These 4 Measures Indicate That Kumpulan H & L High-Tech Berhad (KLSE:HIGHTEC) Is Using Debt Reasonably Well

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that Kumpulan H & L High-Tech Berhad (KLSE:HIGHTEC) does use debt in its business. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Kumpulan H & L High-Tech Berhad

What Is Kumpulan H & L High-Tech Berhad's Net Debt?

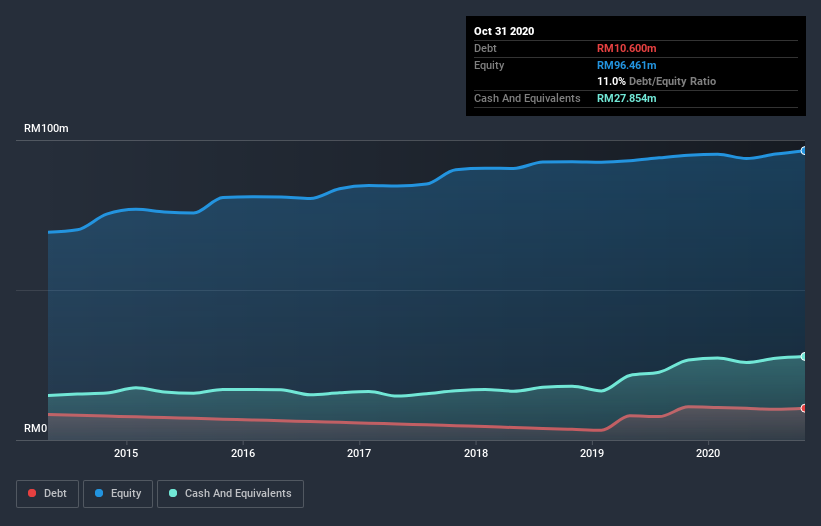

The image below, which you can click on for greater detail, shows that Kumpulan H & L High-Tech Berhad had debt of RM10.6m at the end of October 2020, a reduction from RM11.0m over a year. However, its balance sheet shows it holds RM27.9m in cash, so it actually has RM17.3m net cash.

A Look At Kumpulan H & L High-Tech Berhad's Liabilities

According to the last reported balance sheet, Kumpulan H & L High-Tech Berhad had liabilities of RM2.83m due within 12 months, and liabilities of RM25.1m due beyond 12 months. On the other hand, it had cash of RM27.9m and RM3.03m worth of receivables due within a year. So it actually has RM2.94m more liquid assets than total liabilities.

This short term liquidity is a sign that Kumpulan H & L High-Tech Berhad could probably pay off its debt with ease, as its balance sheet is far from stretched. Succinctly put, Kumpulan H & L High-Tech Berhad boasts net cash, so it's fair to say it does not have a heavy debt load!

Importantly, Kumpulan H & L High-Tech Berhad's EBIT fell a jaw-dropping 66% in the last twelve months. If that decline continues then paying off debt will be harder than selling foie gras at a vegan convention. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Kumpulan H & L High-Tech Berhad's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. While Kumpulan H & L High-Tech Berhad has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Over the most recent three years, Kumpulan H & L High-Tech Berhad recorded free cash flow worth 71% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This cold hard cash means it can reduce its debt when it wants to.

Summing up

While we empathize with investors who find debt concerning, you should keep in mind that Kumpulan H & L High-Tech Berhad has net cash of RM17.3m, as well as more liquid assets than liabilities. The cherry on top was that in converted 71% of that EBIT to free cash flow, bringing in RM2.3m. So we are not troubled with Kumpulan H & L High-Tech Berhad's debt use. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. To that end, you should learn about the 6 warning signs we've spotted with Kumpulan H & L High-Tech Berhad (including 1 which shouldn't be ignored) .

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

When trading Kumpulan H & L High-Tech Berhad or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Kumpulan H & L High-Tech Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:HIGHTEC

Kumpulan H & L High-Tech Berhad

An investment holding company, manufactures and sells precision engineering moulds, dies, jigs, fixtures, tools, and other precision machine parts in Malaysia, Europe, China, and the United States.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives