Investors Who Bought Genomma Lab Internacional. de (BMV:LABB) Shares Five Years Ago Are Now Up 65%

Generally speaking the aim of active stock picking is to find companies that provide returns that are superior to the market average. And the truth is, you can make significant gains if you buy good quality businesses at the right price. For example, long term Genomma Lab Internacional, S.A.B. de C.V. (BMV:LABB) shareholders have enjoyed a 65% share price rise over the last half decade, well in excess of the market return of around 4.7% (not including dividends). On the other hand, the more recent gains haven't been so impressive, with shareholders gaining just 17%.

See our latest analysis for Genomma Lab Internacional. de

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the last half decade, Genomma Lab Internacional. de became profitable. That would generally be considered a positive, so we'd expect the share price to be up. Given that the company made a profit three years ago, but not five years ago, it is worth looking at the share price returns over the last three years, too. We can see that the Genomma Lab Internacional. de share price is up 4.1% in the last three years. Meanwhile, EPS is up 2.8% per year. This EPS growth is higher than the 1.3% average annual increase in the share price over the same three years. So you might conclude the market is a little more cautious about the stock, these days.

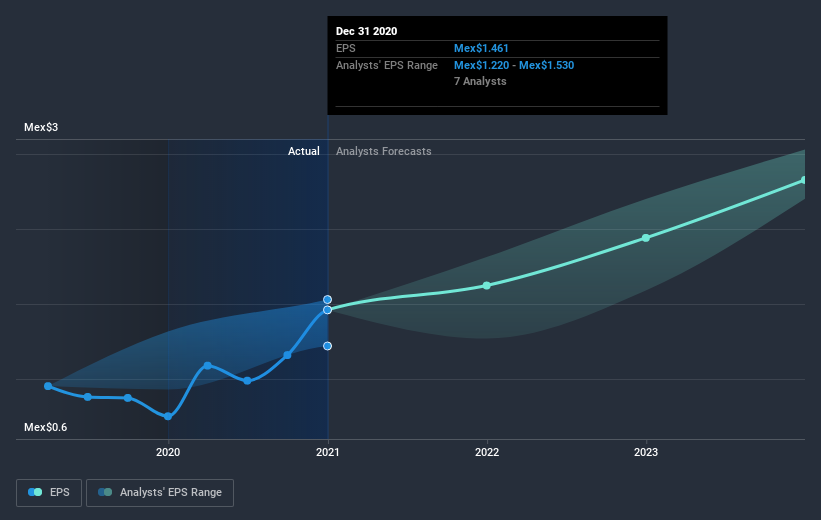

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

We know that Genomma Lab Internacional. de has improved its bottom line lately, but is it going to grow revenue? You could check out this free report showing analyst revenue forecasts.

A Different Perspective

Genomma Lab Internacional. de shareholders are up 17% for the year. But that was short of the market average. The silver lining is that the gain was actually better than the average annual return of 10% per year over five year. This could indicate that the company is winning over new investors, as it pursues its strategy. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 1 warning sign for Genomma Lab Internacional. de that you should be aware of.

We will like Genomma Lab Internacional. de better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on MX exchanges.

If you’re looking to trade Genomma Lab Internacional. de, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BMV:LAB B

Genomma Lab Internacional. de

Provides pharmaceutical and personal care products primarily in Mexico and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives