- South Korea

- /

- Electronic Equipment and Components

- /

- KOSE:A034220

Is LG Display (KRX:034220) Weighed On By Its Debt Load?

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies LG Display Co., Ltd. (KRX:034220) makes use of debt. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for LG Display

What Is LG Display's Net Debt?

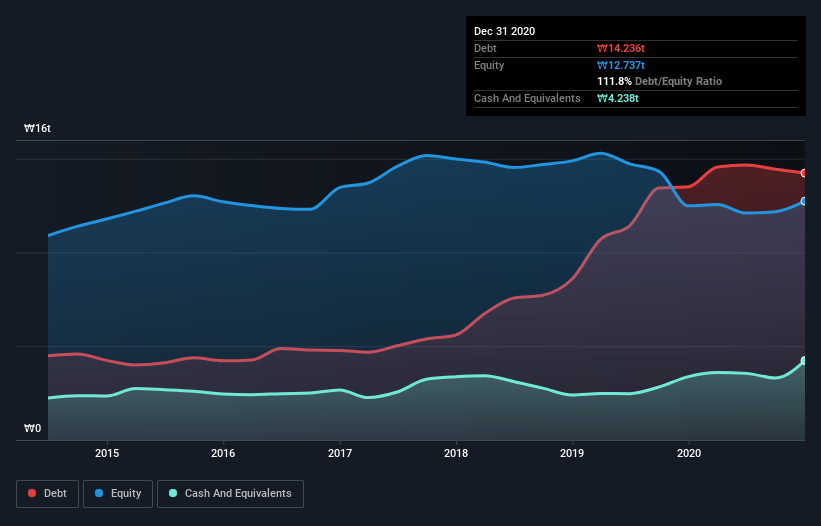

As you can see below, at the end of December 2020, LG Display had ₩14t of debt, up from ₩14t a year ago. Click the image for more detail. However, because it has a cash reserve of ₩4.24t, its net debt is less, at about ₩10.00t.

A Look At LG Display's Liabilities

According to the last reported balance sheet, LG Display had liabilities of ₩11t due within 12 months, and liabilities of ₩11t due beyond 12 months. On the other hand, it had cash of ₩4.24t and ₩4.39t worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by ₩14t.

The deficiency here weighs heavily on the ₩8.69t company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we'd watch its balance sheet closely, without a doubt. At the end of the day, LG Display would probably need a major re-capitalization if its creditors were to demand repayment. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if LG Display can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

In the last year LG Display wasn't profitable at an EBIT level, but managed to grow its revenue by 3.3%, to ₩24t. That rate of growth is a bit slow for our taste, but it takes all types to make a world.

Caveat Emptor

Importantly, LG Display had an earnings before interest and tax (EBIT) loss over the last year. To be specific the EBIT loss came in at ₩29b. When we look at that alongside the significant liabilities, we're not particularly confident about the company. It would need to improve its operations quickly for us to be interested in it. Not least because it burned through ₩653b in negative free cash flow over the last year. That means it's on the risky side of things. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. Case in point: We've spotted 1 warning sign for LG Display you should be aware of.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSE:A034220

LG Display

Engages in the manufacture and sale of thin-film transistor liquid crystal display (TFT-LCD) and organic light emitting diode (OLED) technology-based display panels.

Undervalued with moderate growth potential.