- Malaysia

- /

- Construction

- /

- KLSE:ECONBHD

Econpile Holdings Berhad (KLSE:ECONBHD) Stocks Pounded By 26% But Not Lagging Industry On Growth Or Pricing

The Econpile Holdings Berhad (KLSE:ECONBHD) share price has fared very poorly over the last month, falling by a substantial 26%. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 25% in that time.

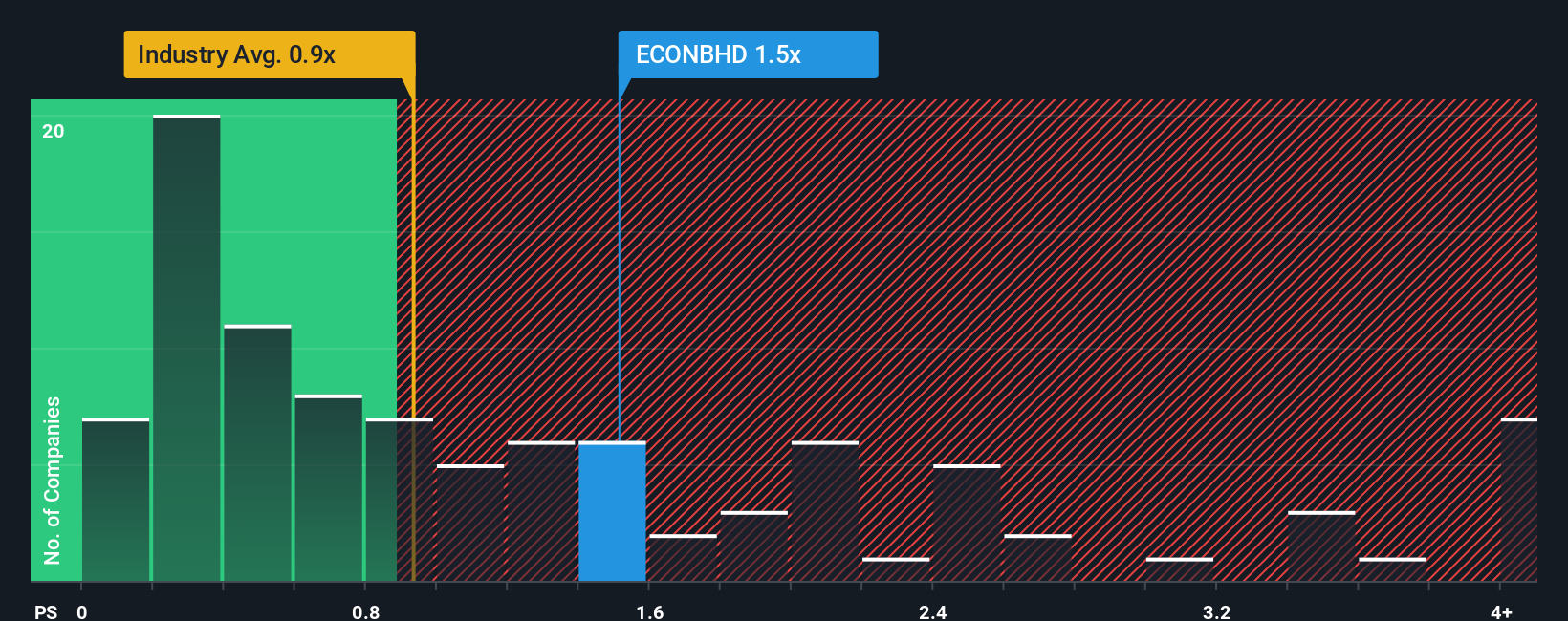

Although its price has dipped substantially, when almost half of the companies in Malaysia's Construction industry have price-to-sales ratios (or "P/S") below 0.9x, you may still consider Econpile Holdings Berhad as a stock probably not worth researching with its 1.5x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

View our latest analysis for Econpile Holdings Berhad

What Does Econpile Holdings Berhad's Recent Performance Look Like?

While the industry has experienced revenue growth lately, Econpile Holdings Berhad's revenue has gone into reverse gear, which is not great. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Econpile Holdings Berhad.Is There Enough Revenue Growth Forecasted For Econpile Holdings Berhad?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Econpile Holdings Berhad's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 32%. As a result, revenue from three years ago have also fallen 22% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 30% per annum as estimated by the two analysts watching the company. That's shaping up to be materially higher than the 22% per year growth forecast for the broader industry.

In light of this, it's understandable that Econpile Holdings Berhad's P/S sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From Econpile Holdings Berhad's P/S?

Despite the recent share price weakness, Econpile Holdings Berhad's P/S remains higher than most other companies in the industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Econpile Holdings Berhad maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Construction industry, as expected. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for Econpile Holdings Berhad with six simple checks will allow you to discover any risks that could be an issue.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Econpile Holdings Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:ECONBHD

Econpile Holdings Berhad

An investment holding company, provides piling and foundation services in Malaysia and Cambodia.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives