- Malaysia

- /

- Construction

- /

- KLSE:ECOHLDS

Benign Growth For Ecobuilt Holdings Berhad (KLSE:ECOHLDS) Underpins Its Share Price

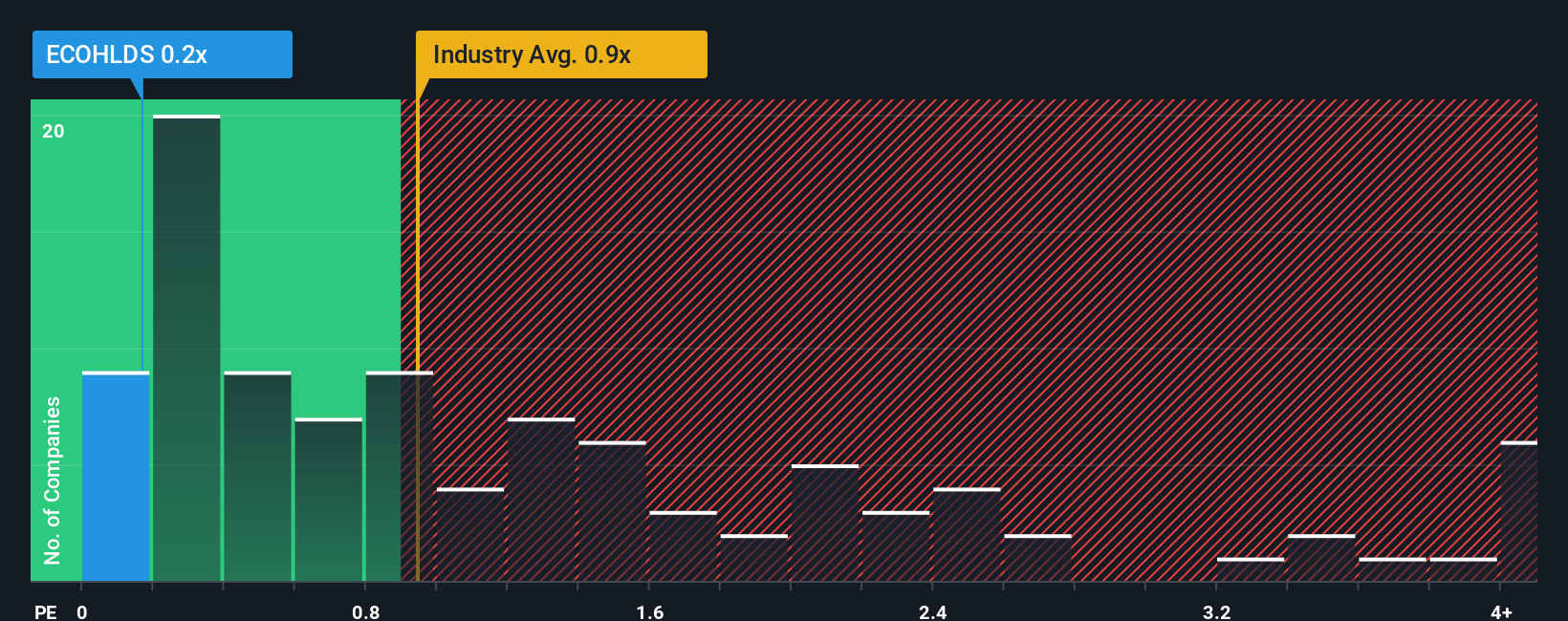

Ecobuilt Holdings Berhad's (KLSE:ECOHLDS) price-to-sales (or "P/S") ratio of 0.2x might make it look like a buy right now compared to the Construction industry in Malaysia, where around half of the companies have P/S ratios above 0.9x and even P/S above 3x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Ecobuilt Holdings Berhad

How Ecobuilt Holdings Berhad Has Been Performing

For instance, Ecobuilt Holdings Berhad's receding revenue in recent times would have to be some food for thought. It might be that many expect the disappointing revenue performance to continue or accelerate, which has repressed the P/S. Those who are bullish on Ecobuilt Holdings Berhad will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Ecobuilt Holdings Berhad's earnings, revenue and cash flow.How Is Ecobuilt Holdings Berhad's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Ecobuilt Holdings Berhad's is when the company's growth is on track to lag the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 52%. The last three years don't look nice either as the company has shrunk revenue by 61% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

In contrast to the company, the rest of the industry is expected to grow by 28% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

With this in mind, we understand why Ecobuilt Holdings Berhad's P/S is lower than most of its industry peers. However, we think shrinking revenues are unlikely to lead to a stable P/S over the longer term, which could set up shareholders for future disappointment. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

What We Can Learn From Ecobuilt Holdings Berhad's P/S?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of Ecobuilt Holdings Berhad confirms that the company's shrinking revenue over the past medium-term is a key factor in its low price-to-sales ratio, given the industry is projected to grow. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Given the current circumstances, it seems unlikely that the share price will experience any significant movement in either direction in the near future if recent medium-term revenue trends persist.

Having said that, be aware Ecobuilt Holdings Berhad is showing 2 warning signs in our investment analysis, you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Ecobuilt Holdings Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:ECOHLDS

Ecobuilt Holdings Berhad

An investment holding company, engages in the civil engineering, building contracting, and construction businesses in Malaysia.

Good value with adequate balance sheet.

Market Insights

Community Narratives