- Malaysia

- /

- Construction

- /

- KLSE:HSSEB

If You Had Bought HSS Engineers Berhad's (KLSE:HSSEB) Shares Three Years Ago You Would Be Down 68%

While it may not be enough for some shareholders, we think it is good to see the HSS Engineers Berhad (KLSE:HSSEB) share price up 12% in a single quarter. But that doesn't change the fact that the returns over the last three years have been disappointing. In that time, the share price dropped 68%. Some might say the recent bounce is to be expected after such a bad drop. The rise has some hopeful, but turnarounds are often precarious.

Check out our latest analysis for HSS Engineers Berhad

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

HSS Engineers Berhad became profitable within the last five years. That would generally be considered a positive, so we are surprised to see the share price is down. So given the share price is down it's worth checking some other metrics too.

With revenue flat over three years, it seems unlikely that the share price is reflecting the top line. There doesn't seem to be any clear correlation between the fundamental business metrics and the share price. That could mean that the stock was previously overrated, or it could spell opportunity now.

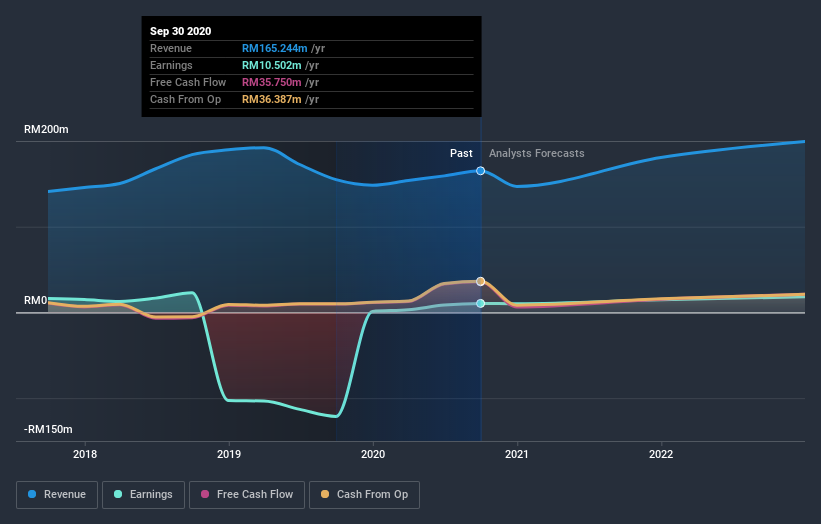

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We know that HSS Engineers Berhad has improved its bottom line lately, but what does the future have in store? So it makes a lot of sense to check out what analysts think HSS Engineers Berhad will earn in the future (free profit forecasts).

A Different Perspective

The last twelve months weren't great for HSS Engineers Berhad shares, which cost holders 39%, while the market was up about 7.9%. Of course the long term matters more than the short term, and even great stocks will sometimes have a poor year. The three-year loss of 19% per year isn't as bad as the last twelve months, suggesting that the company has not been able to convince the market it has solved its problems. We would be wary of buying into a company with unsolved problems, although some investors will buy into struggling stocks if they believe the price is sufficiently attractive. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should be aware of the 2 warning signs we've spotted with HSS Engineers Berhad .

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on MY exchanges.

If you decide to trade HSS Engineers Berhad, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if HSS Engineers Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:HSSEB

HSS Engineers Berhad

An investment holding company, provides engineering and project management primarily in Malaysia, the Middle East, Cambodia, the Philippines, India, and Indonesia.

Undervalued with high growth potential.

Market Insights

Community Narratives