- South Korea

- /

- Electronic Equipment and Components

- /

- KOSDAQ:A321370

Sensorview (KOSDAQ:321370 shareholders incur further losses as stock declines 12% this week, taking one-year losses to 32%

Passive investing in an index fund is a good way to ensure your own returns roughly match the overall market. Active investors aim to buy stocks that vastly outperform the market - but in the process, they risk under-performance. For example, the Sensorview Co., LTD (KOSDAQ:321370) share price is down 43% in the last year. That's disappointing when you consider the market returned 58%. Sensorview hasn't been listed for long, so although we're wary of recent listings that perform poorly, it may still prove itself with time. Even worse, it's down 14% in about a month, which isn't fun at all.

With the stock having lost 12% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

Sensorview wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last twelve months, Sensorview increased its revenue by 45%. We think that is pretty nice growth. Meanwhile, the share price is down 43% over twelve months, which is disappointing given the progress made. You might even wonder if the share price was previously over-hyped. But if revenue keeps growing, then at a certain point the share price would likely follow.

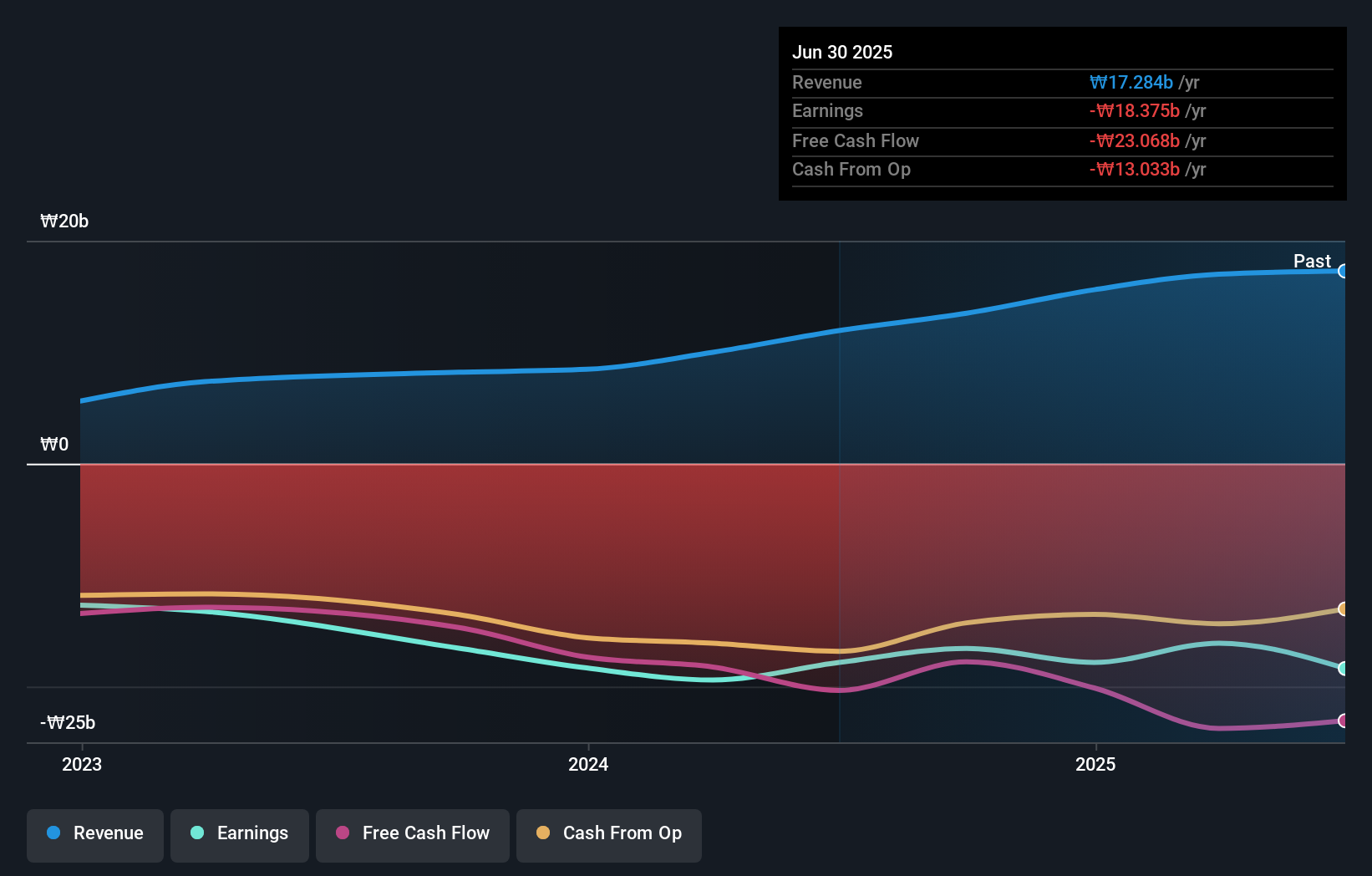

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Take a more thorough look at Sensorview's financial health with this free report on its balance sheet.

What About The Total Shareholder Return (TSR)?

Investors should note that there's a difference between Sensorview's total shareholder return (TSR) and its share price change, which we've covered above. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Sensorview hasn't been paying dividends, but its TSR of -32% exceeds its share price return of -43%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

Given that the market gained 58% in the last year, Sensorview shareholders might be miffed that they lost 32%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. The share price decline has continued throughout the most recent three months, down 0.6%, suggesting an absence of enthusiasm from investors. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should learn about the 4 warning signs we've spotted with Sensorview (including 3 which are significant) .

But note: Sensorview may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A321370

Sensorview

Develops, manufactures, and sells antennas and cables for mmWave and 5G technologies in South Korea and internationally.

Slight risk with worrying balance sheet.

Market Insights

Community Narratives