Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that Becle, S.A.B. de C.V. (BMV:CUERVO) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Becle. de

How Much Debt Does Becle. de Carry?

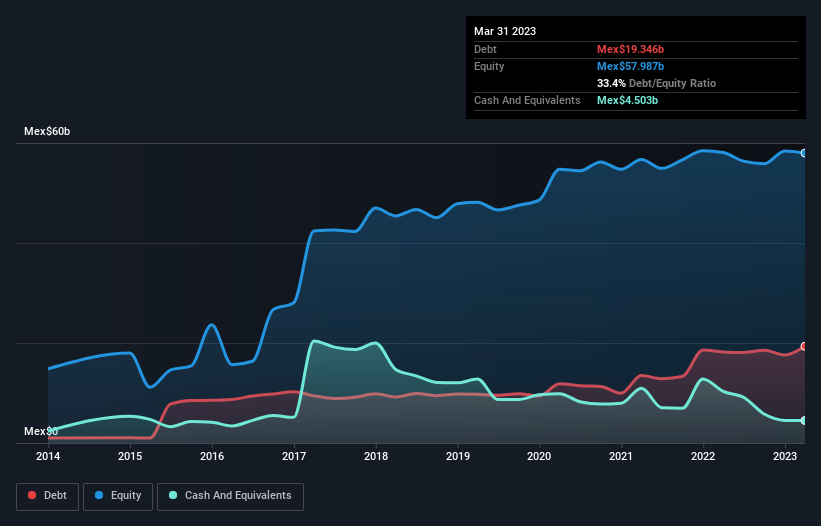

As you can see below, at the end of March 2023, Becle. de had Mex$19.3b of debt, up from Mex$18.2b a year ago. Click the image for more detail. However, because it has a cash reserve of Mex$4.50b, its net debt is less, at about Mex$14.8b.

How Strong Is Becle. de's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Becle. de had liabilities of Mex$14.6b due within 12 months and liabilities of Mex$22.4b due beyond that. On the other hand, it had cash of Mex$4.50b and Mex$10.9b worth of receivables due within a year. So it has liabilities totalling Mex$21.5b more than its cash and near-term receivables, combined.

Of course, Becle. de has a market capitalization of Mex$151.9b, so these liabilities are probably manageable. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Becle. de's net debt to EBITDA ratio of about 1.6 suggests only moderate use of debt. And its strong interest cover of 12.8 times, makes us even more comfortable. Also good is that Becle. de grew its EBIT at 14% over the last year, further increasing its ability to manage debt. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Becle. de can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. During the last three years, Becle. de burned a lot of cash. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

Becle. de's conversion of EBIT to free cash flow was a real negative on this analysis, although the other factors we considered were considerably better. There's no doubt that its ability to to cover its interest expense with its EBIT is pretty flash. Looking at all this data makes us feel a little cautious about Becle. de's debt levels. While we appreciate debt can enhance returns on equity, we'd suggest that shareholders keep close watch on its debt levels, lest they increase. Over time, share prices tend to follow earnings per share, so if you're interested in Becle. de, you may well want to click here to check an interactive graph of its earnings per share history.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

Valuation is complex, but we're here to simplify it.

Discover if Becle. de might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BMV:CUERVO *

Becle. de

Manufactures and distributes spirits and other distilled beverages in Mexico, the United States, Canada, and internationally.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives

Recently Updated Narratives

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth