RHB Bank Berhad (KLSE:RHBBANK) Has Announced A Dividend Of MYR0.15

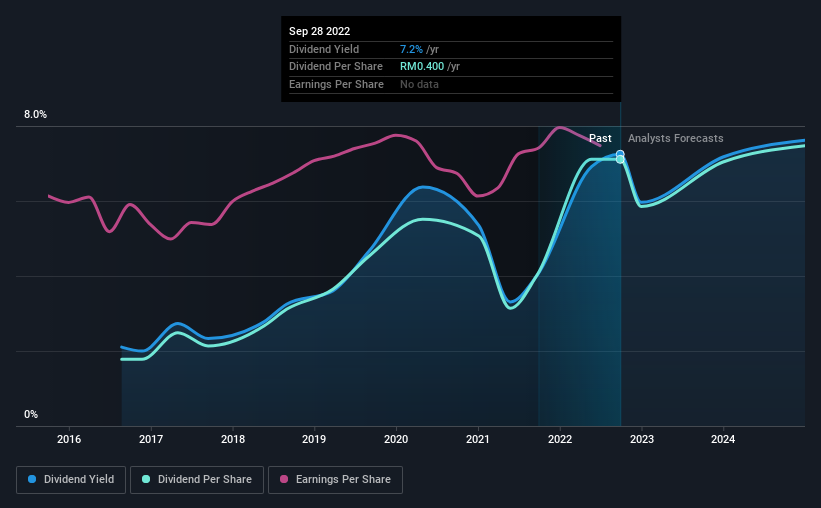

RHB Bank Berhad (KLSE:RHBBANK) will pay a dividend of MYR0.15 on the 7th of November. This makes the dividend yield 7.2%, which will augment investor returns quite nicely.

View our latest analysis for RHB Bank Berhad

RHB Bank Berhad's Earnings Will Easily Cover The Distributions

If the payments aren't sustainable, a high yield for a few years won't matter that much.

RHB Bank Berhad has established itself as a dividend paying company, given its 6-year history of distributing earnings to shareholders. Past distributions do not necessarily guarantee future ones, but RHB Bank Berhad's payout ratio of 66% is a good sign for current shareholders as this means that earnings decently cover dividends.

Looking forward, EPS is forecast to rise by 35.3% over the next 3 years. Analysts forecast the future payout ratio could be 51% over the same time horizon, which is a number we think the company can maintain.

RHB Bank Berhad's Dividend Has Lacked Consistency

It's comforting to see that RHB Bank Berhad has been paying a dividend for a number of years now, however it has been cut at least once in that time. Due to this, we are a little bit cautious about the dividend consistency over a full economic cycle. Since 2016, the dividend has gone from MYR0.10 total annually to MYR0.40. This works out to be a compound annual growth rate (CAGR) of approximately 26% a year over that time. Dividends have grown rapidly over this time, but with cuts in the past we are not certain that this stock will be a reliable source of income in the future.

We Could See RHB Bank Berhad's Dividend Growing

With a relatively unstable dividend, it's even more important to evaluate if earnings per share is growing, which could point to a growing dividend in the future. It's encouraging to see that RHB Bank Berhad has been growing its earnings per share at 6.1% a year over the past five years. Earnings are on the uptrend, and it is only paying a small portion of those earnings to shareholders.

In Summary

In summary, we are pleased with the dividend remaining consistent, and we think there is a good chance of this continuing in the future. While the payout ratios are a good sign, we are less enthusiastic about the company's dividend record. The dividend looks okay, but there have been some issues in the past, so we would be a little bit cautious.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. For example, we've identified 3 warning signs for RHB Bank Berhad (1 is significant!) that you should be aware of before investing. Is RHB Bank Berhad not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:RHBBANK

RHB Bank Berhad

Provides commercial banking and finance related products and services in Malaysia and internationally.

Excellent balance sheet average dividend payer.