- Mexico

- /

- Metals and Mining

- /

- BMV:MFRISCO A-1

Minera Frisco, S.A.B. de C.V.'s (BMV:MFRISCOA-1) Business Is Trailing The Industry But Its Shares Aren't

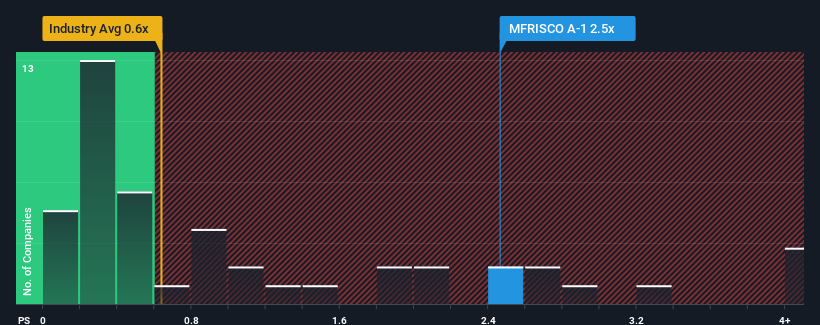

When you see that almost half of the companies in the Metals and Mining industry in Mexico have price-to-sales ratios (or "P/S") below 2x, Minera Frisco, S.A.B. de C.V. (BMV:MFRISCOA-1) looks to be giving off some sell signals with its 2.5x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

See our latest analysis for Minera Frisco. de

What Does Minera Frisco. de's Recent Performance Look Like?

For instance, Minera Frisco. de's receding revenue in recent times would have to be some food for thought. Perhaps the market believes the company can do enough to outperform the rest of the industry in the near future, which is keeping the P/S ratio high. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Minera Frisco. de's earnings, revenue and cash flow.How Is Minera Frisco. de's Revenue Growth Trending?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Minera Frisco. de's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 19% decrease to the company's top line. As a result, revenue from three years ago have also fallen 28% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 108% shows it's an unpleasant look.

With this information, we find it concerning that Minera Frisco. de is trading at a P/S higher than the industry. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

What We Can Learn From Minera Frisco. de's P/S?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of Minera Frisco. de revealed its shrinking revenue over the medium-term isn't resulting in a P/S as low as we expected, given the industry is set to grow. When we see revenue heading backwards and underperforming the industry forecasts, we feel the possibility of the share price declining is very real, bringing the P/S back into the realm of reasonability. Unless the recent medium-term conditions improve markedly, investors will have a hard time accepting the share price as fair value.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Minera Frisco. de that you need to be mindful of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BMV:MFRISCO A-1

Minera Frisco. de

Engages in the exploration and exploitation of mining lots for the production and sale of gold and silver doré in Mexico.

Acceptable track record with very low risk.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success