- South Korea

- /

- Logistics

- /

- KOSE:A009070

KCTC Co. Ltd (KRX:009070) Surges 42% Yet Its Low P/E Is No Reason For Excitement

Despite an already strong run, KCTC Co. Ltd (KRX:009070) shares have been powering on, with a gain of 42% in the last thirty days. Taking a wider view, although not as strong as the last month, the full year gain of 14% is also fairly reasonable.

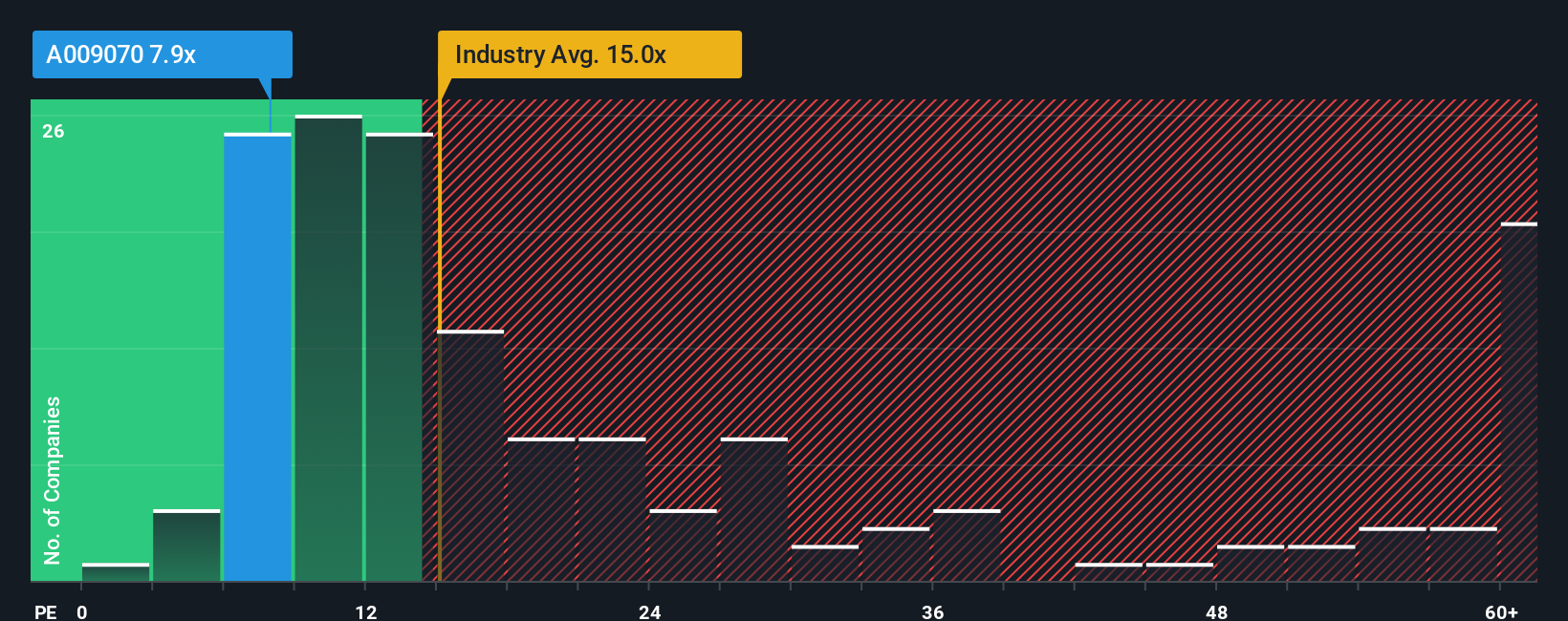

Although its price has surged higher, KCTC's price-to-earnings (or "P/E") ratio of 7.9x might still make it look like a buy right now compared to the market in Korea, where around half of the companies have P/E ratios above 14x and even P/E's above 28x are quite common. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

For example, consider that KCTC's financial performance has been poor lately as its earnings have been in decline. One possibility is that the P/E is low because investors think the company won't do enough to avoid underperforming the broader market in the near future. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

View our latest analysis for KCTC

How Is KCTC's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as low as KCTC's is when the company's growth is on track to lag the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 23%. As a result, earnings from three years ago have also fallen 20% overall. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for expansion of 29% shows it's an unpleasant look.

With this information, we are not surprised that KCTC is trading at a P/E lower than the market. However, we think shrinking earnings are unlikely to lead to a stable P/E over the longer term, which could set up shareholders for future disappointment. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Key Takeaway

The latest share price surge wasn't enough to lift KCTC's P/E close to the market median. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of KCTC revealed its shrinking earnings over the medium-term are contributing to its low P/E, given the market is set to grow. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. If recent medium-term earnings trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

You always need to take note of risks, for example - KCTC has 1 warning sign we think you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if KCTC might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A009070

Mediocre balance sheet second-rate dividend payer.

Market Insights

Community Narratives