- Malaysia

- /

- Construction

- /

- KLSE:PRTASCO

Protasco Berhad's (KLSE:PRTASCO) Price Is Right But Growth Is Lacking After Shares Rocket 29%

Despite an already strong run, Protasco Berhad (KLSE:PRTASCO) shares have been powering on, with a gain of 29% in the last thirty days. The last 30 days bring the annual gain to a very sharp 91%.

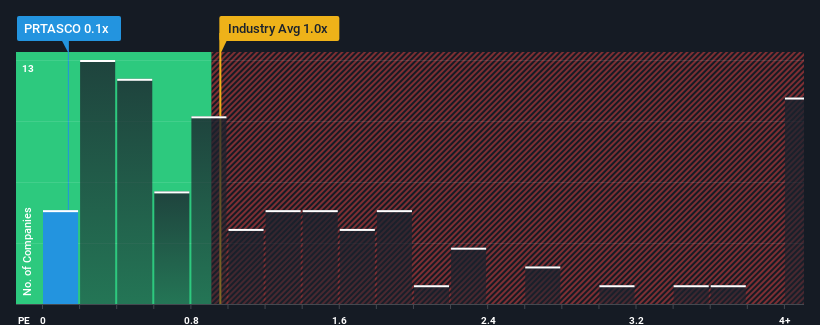

Even after such a large jump in price, considering around half the companies operating in Malaysia's Construction industry have price-to-sales ratios (or "P/S") above 1x, you may still consider Protasco Berhad as an solid investment opportunity with its 0.1x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Protasco Berhad

How Protasco Berhad Has Been Performing

Protasco Berhad has been doing a good job lately as it's been growing revenue at a solid pace. Perhaps the market is expecting this acceptable revenue performance to take a dive, which has kept the P/S suppressed. Those who are bullish on Protasco Berhad will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Protasco Berhad's earnings, revenue and cash flow.How Is Protasco Berhad's Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Protasco Berhad's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 28%. The latest three year period has also seen a 14% overall rise in revenue, aided extensively by its short-term performance. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

This is in contrast to the rest of the industry, which is expected to grow by 12% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this in consideration, it's easy to understand why Protasco Berhad's P/S falls short of the mark set by its industry peers. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the wider industry.

The Bottom Line On Protasco Berhad's P/S

The latest share price surge wasn't enough to lift Protasco Berhad's P/S close to the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Protasco Berhad confirms that the company's revenue trends over the past three-year years are a key factor in its low price-to-sales ratio, as we suspected, given they fall short of current industry expectations. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. If recent medium-term revenue trends continue, it's hard to see the share price experience a reversal of fortunes anytime soon.

Having said that, be aware Protasco Berhad is showing 2 warning signs in our investment analysis, you should know about.

If you're unsure about the strength of Protasco Berhad's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:PRTASCO

Protasco Berhad

An investment holding company, provides infrastructure solutions in Malaysia.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives