- South Korea

- /

- Logistics

- /

- KOSE:A086280

Investors Who Bought Hyundai Glovis (KRX:086280) Shares Three Years Ago Are Now Up 34%

By buying an index fund, investors can approximate the average market return. But many of us dare to dream of bigger returns, and build a portfolio ourselves. For example, the Hyundai Glovis Co., Ltd. (KRX:086280) share price is up 34% in the last three years, clearly besting the market return of around 22% (not including dividends).

See our latest analysis for Hyundai Glovis

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

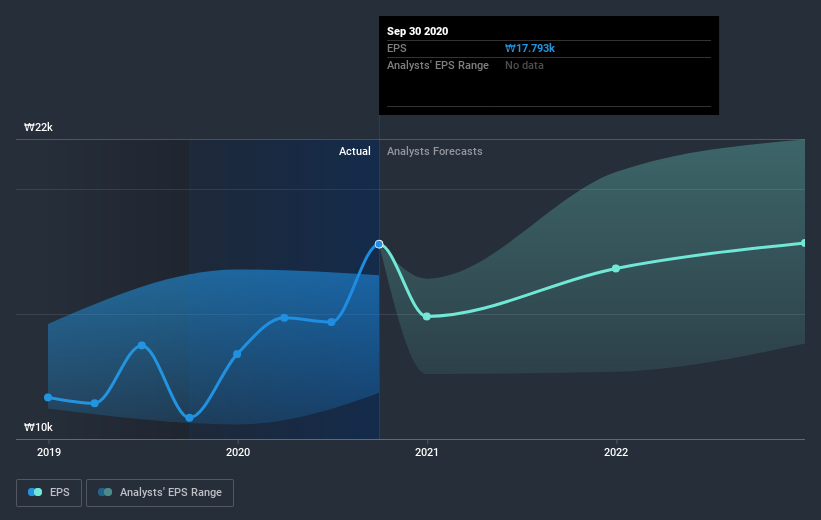

Hyundai Glovis was able to grow its EPS at 12% per year over three years, sending the share price higher. We don't think it is entirely coincidental that the EPS growth is reasonably close to the 10% average annual increase in the share price. This observation indicates that the market's attitude to the business hasn't changed all that much. Au contraire, the share price change has arguably mimicked the EPS growth.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

We know that Hyundai Glovis has improved its bottom line lately, but is it going to grow revenue? This free report showing analyst revenue forecasts should help you figure out if the EPS growth can be sustained.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for Hyundai Glovis the TSR over the last 3 years was 44%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

Hyundai Glovis shareholders gained a total return of 32% during the year. Unfortunately this falls short of the market return. On the bright side, that's still a gain, and it's actually better than the average return of 1.2% over half a decade This suggests the company might be improving over time. Before forming an opinion on Hyundai Glovis you might want to consider these 3 valuation metrics.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

If you decide to trade Hyundai Glovis, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Hyundai Glovis might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSE:A086280

Hyundai Glovis

Operates as logistics and distribution company in South Korea and internationally.

Flawless balance sheet and good value.