As global markets experience fluctuations, with U.S. consumer sentiment nearing record lows and concerns about elevated valuations impacting growth-oriented stocks, investors are increasingly focused on identifying opportunities that may be undervalued. In this environment, finding stocks that offer solid fundamentals and potential for growth amidst broader market uncertainties can be a strategic approach for those looking to navigate the current economic landscape effectively.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Tianqi Lithium (SZSE:002466) | CN¥57.51 | CN¥114.45 | 49.8% |

| Recupero Etico Sostenibile (BIT:RES) | €6.50 | €12.89 | 49.6% |

| PharmaEssentia (TWSE:6446) | NT$499.50 | NT$997.99 | 49.9% |

| LianChuang Electronic TechnologyLtd (SZSE:002036) | CN¥10.12 | CN¥20.06 | 49.6% |

| Genesem (KOSDAQ:A217190) | ₩9110.00 | ₩18135.98 | 49.8% |

| Doxee (BIT:DOX) | €3.72 | €7.40 | 49.7% |

| doValue (BIT:DOV) | €2.608 | €5.20 | 49.8% |

| Daiichi Sankyo Company (TSE:4568) | ¥3313.00 | ¥6603.36 | 49.8% |

| CHEMTRONICS.Co.Ltd (KOSDAQ:A089010) | ₩36000.00 | ₩72845.08 | 50.6% |

| B&S Group (ENXTAM:BSGR) | €5.94 | €11.85 | 49.9% |

Let's review some notable picks from our screened stocks.

Grupo Aeroportuario del Sureste S. A. B. de C. V (BMV:ASUR B)

Overview: Grupo Aeroportuario del Sureste, S. A. B. de C. V operates airport facilities and services across Mexico, the Caribbean, and South America with a market cap of MX$171.10 billion.

Operations: The company's revenue segments include operations in Colombia (MX$3.79 billion), Mexico - Cancun (MX$20.37 billion), Mexico - Merida (MX$1.75 billion), Mexico - Villahermosa (MX$661.60 million), other airports in Mexico (MX$3.33 billion), and San Juan, Puerto Rico, US (MX$5.39 billion).

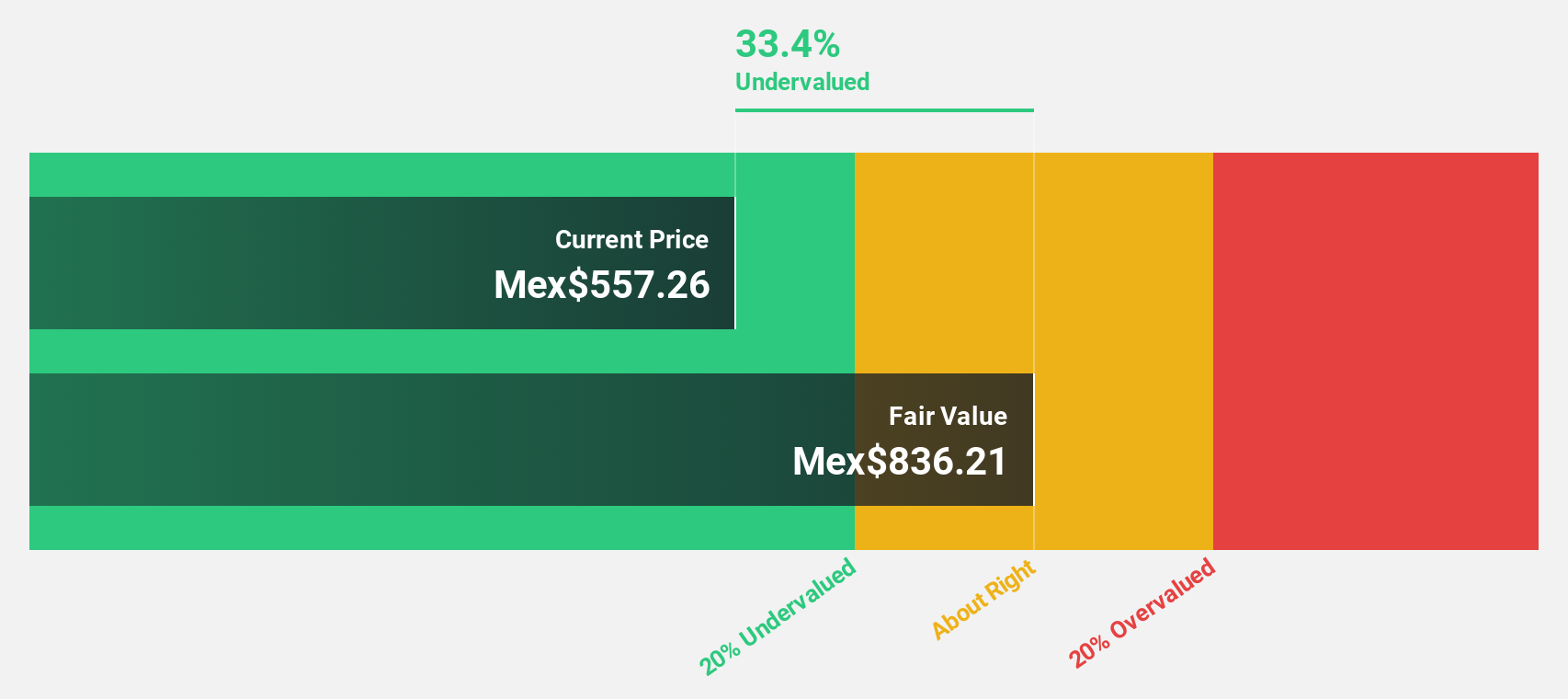

Estimated Discount To Fair Value: 31.8%

Grupo Aeroportuario del Sureste S.A.B. de C.V. is trading at MX$570.33, significantly below its estimated fair value of MX$836.19, indicating it may be undervalued based on cash flows. Despite a modest 13.48% forecasted annual earnings growth and high return on equity projected at 30.1%, the company faces challenges with a dividend yield of 14.03% that isn't well covered by earnings or free cash flow, highlighting potential financial strain despite robust revenue projections exceeding market growth rates.

- Our expertly prepared growth report on Grupo Aeroportuario del Sureste S. A. B. de C. V implies its future financial outlook may be stronger than recent results.

- Take a closer look at Grupo Aeroportuario del Sureste S. A. B. de C. V's balance sheet health here in our report.

Otokar Otomotiv ve Savunma Sanayi (IBSE:OTKAR)

Overview: Otokar Otomotiv ve Savunma Sanayi A.S. manufactures and sells commercial and defense vehicles in Turkey, with a market cap of TRY59.40 billion.

Operations: The company's revenue is derived from the manufacturing and sale of commercial and defense industry vehicles in Turkey.

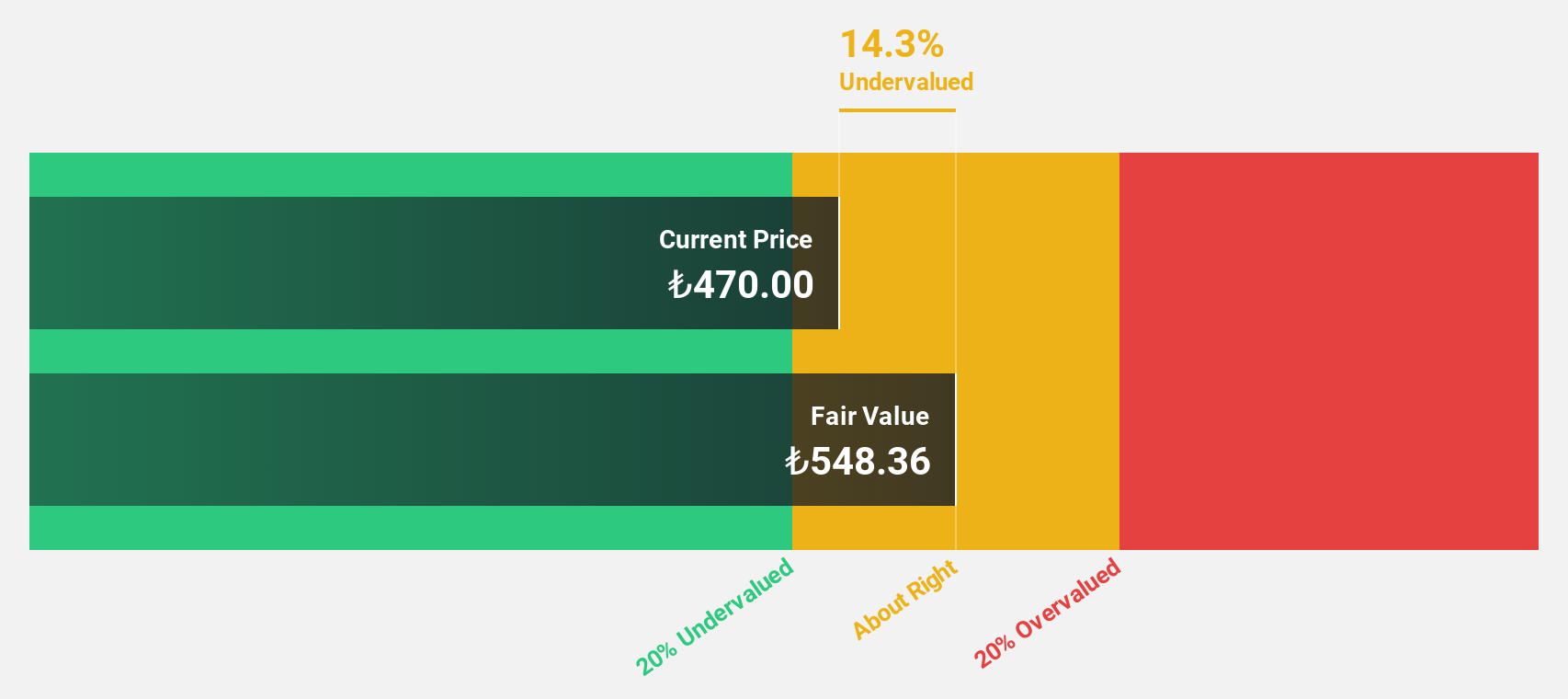

Estimated Discount To Fair Value: 10.1%

Otokar Otomotiv ve Savunma Sanayi is trading at TRY495, slightly below its fair value estimate of TRY550.35, suggesting undervaluation based on cash flows. Despite reporting a net loss of TRY 350.61 million for the third quarter, improved from last year's larger loss, revenue growth is strong and expected to outpace the Turkish market significantly. Analysts forecast profitability within three years with high return on equity projections, though interest coverage remains a concern.

- According our earnings growth report, there's an indication that Otokar Otomotiv ve Savunma Sanayi might be ready to expand.

- Get an in-depth perspective on Otokar Otomotiv ve Savunma Sanayi's balance sheet by reading our health report here.

Tianqi Lithium (SZSE:002466)

Overview: Tianqi Lithium Corporation engages in the investment, production, processing, extraction, and sale of lithium and its compounds across Australia, Chile, and China with a market cap of CN¥92.08 billion.

Operations: The company generates revenue from the investment, production, processing, extraction, and sale of lithium products and specialty compounds in Australia, Chile, and China.

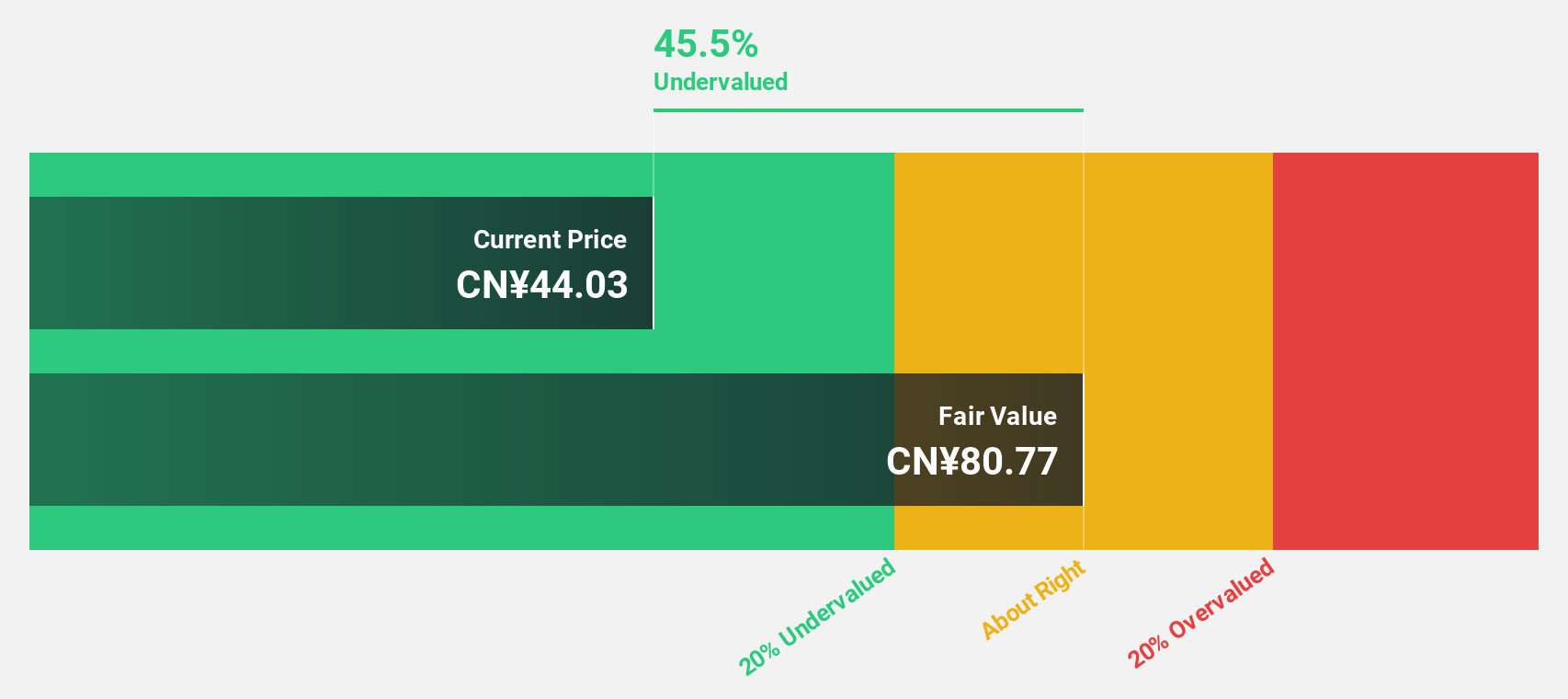

Estimated Discount To Fair Value: 49.8%

Tianqi Lithium, trading at CN¥57.51, is significantly undervalued compared to its fair value estimate of CN¥114.45. Despite recent revenue declines, the company has turned a net income of CN¥179.9 million for the first nine months of 2025 from a substantial loss last year, with earnings per share improving to CN¥0.11. Analysts project robust annual profit growth and profitability within three years, although return on equity forecasts remain modest at 7.1%.

- Upon reviewing our latest growth report, Tianqi Lithium's projected financial performance appears quite optimistic.

- Unlock comprehensive insights into our analysis of Tianqi Lithium stock in this financial health report.

Make It Happen

- Access the full spectrum of 510 Undervalued Global Stocks Based On Cash Flows by clicking on this link.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tianqi Lithium might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002466

Tianqi Lithium

Invests, produces, process, extracts, and sells lithium, lithium concentrate, and the lithium specialty compounds in Australia, Chile, and China.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives