- South Korea

- /

- Gas Utilities

- /

- KOSE:A004690

Top KRX Dividend Stocks To Watch In August 2024

Reviewed by Simply Wall St

Over the last 7 days, the South Korean market has dropped 8.1%, and it is down 4.2% over the past year, despite expectations of a 28% annual earnings growth in the coming years. In such volatile conditions, dividend stocks can offer stability and income potential for investors looking to navigate uncertain markets.

Top 10 Dividend Stocks In South Korea

| Name | Dividend Yield | Dividend Rating |

| Kia (KOSE:A000270) | 5.51% | ★★★★★★ |

| LOTTE Fine Chemical (KOSE:A004000) | 4.62% | ★★★★★☆ |

| NH Investment & Securities (KOSE:A005940) | 6.03% | ★★★★★☆ |

| Hyundai Steel (KOSE:A004020) | 3.94% | ★★★★★☆ |

| KT (KOSE:A030200) | 5.29% | ★★★★★☆ |

| Industrial Bank of Korea (KOSE:A024110) | 7.45% | ★★★★★☆ |

| Kyung Nong (KOSE:A002100) | 6.93% | ★★★★★☆ |

| HANYANG ENGLtd (KOSDAQ:A045100) | 3.46% | ★★★★★☆ |

| Tong Yang Life Insurance (KOSE:A082640) | 4.46% | ★★★★☆☆ |

| Korea Cast Iron Pipe Ind (KOSE:A000970) | 6.11% | ★★★★☆☆ |

Click here to see the full list of 62 stocks from our Top KRX Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

Korea Cast Iron Pipe Ind (KOSE:A000970)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Korea Cast Iron Pipe Ind. Co., Ltd. manufactures and sells pipes in South Korea and internationally, with a market cap of ₩140.90 billion.

Operations: Korea Cast Iron Pipe Ind. Co., Ltd. generates revenue from three main segments: Steel Pipe (₩238.13 billion), Cast Iron Pipe (₩129.69 billion), and the Cosmetics Sector (₩83.67 billion).

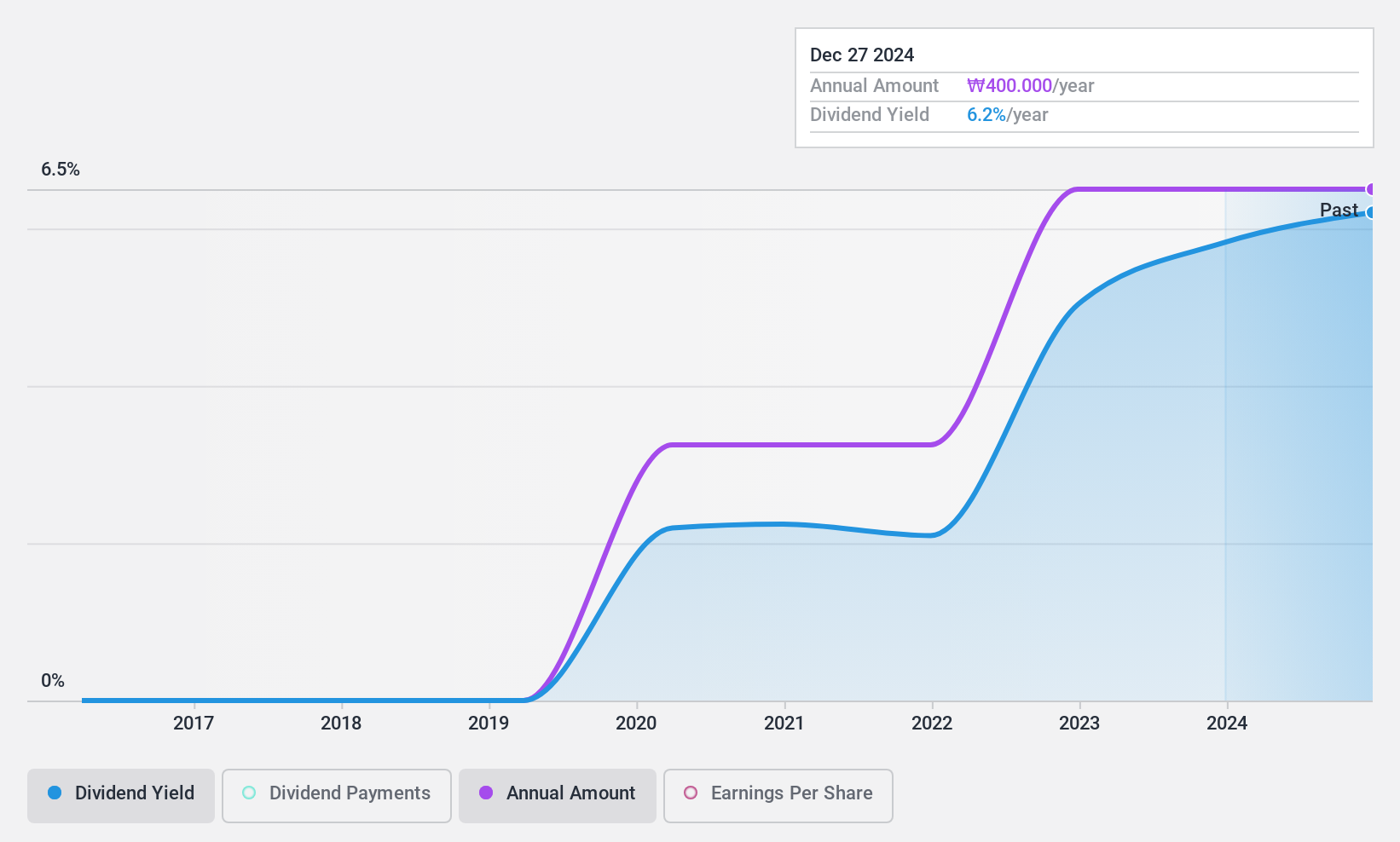

Dividend Yield: 6.1%

Korea Cast Iron Pipe Ind. offers a compelling dividend profile with a 6.11% yield, placing it in the top 25% of South Korean dividend payers. The company's dividends are well-covered by both earnings (50.2% payout ratio) and cash flows (49.9% cash payout ratio). Despite only five years of dividend history, payments have been stable and growing, supported by robust earnings growth of 45.7% over the past year and an attractive price-to-earnings ratio of 8.2x compared to the market's 11.1x.

- Unlock comprehensive insights into our analysis of Korea Cast Iron Pipe Ind stock in this dividend report.

- The analysis detailed in our Korea Cast Iron Pipe Ind valuation report hints at an inflated share price compared to its estimated value.

Asia Paper Manufacturing (KOSE:A002310)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Asia Paper Manufacturing Co., Ltd specializes in producing and selling industrial paper in South Korea, with a market cap of ₩342.65 billion.

Operations: Asia Paper Manufacturing Co., Ltd generates revenue primarily from the production and sale of specialized industrial paper in South Korea.

