- South Korea

- /

- Telecom Services and Carriers

- /

- KOSDAQ:A093320

What To Know Before Buying KINX, Inc. (KOSDAQ:093320) For Its Dividend

Is KINX, Inc. (KOSDAQ:093320) a good dividend stock? How can we tell? Dividend paying companies with growing earnings can be highly rewarding in the long term. On the other hand, investors have been known to buy a stock because of its yield, and then lose money if the company's dividend doesn't live up to expectations.

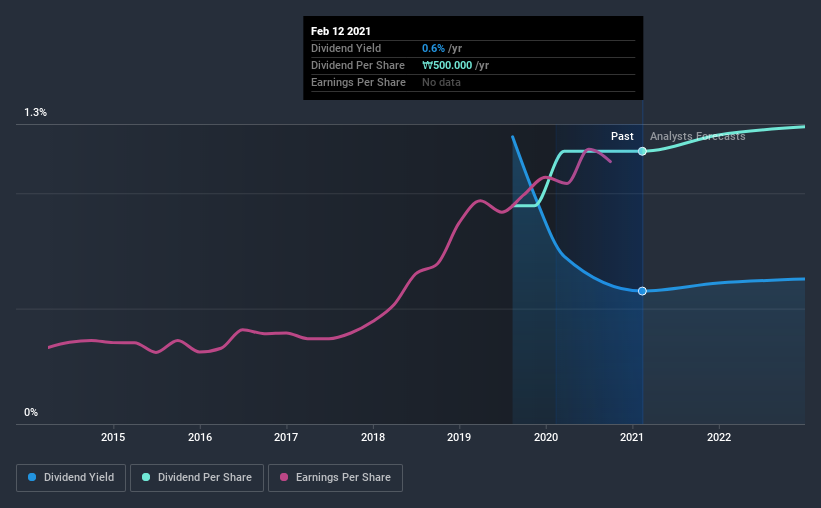

KINX has only been paying a dividend for a year or so, so investors might be curious about its 0.6% yield. Before you buy any stock for its dividend however, you should always remember Warren Buffett's two rules: 1) Don't lose money, and 2) Remember rule #1. We'll run through some checks below to help with this.

Explore this interactive chart for our latest analysis on KINX!

Payout ratios

Companies (usually) pay dividends out of their earnings. If a company is paying more than it earns, the dividend might have to be cut. So we need to form a view on if a company's dividend is sustainable, relative to its net profit after tax. KINX paid out 14% of its profit as dividends, over the trailing twelve month period. We'd say its dividends are thoroughly covered by earnings.

We also measure dividends paid against a company's levered free cash flow, to see if enough cash was generated to cover the dividend. KINX's cash payout ratio last year was 9.7%. Cash flows are typically lumpy, but this looks like an appropriately conservative payout. It's positive to see that KINX's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

With a strong net cash balance, KINX investors may not have much to worry about in the near term from a dividend perspective.

Remember, you can always get a snapshot of KINX's latest financial position, by checking our visualisation of its financial health.

Dividend Volatility

Before buying a stock for its income, we want to see if the dividends have been stable in the past, and if the company has a track record of maintaining its dividend. With a payment history of less than 2 years, we think it's a bit too soon to think about living on the income from its dividend. This works out to be a compound annual growth rate (CAGR) of approximately 25% a year over that time.

The dividend has been growing pretty quickly, which could be enough to get us interested even though the dividend history is relatively short. Further research may be warranted.

Dividend Growth Potential

Examining whether the dividend is affordable and stable is important. However, it's also important to assess if earnings per share (EPS) are growing. Growing EPS can help maintain or increase the purchasing power of the dividend over the long run. It's good to see KINX has been growing its earnings per share at 26% a year over the past five years. Earnings per share have grown rapidly, and the company is retaining a majority of its earnings. We think this is ideal from an investment perspective, if the company is able to reinvest these earnings effectively.

We'd also point out that KINX issued a meaningful number of new shares in the past year. Trying to grow the dividend when issuing new shares reminds us of the ancient Greek tale of Sisyphus - perpetually pushing a boulder uphill. Companies that consistently issue new shares are often suboptimal from a dividend perspective.

Conclusion

Dividend investors should always want to know if a) a company's dividends are affordable, b) if there is a track record of consistent payments, and c) if the dividend is capable of growing. It's great to see that KINX is paying out a low percentage of its earnings and cash flow. Next, earnings growth has been good, but unfortunately the company has not been paying dividends as long as we'd like. Overall we think KINX scores well on our analysis. It's not quite perfect, but we'd definitely be keen to take a closer look.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. However, there are other things to consider for investors when analysing stock performance. As an example, we've identified 1 warning sign for KINX that you should be aware of before investing.

Looking for more high-yielding dividend ideas? Try our curated list of dividend stocks with a yield above 3%.

If you decide to trade KINX, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if KINX might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A093320

KINX

Engages in the provision of Internet exchange (IX) services to various carriers, content providers, multiple system operators, financial institutions, and government agencies in South Korea and internationally.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success