Stock Analysis

- South Korea

- /

- Electronic Equipment and Components

- /

- KOSDAQ:A290740

What Type Of Returns Would ActRO's(KOSDAQ:290740) Shareholders Have Earned If They Purchased Their SharesYear Ago?

ActRO Co., Ltd (KOSDAQ:290740) shareholders should be happy to see the share price up 15% in the last month. But that is minimal compensation for the share price under-performance over the last year. After all, the share price is down 18% in the last year, significantly under-performing the market.

Check out our latest analysis for ActRO

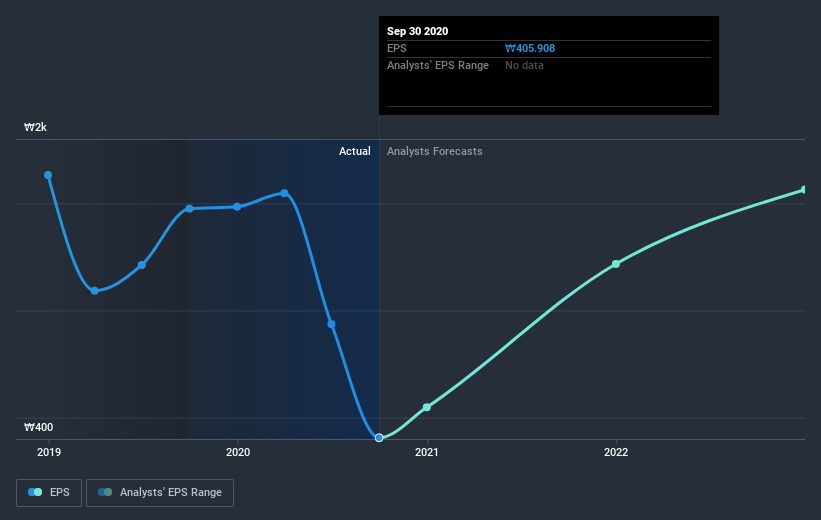

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Unfortunately ActRO reported an EPS drop of 72% for the last year. This fall in the EPS is significantly worse than the 18% the share price fall. So despite the weak per-share profits, some investors are probably relieved the situation wasn't more difficult.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

Dive deeper into ActRO's key metrics by checking this interactive graph of ActRO's earnings, revenue and cash flow.

A Different Perspective

While ActRO shareholders are down 17% for the year (even including dividends), the market itself is up 32%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. It's great to see a nice little 7.0% rebound in the last three months. Let's just hope this isn't the widely-feared 'dead cat bounce' (which would indicate further declines to come). I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 2 warning signs for ActRO that you should be aware of before investing here.

But note: ActRO may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

When trading ActRO or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're helping make it simple.

Find out whether ActRO is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A290740

ActRO

Manufactures optical image stabilizers (OIS) and voice coil motors that are applied in compact camera modules in South Korea.

Flawless balance sheet second-rate dividend payer.