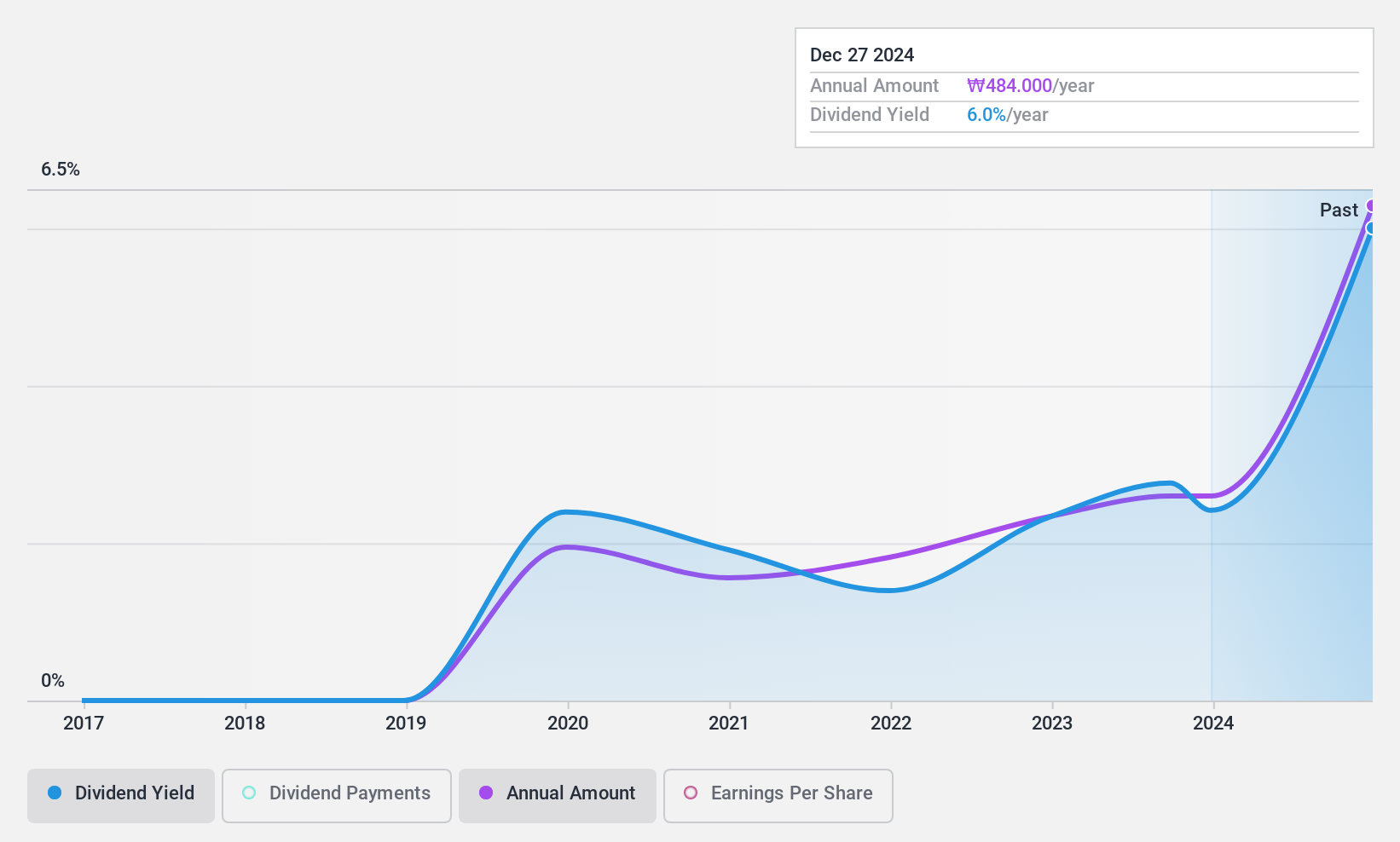

Dividend Yield: 5.9%

Asia Paper Manufacturing's dividend yield of 5.87% places it in the top 25% of South Korean dividend payers. Despite this, its dividend track record has been volatile over the past five years. The company's dividends are well-covered by earnings (27.4% payout ratio) and cash flows (58.5% cash payout ratio). Recently, Asia Paper completed a share buyback program, repurchasing 985,000 shares for KRW 10.76 billion, potentially signaling confidence in its financial stability.

- Navigate through the intricacies of Asia Paper Manufacturing with our comprehensive dividend report here.

- Our valuation report here indicates Asia Paper Manufacturing may be undervalued.

SamchullyLtd (KOSE:A004690)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Samchully Co., Ltd. supplies natural gas in South Korea and the United States, with a market cap of ₩301.99 billion.

Operations: Samchully Co., Ltd. generates revenue primarily from supplying natural gas in South Korea and the United States.

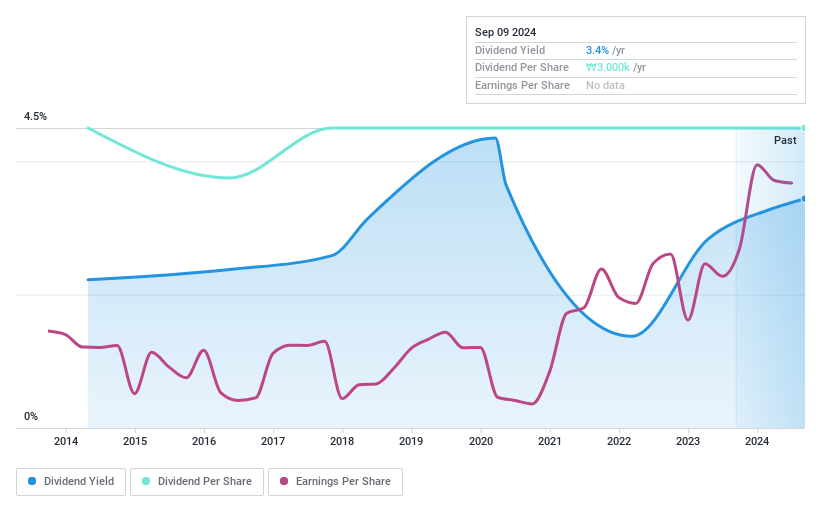

Dividend Yield: 3.4%

Samchully Ltd. offers a stable dividend yield of 3.4%, though it falls short compared to the top 25% of South Korean dividend payers. The company's dividends are well-covered by earnings (9.1% payout ratio) and cash flows (21.9% cash payout ratio), indicating sustainability. However, its dividend payments have not increased in the past decade, and despite stable payouts, they have been considered unreliable due to volatility in previous years' distributions.

- Take a closer look at SamchullyLtd's potential here in our dividend report.

- Our valuation report here indicates SamchullyLtd may be overvalued.

Turning Ideas Into Actions

- Investigate our full lineup of 62 Top KRX Dividend Stocks right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A004690

SamchullyLtd

Engages in the supplying of natural gas in South Korea and the United States.

Excellent balance sheet average dividend payer.