- South Korea

- /

- Communications

- /

- KOSDAQ:A211270

Asia Pacific Satellite Inc. (KOSDAQ:211270) Shares May Have Slumped 27% But Getting In Cheap Is Still Unlikely

Asia Pacific Satellite Inc. (KOSDAQ:211270) shares have had a horrible month, losing 27% after a relatively good period beforehand. The last month has meant the stock is now only up 5.2% during the last year.

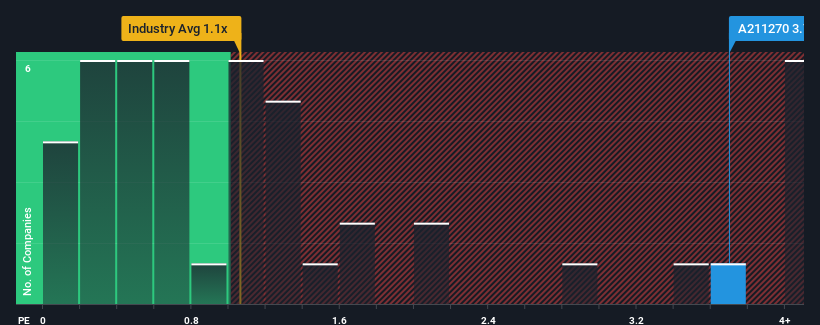

Although its price has dipped substantially, when almost half of the companies in Korea's Communications industry have price-to-sales ratios (or "P/S") below 1.1x, you may still consider Asia Pacific Satellite as a stock not worth researching with its 3.7x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for Asia Pacific Satellite

What Does Asia Pacific Satellite's P/S Mean For Shareholders?

Asia Pacific Satellite certainly has been doing a good job lately as its revenue growth has been positive while most other companies have been seeing their revenue go backwards. Perhaps the market is expecting the company's future revenue growth to buck the trend of the industry, contributing to a higher P/S. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Asia Pacific Satellite's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The High P/S?

The only time you'd be truly comfortable seeing a P/S as steep as Asia Pacific Satellite's is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered an exceptional 28% gain to the company's top line. The latest three year period has also seen an excellent 37% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Shifting to the future, estimates from the only analyst covering the company suggest revenue should grow by 14% over the next year. That's shaping up to be materially lower than the 51% growth forecast for the broader industry.

With this in consideration, we believe it doesn't make sense that Asia Pacific Satellite's P/S is outpacing its industry peers. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Bottom Line On Asia Pacific Satellite's P/S

A significant share price dive has done very little to deflate Asia Pacific Satellite's very lofty P/S. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

It comes as a surprise to see Asia Pacific Satellite trade at such a high P/S given the revenue forecasts look less than stellar. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Asia Pacific Satellite, and understanding should be part of your investment process.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A211270

Asia Pacific Satellite

Develops and manufactures satellite communication devices worldwide.

Flawless balance sheet with weak fundamentals.

Market Insights

Community Narratives