- Mexico

- /

- Auto Components

- /

- BMV:NEMAK A

Slammed 28% Nemak, S. A. B. de C. V. (BMV:NEMAKA) Screens Well Here But There Might Be A Catch

Nemak, S. A. B. de C. V. (BMV:NEMAKA) shareholders that were waiting for something to happen have been dealt a blow with a 28% share price drop in the last month. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 45% share price drop.

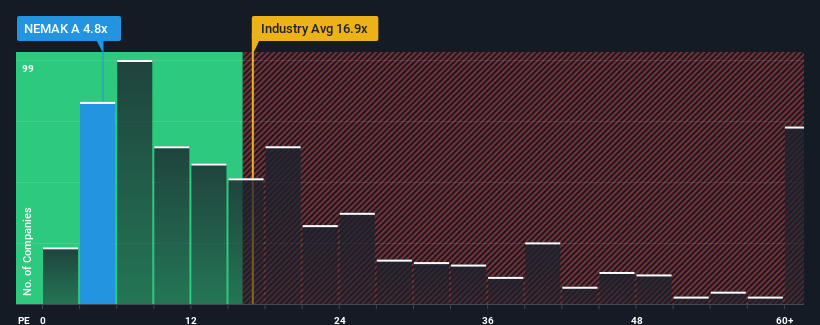

Even after such a large drop in price, Nemak S. A. B. de C. V may still be sending very bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 4.8x, since almost half of all companies in Mexico have P/E ratios greater than 12x and even P/E's higher than 18x are not unusual. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

Nemak S. A. B. de C. V certainly has been doing a good job lately as it's been growing earnings more than most other companies. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for Nemak S. A. B. de C. V

How Is Nemak S. A. B. de C. V's Growth Trending?

In order to justify its P/E ratio, Nemak S. A. B. de C. V would need to produce anemic growth that's substantially trailing the market.

Retrospectively, the last year delivered an exceptional 265% gain to the company's bottom line. However, this wasn't enough as the latest three year period has seen a very unpleasant 65% drop in EPS in aggregate. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Turning to the outlook, the next three years should generate growth of 25% each year as estimated by the five analysts watching the company. That's shaping up to be materially higher than the 14% per annum growth forecast for the broader market.

In light of this, it's peculiar that Nemak S. A. B. de C. V's P/E sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Bottom Line On Nemak S. A. B. de C. V's P/E

Shares in Nemak S. A. B. de C. V have plummeted and its P/E is now low enough to touch the ground. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Nemak S. A. B. de C. V's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. There could be some major unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

You need to take note of risks, for example - Nemak S. A. B. de C. V has 3 warning signs (and 1 which is a bit unpleasant) we think you should know about.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're here to simplify it.

Discover if Nemak S. A. B. de C. V might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BMV:NEMAK A

Nemak S. A. B. de C. V

Develops, manufactures, and sells aluminum components for e-mobility, structure and chassis, and ICE powertrain applications to the automotive industry in North America, Europe, and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives