- Mexico

- /

- Infrastructure

- /

- BMV:GAP B

Did You Participate In Any Of Grupo Aeroportuario del Pacífico. de's (BMV:GAPB) Respectable 77% Return?

When we invest, we're generally looking for stocks that outperform the market average. And while active stock picking involves risks (and requires diversification) it can also provide excess returns. To wit, the Grupo Aeroportuario del Pacífico. de share price has climbed 43% in five years, easily topping the market return of 2.0% (ignoring dividends).

See our latest analysis for Grupo Aeroportuario del Pacífico. de

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

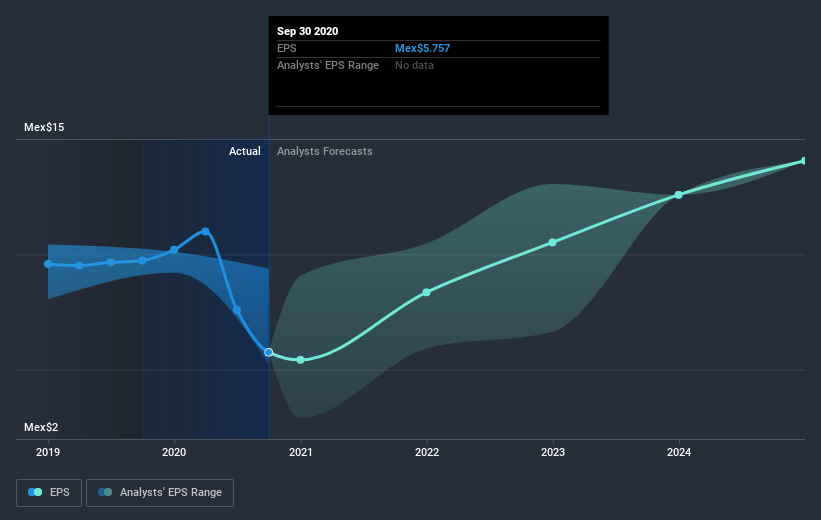

During five years of share price growth, Grupo Aeroportuario del Pacífico. de achieved compound earnings per share (EPS) growth of 4.7% per year. This EPS growth is slower than the share price growth of 7% per year, over the same period. This suggests that market participants hold the company in higher regard, these days. And that's hardly shocking given the track record of growth.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

This free interactive report on Grupo Aeroportuario del Pacífico. de's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of Grupo Aeroportuario del Pacífico. de, it has a TSR of 77% for the last 5 years. That exceeds its share price return that we previously mentioned. This is largely a result of its dividend payments!

A Different Perspective

Investors in Grupo Aeroportuario del Pacífico. de had a tough year, with a total loss of 3.9% (including dividends), against a market gain of about 1.2%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn't be so upset, since they would have made 12%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Like risks, for instance. Every company has them, and we've spotted 4 warning signs for Grupo Aeroportuario del Pacífico. de (of which 1 is a bit concerning!) you should know about.

But note: Grupo Aeroportuario del Pacífico. de may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on MX exchanges.

If you’re looking to trade Grupo Aeroportuario del Pacífico. de, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BMV:GAP B

Grupo Aeroportuario del Pacífico. de

Grupo Aeroportuario del Pacífico, S.A.B. de C.V., together with its subsidiaries, holds concessions to develop, operate, and manage airports in Mexico and Jamaica.

Reasonable growth potential with acceptable track record.