What Kind Of Investors Own Most Of Grupo Bafar, S.A.B. de C.V. (BMV:BAFARB)?

A look at the shareholders of Grupo Bafar, S.A.B. de C.V. (BMV:BAFARB) can tell us which group is most powerful. Large companies usually have institutions as shareholders, and we usually see insiders owning shares in smaller companies. Warren Buffett said that he likes "a business with enduring competitive advantages that is run by able and owner-oriented people." So it's nice to see some insider ownership, because it may suggest that management is owner-oriented.

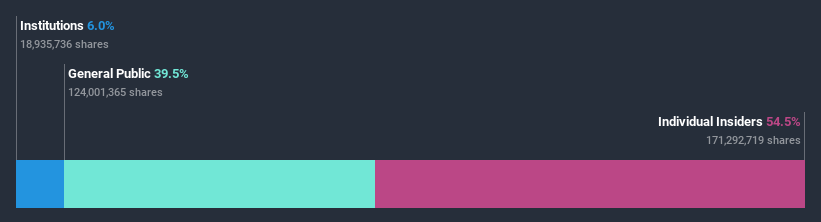

Grupo Bafar. de is a smaller company with a market capitalization of Mex$12b, so it may still be flying under the radar of many institutional investors. Taking a look at our data on the ownership groups (below), it seems that institutional investors have bought into the company. Let's delve deeper into each type of owner, to discover more about Grupo Bafar. de.

View our latest analysis for Grupo Bafar. de

What Does The Institutional Ownership Tell Us About Grupo Bafar. de?

Institutions typically measure themselves against a benchmark when reporting to their own investors, so they often become more enthusiastic about a stock once it's included in a major index. We would expect most companies to have some institutions on the register, especially if they are growing.

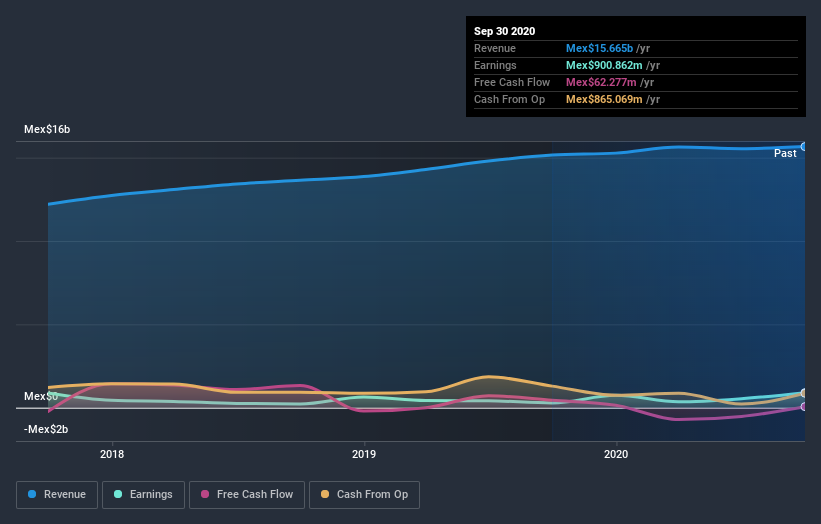

Grupo Bafar. de already has institutions on the share registry. Indeed, they own a respectable stake in the company. This suggests some credibility amongst professional investors. But we can't rely on that fact alone since institutions make bad investments sometimes, just like everyone does. When multiple institutions own a stock, there's always a risk that they are in a 'crowded trade'. When such a trade goes wrong, multiple parties may compete to sell stock fast. This risk is higher in a company without a history of growth. You can see Grupo Bafar. de's historic earnings and revenue below, but keep in mind there's always more to the story.

We note that hedge funds don't have a meaningful investment in Grupo Bafar. de. Looking at our data, we can see that the largest shareholder is the CEO Oscar Eugenio Baeza Fares with 35% of shares outstanding. Guillermo Enrique Baeza Fares is the second largest shareholder owning 13% of common stock, and Operadora de Fondos GBM S.A. de C.V holds about 6.0% of the company stock. Interestingly, the second-largest shareholder, Guillermo Enrique Baeza Fares is also Head of Corporate Development, again, pointing towards strong insider ownership amongst the company's top shareholders.

To make our study more interesting, we found that the top 3 shareholders have a majority ownership in the company, meaning that they are powerful enough to influence the decisions of the company.

While it makes sense to study institutional ownership data for a company, it also makes sense to study analyst sentiments to know which way the wind is blowing. As far I can tell there isn't analyst coverage of the company, so it is probably flying under the radar.

Insider Ownership Of Grupo Bafar. de

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. Company management run the business, but the CEO will answer to the board, even if he or she is a member of it.

Insider ownership is positive when it signals leadership are thinking like the true owners of the company. However, high insider ownership can also give immense power to a small group within the company. This can be negative in some circumstances.

It seems that insiders own more than half the Grupo Bafar, S.A.B. de C.V. stock. This gives them a lot of power. Given it has a market cap of Mex$12b, that means they have Mex$6.7b worth of shares. Most would be pleased to see the board is investing alongside them. You may wish todiscover (for free) if they have been buying or selling.

General Public Ownership

The general public, with a 39% stake in the company, will not easily be ignored. While this group can't necessarily call the shots, it can certainly have a real influence on how the company is run.

Next Steps:

While it is well worth considering the different groups that own a company, there are other factors that are even more important. Take risks for example - Grupo Bafar. de has 1 warning sign we think you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

If you’re looking to trade Grupo Bafar. de, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BMV:BAFAR B

Grupo Bafar. de

Grupo Bafar, S.A.B. de C.V. produces and sells food products in Mexico and internationally.

Outstanding track record with mediocre balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success