- Malaysia

- /

- Electrical

- /

- KLSE:MTEC

Master Tec Group Berhad's (KLSE:MTEC) Share Price Matching Investor Opinion

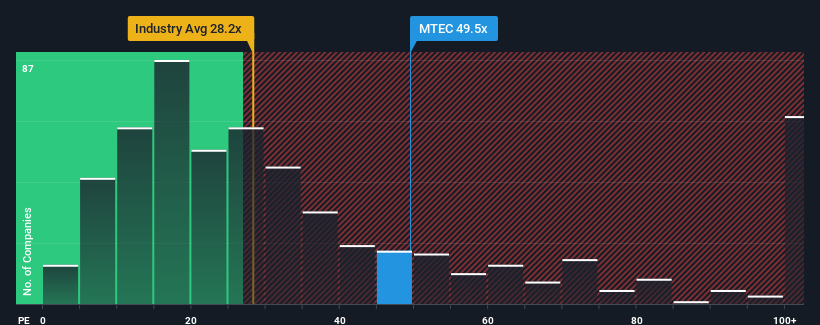

With a price-to-earnings (or "P/E") ratio of 49.5x Master Tec Group Berhad (KLSE:MTEC) may be sending very bearish signals at the moment, given that almost half of all companies in Malaysia have P/E ratios under 16x and even P/E's lower than 10x are not unusual. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Master Tec Group Berhad has been doing a good job lately as it's been growing earnings at a solid pace. One possibility is that the P/E is high because investors think this respectable earnings growth will be enough to outperform the broader market in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Master Tec Group Berhad

What Are Growth Metrics Telling Us About The High P/E?

In order to justify its P/E ratio, Master Tec Group Berhad would need to produce outstanding growth well in excess of the market.

Retrospectively, the last year delivered an exceptional 20% gain to the company's bottom line. Pleasingly, EPS has also lifted 278% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing earnings over that time.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 17% shows it's noticeably more attractive on an annualised basis.

With this information, we can see why Master Tec Group Berhad is trading at such a high P/E compared to the market. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the bourse.

The Key Takeaway

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of Master Tec Group Berhad revealed its three-year earnings trends are contributing to its high P/E, given they look better than current market expectations. Right now shareholders are comfortable with the P/E as they are quite confident earnings aren't under threat. If recent medium-term earnings trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Master Tec Group Berhad you should know about.

If you're unsure about the strength of Master Tec Group Berhad's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:MTEC

Master Tec Group Berhad

Through its subsidiary, Master Tec Wire & Cable Sdn Bhd, engages in the manufacturing and distribution of power cables, control and instrumentation cables, and other related products in Malaysia and internationally.

Excellent balance sheet with poor track record.

Similar Companies

Market Insights

Community Narratives