Cautious Investors Not Rewarding Seremban Engineering Berhad's (KLSE:SEB) Performance Completely

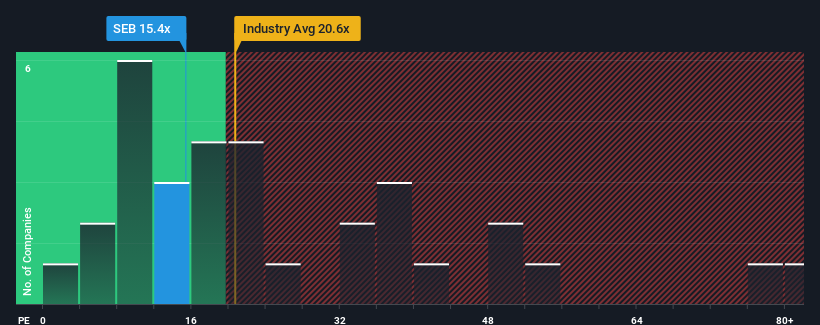

There wouldn't be many who think Seremban Engineering Berhad's (KLSE:SEB) price-to-earnings (or "P/E") ratio of 15.4x is worth a mention when the median P/E in Malaysia is similar at about 16x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

For instance, Seremban Engineering Berhad's receding earnings in recent times would have to be some food for thought. One possibility is that the P/E is moderate because investors think the company might still do enough to be in line with the broader market in the near future. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

Check out our latest analysis for Seremban Engineering Berhad

How Is Seremban Engineering Berhad's Growth Trending?

The only time you'd be comfortable seeing a P/E like Seremban Engineering Berhad's is when the company's growth is tracking the market closely.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 35%. However, a few very strong years before that means that it was still able to grow EPS by an impressive 115% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

This is in contrast to the rest of the market, which is expected to grow by 17% over the next year, materially lower than the company's recent medium-term annualised growth rates.

In light of this, it's curious that Seremban Engineering Berhad's P/E sits in line with the majority of other companies. It may be that most investors are not convinced the company can maintain its recent growth rates.

The Bottom Line On Seremban Engineering Berhad's P/E

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Seremban Engineering Berhad revealed its three-year earnings trends aren't contributing to its P/E as much as we would have predicted, given they look better than current market expectations. When we see strong earnings with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued if recent medium-term earnings trends continue, but investors seem to think future earnings could see some volatility.

Before you take the next step, you should know about the 4 warning signs for Seremban Engineering Berhad (2 are concerning!) that we have uncovered.

If these risks are making you reconsider your opinion on Seremban Engineering Berhad, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:SEB

Seremban Engineering Berhad

Engages in the manufacture, sales, and fabrication of process equipment and steel structures in Europe, Malaysia, Singapore, and the rest of Asia.

Mediocre balance sheet with low risk.

Market Insights

Community Narratives