- South Korea

- /

- Marine and Shipping

- /

- KOSE:A011200

Announcing: HMMLtd (KRX:011200) Stock Increased An Energizing 276% In The Last Year

When you buy shares in a company, there is always a risk that the price drops to zero. On the other hand, if you find a high quality business to buy (at the right price) you can more than double your money! For example, the HMM Co.,Ltd (KRX:011200) share price has soared 276% in the last year. Most would be very happy with that, especially in just one year! Also pleasing for shareholders was the 117% gain in the last three months. This could be related to the recent financial results, released recently - you can catch up on the most recent data by reading our company report. It is also impressive that the stock is up 155% over three years, adding to the sense that it is a real winner.

See our latest analysis for HMMLtd

Because HMMLtd made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over the last twelve months, HMMLtd's revenue grew by 2.8%. That's not great considering the company is losing money. In contrast, the share price took off during the year, gaining 276%. We're happy that investors have made money, though we wonder if the increase will be sustained. We're not so sure that revenue growth is driving the market optimism about the stock.

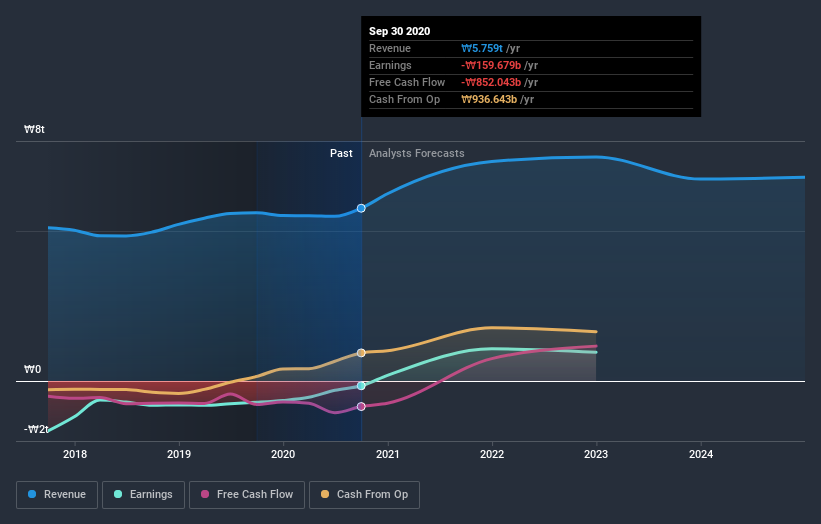

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

If you are thinking of buying or selling HMMLtd stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

It's good to see that HMMLtd has rewarded shareholders with a total shareholder return of 276% in the last twelve months. That certainly beats the loss of about 9% per year over the last half decade. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should be aware of the 3 warning signs we've spotted with HMMLtd .

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

If you’re looking to trade HMMLtd, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if HMMLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KOSE:A011200

HMMLtd

An integrated logistics company, provides shipping and logistics services worldwide.

Flawless balance sheet slight.