52.6m and RM278.3m worth of receivables due within a year. So it can boast RM279.5m more liquid assets than total liabilities.

This luscious liquidity implies that Vivocom Intl Holdings Berhad's balance sheet is sturdy like a giant sequoia tree. On this basis we think its balance sheet is strong like a sleek panther or even a proud lion. Simply put, the fact that Vivocom Intl Holdings Berhad has more cash than debt is arguably a good indication that it can manage its debt safely.

Notably, Vivocom Intl Holdings Berhad made a loss at the EBIT level, last year, but improved that to positive EBIT of RM19m in the last twelve months. When analysing debt levels, the balance sheet is the obvious place to start. But it is Vivocom Intl Holdings Berhad's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. Vivocom Intl Holdings Berhad may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. During the last year, Vivocom Intl Holdings Berhad burned a lot of cash. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

Summing up

While it is always sensible to investigate a company's debt, in this case Vivocom Intl Holdings Berhad has RM27.1m in net cash and a decent-looking balance sheet. So we don't have any problem with Vivocom Intl Holdings Berhad's use of debt. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. Be aware that Vivocom Intl Holdings Berhad is showing 1 warning sign in our investment analysis , you should know about...

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you decide to trade Vivocom Intl Holdings Berhad, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:VINVEST

Vinvest Capital Holdings Berhad

An investment holding company, provides construction, property development, aluminium design and fabrication, and telecommunication engineering services in Malaysia.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives