- Malaysia

- /

- Electrical

- /

- KLSE:SCOMNET

One Supercomnet Technologies Berhad (KLSE:SCOMNET) Analyst Just Made A Major Cut To Next Year's Estimates

The latest analyst coverage could presage a bad day for Supercomnet Technologies Berhad (KLSE:SCOMNET), with the covering analyst making across-the-board cuts to their statutory estimates that might leave shareholders a little shell-shocked. Both revenue and earnings per share (EPS) forecasts went under the knife, suggesting the analyst has soured majorly on the business.

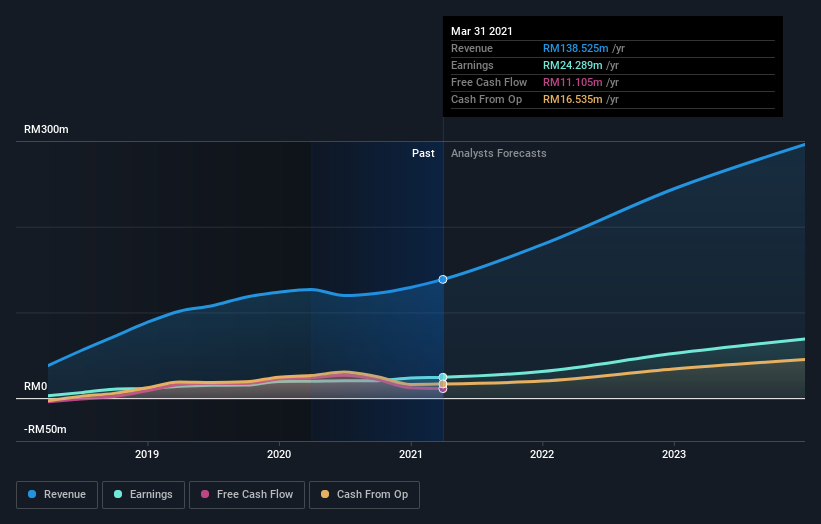

Following the downgrade, the current consensus from Supercomnet Technologies Berhad's lone analyst is for revenues of RM179m in 2021 which - if met - would reflect a sizeable 29% increase on its sales over the past 12 months. Per-share earnings are expected to surge 30% to RM0.046. Before this latest update, the analyst had been forecasting revenues of RM228m and earnings per share (EPS) of RM0.052 in 2021. It looks like analyst sentiment has declined substantially, with a sizeable cut to revenue estimates and a considerable drop in earnings per share numbers as well.

See our latest analysis for Supercomnet Technologies Berhad

The consensus price target fell 6.5% to RM2.15, with the weaker earnings outlook clearly leading analyst valuation estimates.

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. The period to the end of 2021 brings more of the same, according to the analyst, with revenue forecast to display 29% growth on an annualised basis. That is in line with its 35% annual growth over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to see their revenues grow 20% per year. So it's pretty clear that Supercomnet Technologies Berhad is forecast to grow substantially faster than its industry.

The Bottom Line

The biggest issue in the new estimates is that the analyst has reduced their earnings per share estimates, suggesting business headwinds lay ahead for Supercomnet Technologies Berhad. While the analyst did downgrade their revenue estimates, these forecasts still imply revenues will perform better than the wider market. Given the scope of the downgrades, it would not be a surprise to see the market become more wary of the business.

Still, the long-term prospects of the business are much more relevant than next year's earnings. We have analyst estimates for Supercomnet Technologies Berhad going out as far as 2023, and you can see them free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:SCOMNET

Supercomnet Technologies Berhad

Engages in the manufacture and sale of PVC compounds, and cables and wires for electronic devices and data control switches in Malaysia, the Dominican Republic, the United States, Denmark, Singapore, Taiwan, and Hong Kong.

Flawless balance sheet average dividend payer.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026