- Malaysia

- /

- Construction

- /

- KLSE:MERCURY

Does Mercury Industries Berhad (KLSE:MERCURY) Have A Healthy Balance Sheet?

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, Mercury Industries Berhad (KLSE:MERCURY) does carry debt. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for Mercury Industries Berhad

What Is Mercury Industries Berhad's Net Debt?

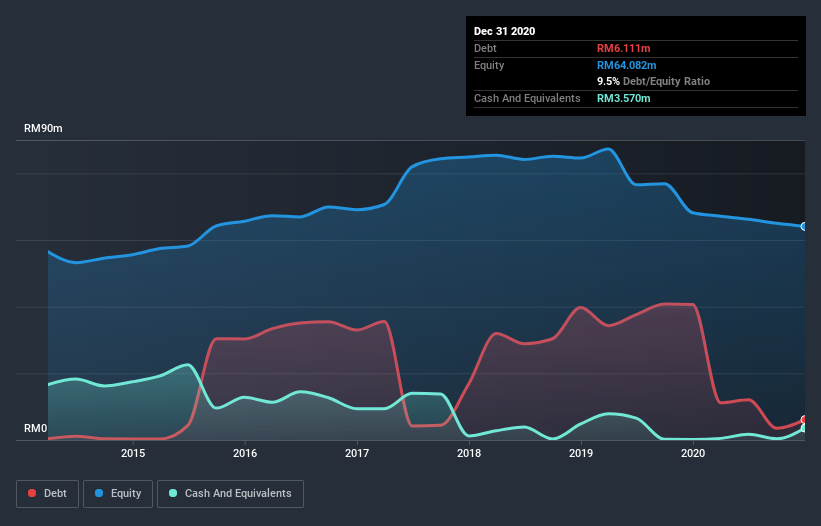

The image below, which you can click on for greater detail, shows that Mercury Industries Berhad had debt of RM6.11m at the end of December 2020, a reduction from RM40.7m over a year. However, because it has a cash reserve of RM3.57m, its net debt is less, at about RM2.54m.

How Strong Is Mercury Industries Berhad's Balance Sheet?

According to the last reported balance sheet, Mercury Industries Berhad had liabilities of RM36.0m due within 12 months, and liabilities of RM810.0k due beyond 12 months. On the other hand, it had cash of RM3.57m and RM57.2m worth of receivables due within a year. So it actually has RM24.0m more liquid assets than total liabilities.

This luscious liquidity implies that Mercury Industries Berhad's balance sheet is sturdy like a giant sequoia tree. With this in mind one could posit that its balance sheet means the company is able to handle some adversity. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Mercury Industries Berhad will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

In the last year Mercury Industries Berhad had a loss before interest and tax, and actually shrunk its revenue by 88%, to RM10m. To be frank that doesn't bode well.

Caveat Emptor

While Mercury Industries Berhad's falling revenue is about as heartwarming as a wet blanket, arguably its earnings before interest and tax (EBIT) loss is even less appealing. To be specific the EBIT loss came in at RM1.5m. That said, we're impressed with the strong balance sheet liquidity. That will give the company some time and space to grow and develop its business as need be. The company is risky because it will grow into the future to get to profitability and free cash flow. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. For example, we've discovered 3 warning signs for Mercury Industries Berhad (2 can't be ignored!) that you should be aware of before investing here.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you’re looking to trade Mercury Industries Berhad, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:MERCURY

Mercury Industries Berhad

An investment holding company, engages in the civil and building construction works in Malaysia and internationally.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success