- South Korea

- /

- Electronic Equipment and Components

- /

- KOSE:A336370

Solus Advanced Materials (KRX:336370) Is Paying Out A Dividend Of ₩10.00

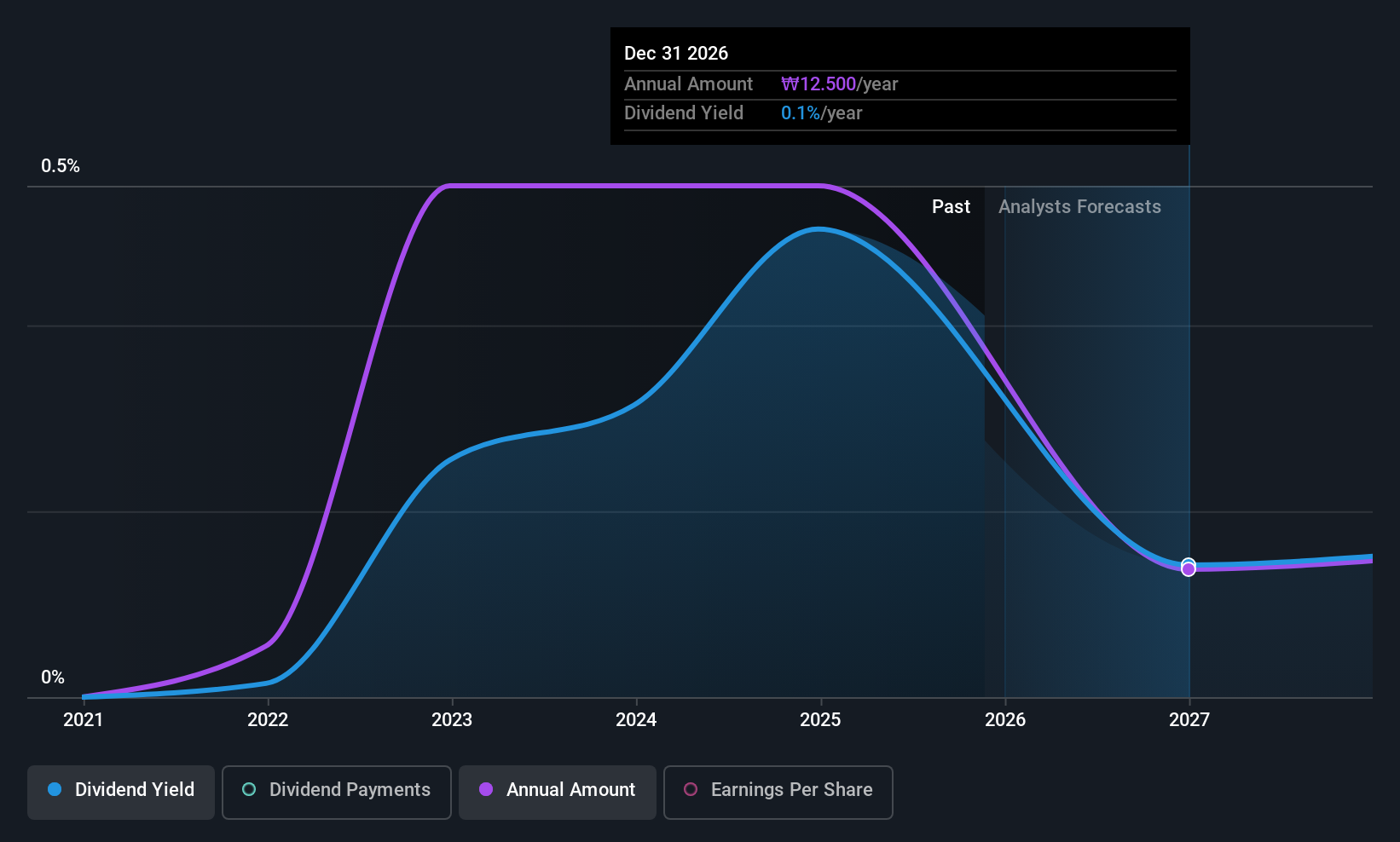

The board of Solus Advanced Materials Co., Ltd. (KRX:336370) has announced that it will pay a dividend of ₩10.00 per share on the 27th of April. The dividend yield is 0.6% based on this payment, which is a little bit low compared to the other companies in the industry.

Solus Advanced Materials' Long-term Dividend Outlook appears Promising

It would be nice for the yield to be higher, but we should also check if higher levels of dividend payment would be sustainable. Even though Solus Advanced Materials is not generating a profit, it is still paying a dividend. It is also not generating any free cash flow, we definitely have concerns when it comes to the sustainability of the dividend.

According to analysts, EPS should be several times higher next year. If the dividend extends its recent trend, estimates say the dividend could reach 0.3%, which we would be comfortable to see continuing.

See our latest analysis for Solus Advanced Materials

Solus Advanced Materials Is Still Building Its Track Record

Solus Advanced Materials' dividend has been pretty stable for a little while now, but we will continue to be cautious until it has been demonstrated for a few more years. Since 2020, the dividend has gone from ₩5.00 total annually to ₩50.00. This means that it has been growing its distributions at 58% per annum over that time. The dividend has been growing rapidly, however with such a short payment history we can't know for sure if payment can continue to grow over the long term, so caution may be warranted.

The Company Could Face Some Challenges Growing The Dividend

The company's investors will be pleased to have been receiving dividend income for some time. Solus Advanced Materials has seen EPS rising for the last five years, at 14% per annum. It's not great that the company is not turning a profit, but the decent growth in recent years is certainly a positive sign. Assuming the company can post positive net income numbers soon, it could has the potential to be a decent dividend payer.

The Dividend Could Prove To Be Unreliable

Overall, we don't think this company makes a great dividend stock, even though the dividend wasn't cut this year. While we generally think the level of distributions are a bit high, we wouldn't rule it out as becoming a good dividend payer in the future as its earnings are growing healthily. We would be a touch cautious of relying on this stock primarily for the dividend income.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. As an example, we've identified 2 warning signs for Solus Advanced Materials that you should be aware of before investing. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A336370

Solus Advanced Materials

Provides materials and solutions in South Korea, Europe, and internationally.

Reasonable growth potential with very low risk.

Similar Companies

Market Insights

Community Narratives