- Mexico

- /

- Metals and Mining

- /

- BMV:PE&OLES *

These 4 Measures Indicate That Industrias Peñoles. de (BMV:PE&OLES) Is Using Debt Reasonably Well

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, Industrias Peñoles, S.A.B. de C.V. (BMV:PE&OLES) does carry debt. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for Industrias Peñoles. de

What Is Industrias Peñoles. de's Net Debt?

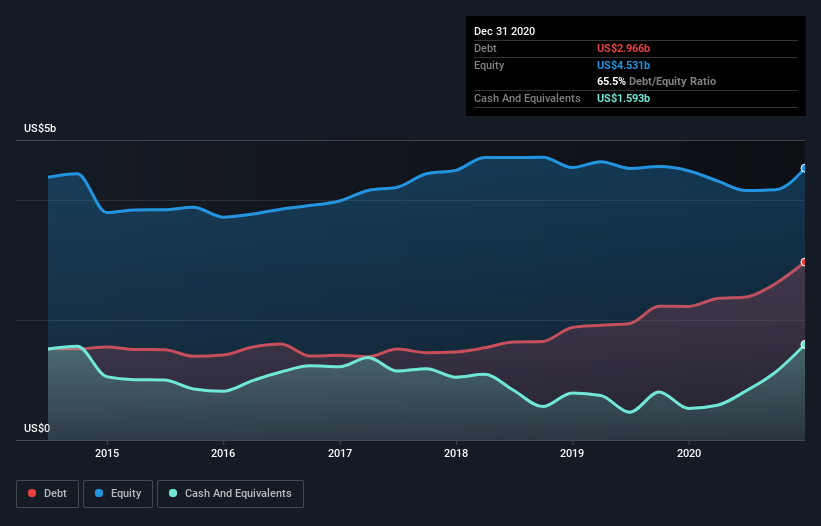

As you can see below, at the end of December 2020, Industrias Peñoles. de had US$2.97b of debt, up from US$2.23b a year ago. Click the image for more detail. However, it also had US$1.59b in cash, and so its net debt is US$1.37b.

How Strong Is Industrias Peñoles. de's Balance Sheet?

According to the last reported balance sheet, Industrias Peñoles. de had liabilities of US$994.2m due within 12 months, and liabilities of US$3.73b due beyond 12 months. Offsetting this, it had US$1.59b in cash and US$608.1m in receivables that were due within 12 months. So it has liabilities totalling US$2.52b more than its cash and near-term receivables, combined.

This deficit isn't so bad because Industrias Peñoles. de is worth US$5.66b, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. But it's clear that we should definitely closely examine whether it can manage its debt without dilution.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

While Industrias Peñoles. de's low debt to EBITDA ratio of 0.97 suggests only modest use of debt, the fact that EBIT only covered the interest expense by 4.5 times last year does give us pause. So we'd recommend keeping a close eye on the impact financing costs are having on the business. Notably, Industrias Peñoles. de's EBIT launched higher than Elon Musk, gaining a whopping 203% on last year. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if Industrias Peñoles. de can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Over the last three years, Industrias Peñoles. de recorded negative free cash flow, in total. Debt is far more risky for companies with unreliable free cash flow, so shareholders should be hoping that the past expenditure will produce free cash flow in the future.

Our View

On our analysis Industrias Peñoles. de's EBIT growth rate should signal that it won't have too much trouble with its debt. But the other factors we noted above weren't so encouraging. To be specific, it seems about as good at converting EBIT to free cash flow as wet socks are at keeping your feet warm. When we consider all the factors mentioned above, we do feel a bit cautious about Industrias Peñoles. de's use of debt. While debt does have its upside in higher potential returns, we think shareholders should definitely consider how debt levels might make the stock more risky. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. To that end, you should learn about the 2 warning signs we've spotted with Industrias Peñoles. de (including 1 which is concerning) .

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

When trading Industrias Peñoles. de or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BMV:PE&OLES *

Industrias Peñoles. de

Engages in the exploration, extraction, and sale of mineral concentrates and ores in Mexico, Europe, Asia, North America, South America, and internationally.

Excellent balance sheet with questionable track record.