- South Korea

- /

- Transportation

- /

- KOSDAQ:A024800

Yoosung T&S' (KOSDAQ:024800) Earnings Are Growing But Is There More To The Story?

Many investors consider it preferable to invest in profitable companies over unprofitable ones, because profitability suggests a business is sustainable. However, sometimes companies receive a one-off boost (or reduction) to their profit, and it's not always clear whether statutory profits are a good guide, going forward. This article will consider whether Yoosung T&S' (KOSDAQ:024800) statutory profits are a good guide to its underlying earnings.

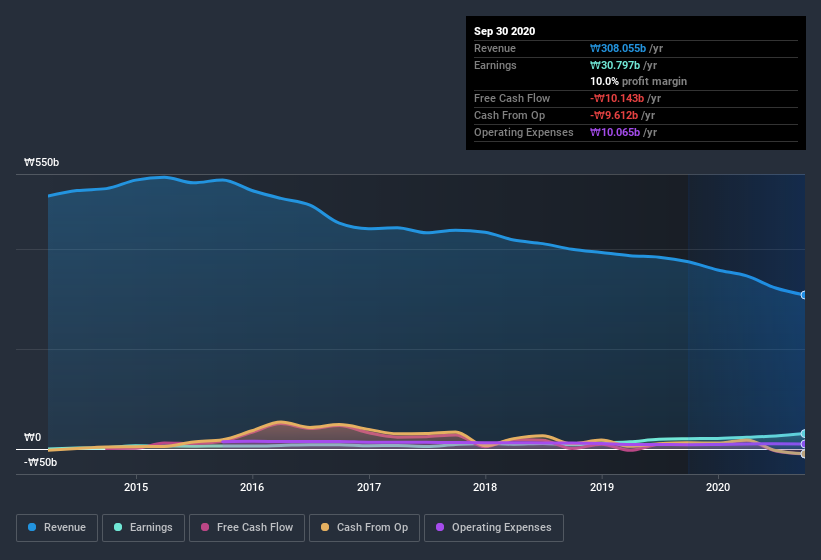

We like the fact that Yoosung T&S made a profit of ₩30.8b on its revenue of ₩308.1b, in the last year. As depicted below, while its revenue may have fallen over the last few years, its profit actually improved.

See our latest analysis for Yoosung T&S

Importantly, statutory profits are not always the best tool for understanding a company's true earnings power, so it's well worth examining profits in a little more detail. This article will focus on the impact unusual items have had on Yoosung T&S' statutory earnings. Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Yoosung T&S.

The Impact Of Unusual Items On Profit

To properly understand Yoosung T&S' profit results, we need to consider the ₩2.8b gain attributed to unusual items. While we like to see profit increases, we tend to be a little more cautious when unusual items have made a big contribution. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And, after all, that's exactly what the accounting terminology implies. We can see that Yoosung T&S' positive unusual items were quite significant relative to its profit in the year to September 2020. As a result, we can surmise that the unusual items are making its statutory profit significantly stronger than it would otherwise be.

Our Take On Yoosung T&S' Profit Performance

As previously mentioned, Yoosung T&S' large boost from unusual items won't be there indefinitely, so its statutory earnings are probably a poor guide to its underlying profitability. As a result, we think it may well be the case that Yoosung T&S' underlying earnings power is lower than its statutory profit. But on the bright side, its earnings per share have grown at an extremely impressive rate over the last three years. The goal of this article has been to assess how well we can rely on the statutory earnings to reflect the company's potential, but there is plenty more to consider. If you'd like to know more about Yoosung T&S as a business, it's important to be aware of any risks it's facing. To that end, you should learn about the 2 warning signs we've spotted with Yoosung T&S (including 1 which is concerning).

This note has only looked at a single factor that sheds light on the nature of Yoosung T&S' profit. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you’re looking to trade Yoosung T&S, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A024800

Slightly overvalued with questionable track record.

Market Insights

Community Narratives