- South Korea

- /

- Communications

- /

- KOSDAQ:A230240

The three-year earnings decline is not helping HFR's (KOSDAQ:230240 share price, as stock falls another 15% in past week

The truth is that if you invest for long enough, you're going to end up with some losing stocks. But long term HFR, Inc. (KOSDAQ:230240) shareholders have had a particularly rough ride in the last three year. Sadly for them, the share price is down 57% in that time. And the share price decline continued over the last week, dropping some 15%.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

HFR became profitable within the last five years. We would usually expect to see the share price rise as a result. So it's worth looking at other metrics to try to understand the share price move.

The modest 1.5% dividend yield is unlikely to be guiding the market view of the stock. Arguably the revenue decline of 35% per year has people thinking HFR is shrinking. And that's not surprising, since it seems unlikely that EPS growth can continue for long in the absence of revenue growth.

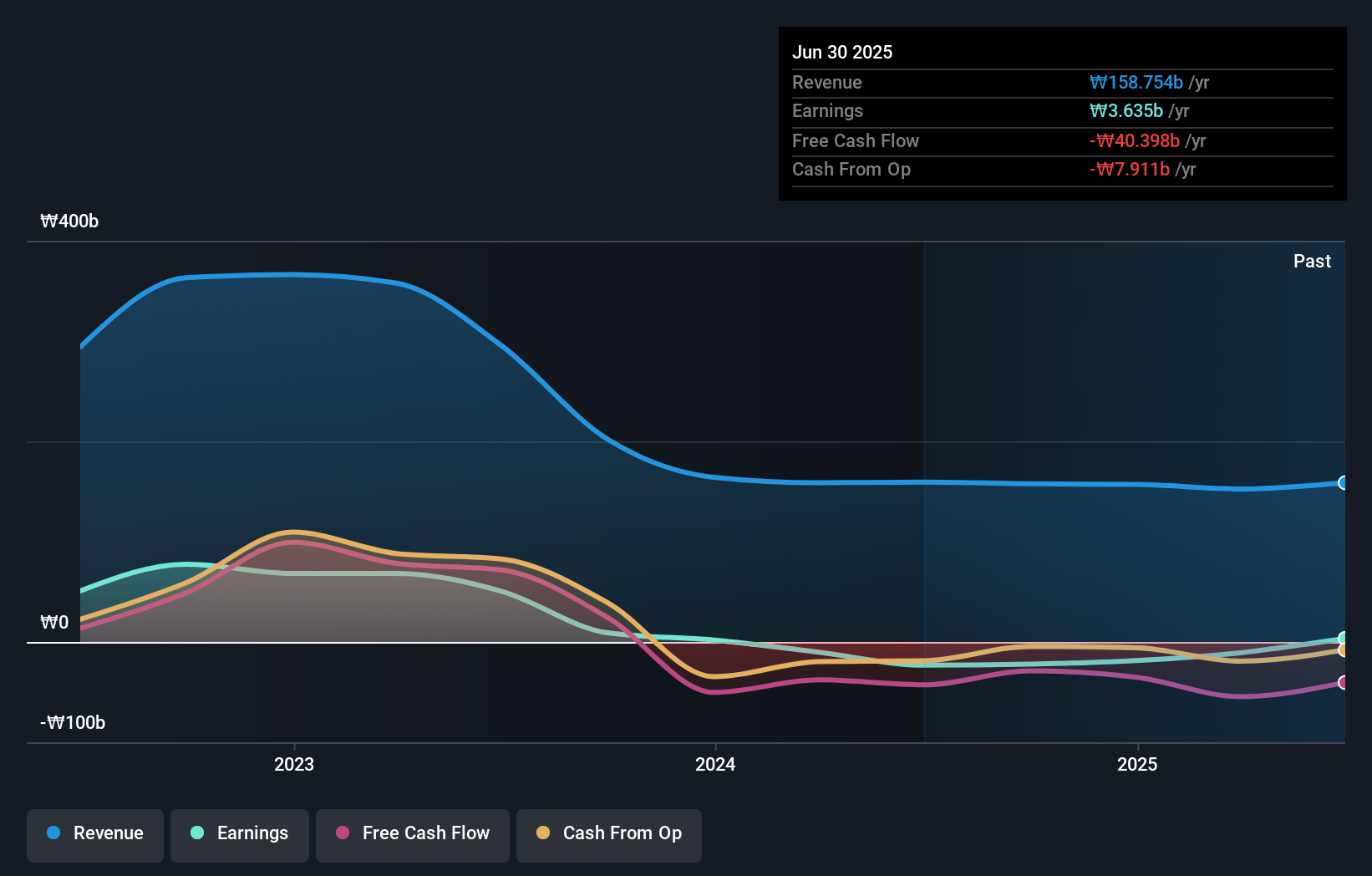

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

If you are thinking of buying or selling HFR stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

HFR shareholders gained a total return of 52% during the year. Unfortunately this falls short of the market return. But at least that's still a gain! Over five years the TSR has been a reduction of 8% per year, over five years. So this might be a sign the business has turned its fortunes around. It's always interesting to track share price performance over the longer term. But to understand HFR better, we need to consider many other factors. To that end, you should learn about the 2 warning signs we've spotted with HFR (including 1 which is potentially serious) .

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

Valuation is complex, but we're here to simplify it.

Discover if HFR might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A230240

HFR

Provides digital infrastructure solutions for telco/enterprise markets in the field of wired and wireless access in South Korea.

Adequate balance sheet with questionable track record.

Market Insights

Community Narratives