The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that Hap Seng Consolidated Berhad (KLSE:HAPSENG) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for Hap Seng Consolidated Berhad

How Much Debt Does Hap Seng Consolidated Berhad Carry?

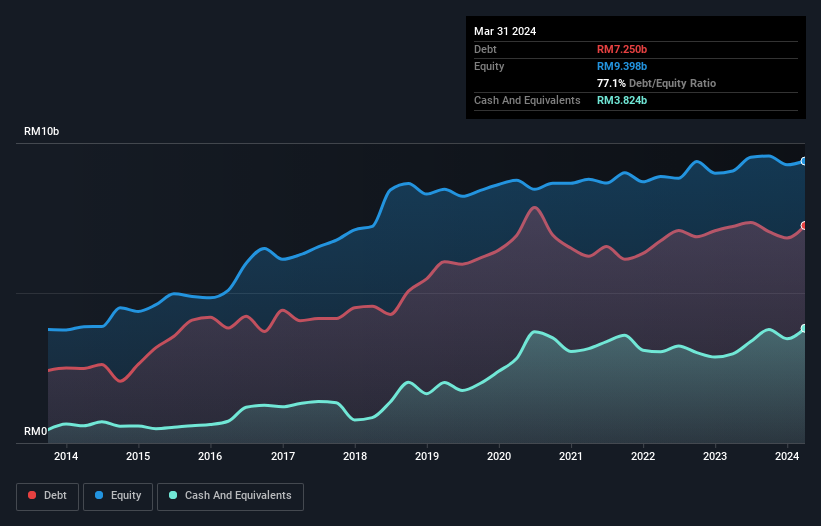

As you can see below, Hap Seng Consolidated Berhad had RM7.25b of debt, at March 2024, which is about the same as the year before. You can click the chart for greater detail. However, because it has a cash reserve of RM3.82b, its net debt is less, at about RM3.43b.

How Healthy Is Hap Seng Consolidated Berhad's Balance Sheet?

We can see from the most recent balance sheet that Hap Seng Consolidated Berhad had liabilities of RM4.41b falling due within a year, and liabilities of RM5.26b due beyond that. On the other hand, it had cash of RM3.82b and RM1.70b worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by RM4.15b.

While this might seem like a lot, it is not so bad since Hap Seng Consolidated Berhad has a market capitalization of RM10.7b, and so it could probably strengthen its balance sheet by raising capital if it needed to. However, it is still worthwhile taking a close look at its ability to pay off debt.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Hap Seng Consolidated Berhad has a debt to EBITDA ratio of 3.6 and its EBIT covered its interest expense 3.9 times. This suggests that while the debt levels are significant, we'd stop short of calling them problematic. Investors should also be troubled by the fact that Hap Seng Consolidated Berhad saw its EBIT drop by 13% over the last twelve months. If that's the way things keep going handling the debt load will be like delivering hot coffees on a pogo stick. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Hap Seng Consolidated Berhad will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Looking at the most recent three years, Hap Seng Consolidated Berhad recorded free cash flow of 25% of its EBIT, which is weaker than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.

Our View

Mulling over Hap Seng Consolidated Berhad's attempt at (not) growing its EBIT, we're certainly not enthusiastic. Having said that, its ability to handle its total liabilities isn't such a worry. Once we consider all the factors above, together, it seems to us that Hap Seng Consolidated Berhad's debt is making it a bit risky. That's not necessarily a bad thing, but we'd generally feel more comfortable with less leverage. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. For example, we've discovered 2 warning signs for Hap Seng Consolidated Berhad that you should be aware of before investing here.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

Valuation is complex, but we're here to simplify it.

Discover if Hap Seng Consolidated Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KLSE:HAPSENG

Hap Seng Consolidated Berhad

An investment holding company, engages in the plantation, property investment and development, credit financing, automotive, trading, and building materials businesses in Malaysia and internationally.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives