- Malaysia

- /

- Construction

- /

- KLSE:HSSEB

Market Might Still Lack Some Conviction On HSS Engineers Berhad (KLSE:HSSEB) Even After 25% Share Price Boost

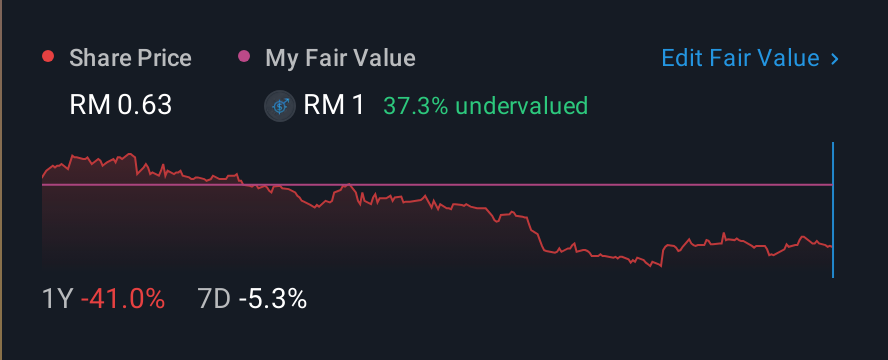

Those holding HSS Engineers Berhad (KLSE:HSSEB) shares would be relieved that the share price has rebounded 25% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 48% over that time.

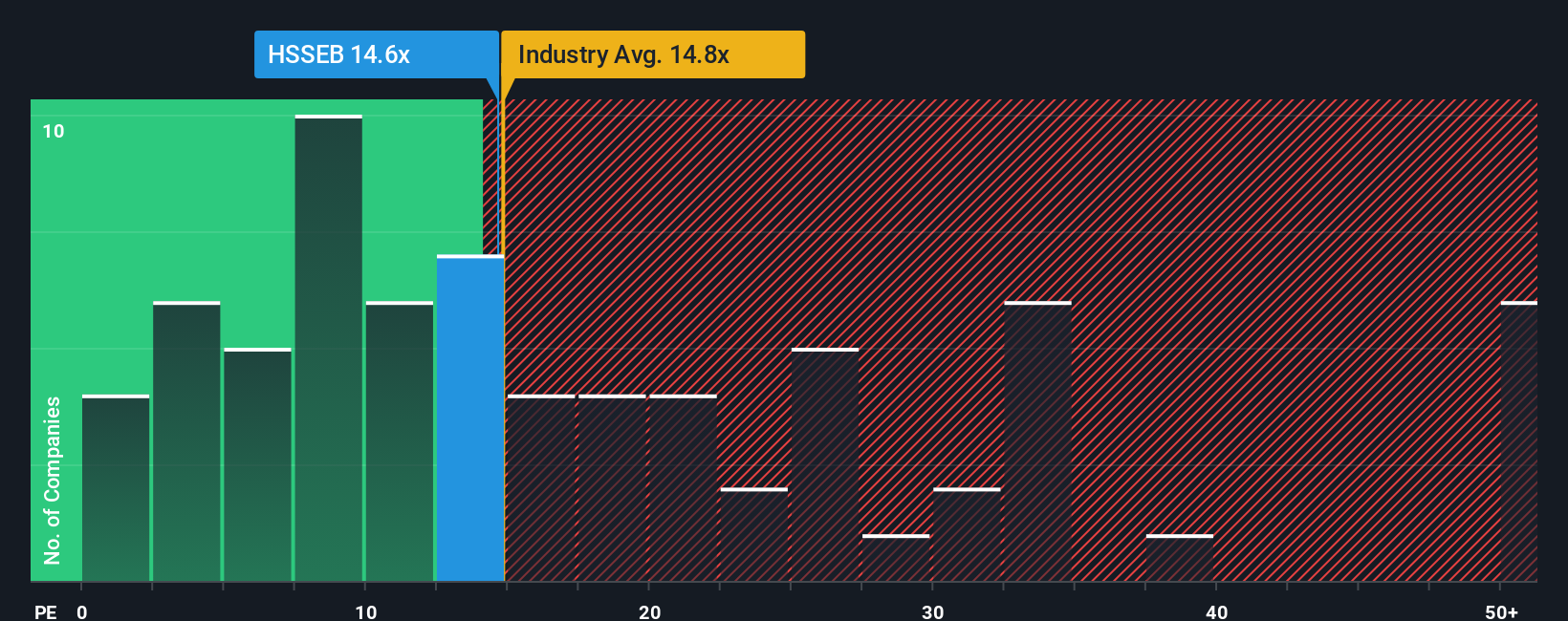

In spite of the firm bounce in price, it's still not a stretch to say that HSS Engineers Berhad's price-to-earnings (or "P/E") ratio of 14.6x right now seems quite "middle-of-the-road" compared to the market in Malaysia, where the median P/E ratio is around 14x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

HSS Engineers Berhad's earnings growth of late has been pretty similar to most other companies. The P/E is probably moderate because investors think this modest earnings performance will continue. If this is the case, then at least existing shareholders won't be losing sleep over the current share price.

View our latest analysis for HSS Engineers Berhad

Is There Some Growth For HSS Engineers Berhad?

In order to justify its P/E ratio, HSS Engineers Berhad would need to produce growth that's similar to the market.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 5.5% last year. Pleasingly, EPS has also lifted 502% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 39% per annum as estimated by the two analysts watching the company. Meanwhile, the rest of the market is forecast to only expand by 11% per annum, which is noticeably less attractive.

With this information, we find it interesting that HSS Engineers Berhad is trading at a fairly similar P/E to the market. It may be that most investors aren't convinced the company can achieve future growth expectations.

What We Can Learn From HSS Engineers Berhad's P/E?

HSS Engineers Berhad's stock has a lot of momentum behind it lately, which has brought its P/E level with the market. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of HSS Engineers Berhad's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. It appears some are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

Before you settle on your opinion, we've discovered 3 warning signs for HSS Engineers Berhad that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if HSS Engineers Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:HSSEB

HSS Engineers Berhad

An investment holding company, provides engineering and project management primarily in Malaysia, the Middle East, Cambodia, the Philippines, India, and Indonesia.

Undervalued with high growth potential.

Market Insights

Community Narratives