- South Korea

- /

- Electronic Equipment and Components

- /

- KOSDAQ:A204270

High Growth Tech Stocks In South Korea To Watch

Reviewed by Simply Wall St

The South Korea stock market has finished lower in two of three trading days since the end of a six-day winning streak, with the KOSPI now sitting just beneath the 2,650-point plateau. Amidst a mixed global forecast and recent fluctuations in key sectors such as technology and automobiles, investors are keenly observing high-growth tech stocks that show potential for resilience and innovation. Identifying promising tech stocks involves looking at companies with strong fundamentals, innovative products or services, and the ability to adapt to changing market conditions.

Top 10 High Growth Tech Companies In South Korea

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 33.61% | 52.05% | ★★★★★★ |

| IMLtd | 21.80% | 111.43% | ★★★★★★ |

| Bioneer | 23.53% | 97.58% | ★★★★★★ |

| FLITTO | 32.60% | 106.82% | ★★★★★★ |

| ALTEOGEN | 64.22% | 99.46% | ★★★★★★ |

| NEXON Games | 29.64% | 66.98% | ★★★★★★ |

| Devsisters | 29.08% | 63.02% | ★★★★★★ |

| Park Systems | 23.74% | 35.63% | ★★★★★★ |

| AmosenseLtd | 24.04% | 71.97% | ★★★★★★ |

| UTI | 114.97% | 134.59% | ★★★★★★ |

Click here to see the full list of 50 stocks from our KRX High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Daejoo Electronic Materials (KOSDAQ:A078600)

Simply Wall St Growth Rating: ★★★★★★

Overview: Daejoo Electronic Materials Co., Ltd. develops and sells electronic materials across various regions including South Korea, China, Taiwan, the United States, Europe, and Southeast Asia with a market cap of ₩1.71 trillion.

Operations: Daejoo Electronic Materials Co., Ltd. focuses on the development, production, and sale of electrical and electronic components, generating revenue of ₩206.32 billion from these activities. The company operates in various international markets including South Korea, China, Taiwan, the United States, Europe, and Southeast Asia.

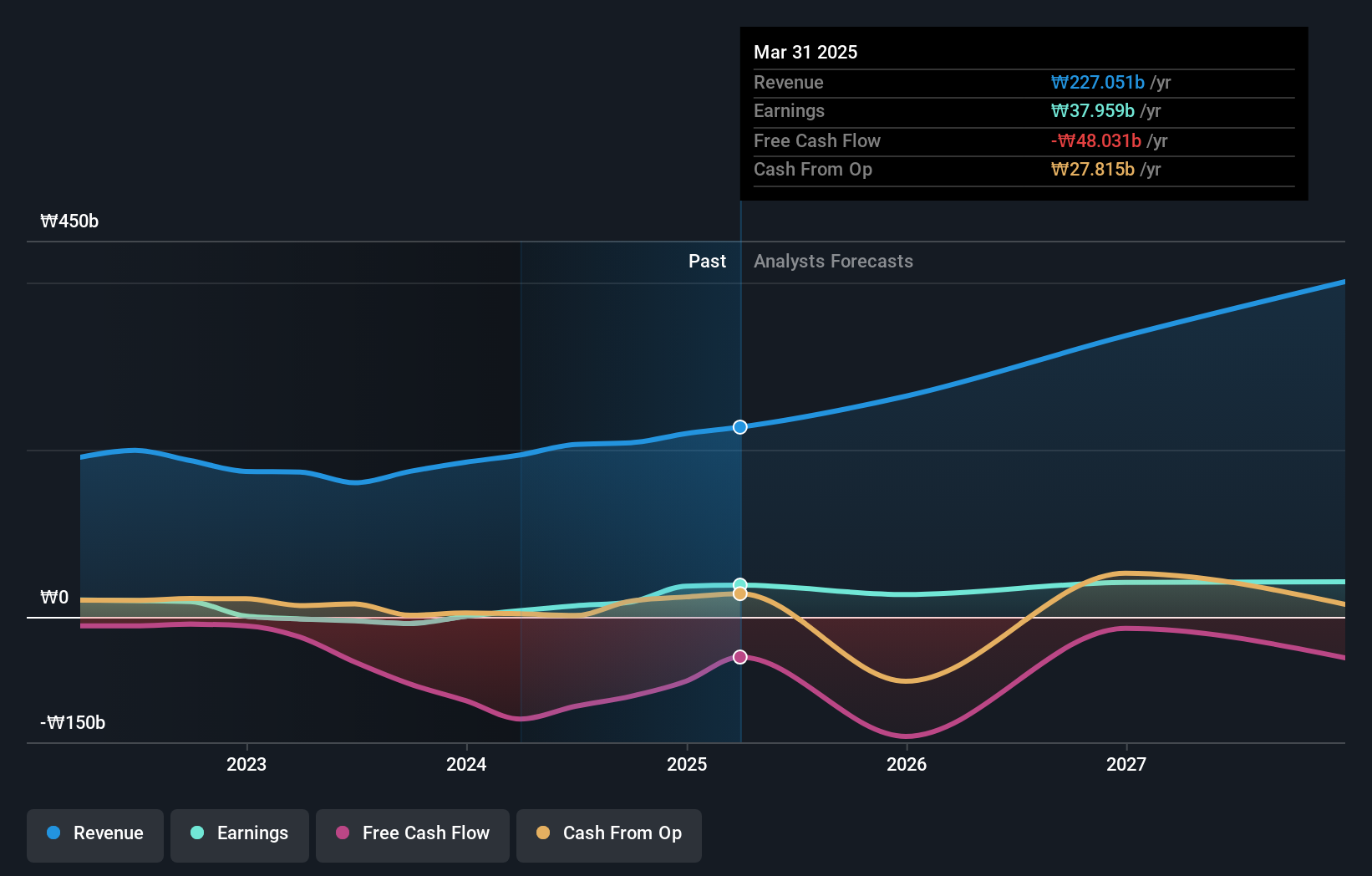

Daejoo Electronic Materials, amidst a challenging market, has shown a robust turnaround with its net income soaring to KRW 12.21 billion in the first half of 2024 from a loss previously, underpinned by significant non-cash earnings. This performance is particularly notable as it contrasts with an overall industry downturn where electronic peers saw earnings shrink by 3.3%. Looking ahead, Daejoo is poised for substantial growth with revenue expected to increase at an impressive rate of 42.2% annually, outpacing the broader South Korean market's forecast of 10.5%. Moreover, its projected annual profit growth rate stands at a striking 48.7%, suggesting potential for continued upward trajectory in financial health and shareholder value creation despite current debt concerns not being fully covered by operating cash flow.

JNTC (KOSDAQ:A204270)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: JNTC Co., Ltd. manufactures and sells connectors, hinges, and tempered glass products in South Korea with a market cap of ₩1.26 billion.

Operations: JNTC Co., Ltd. generates revenue primarily through the manufacturing and sales of mobile parts, amounting to ₩402.99 billion. The company focuses on producing connectors, hinges, and tempered glass products for various applications in South Korea.

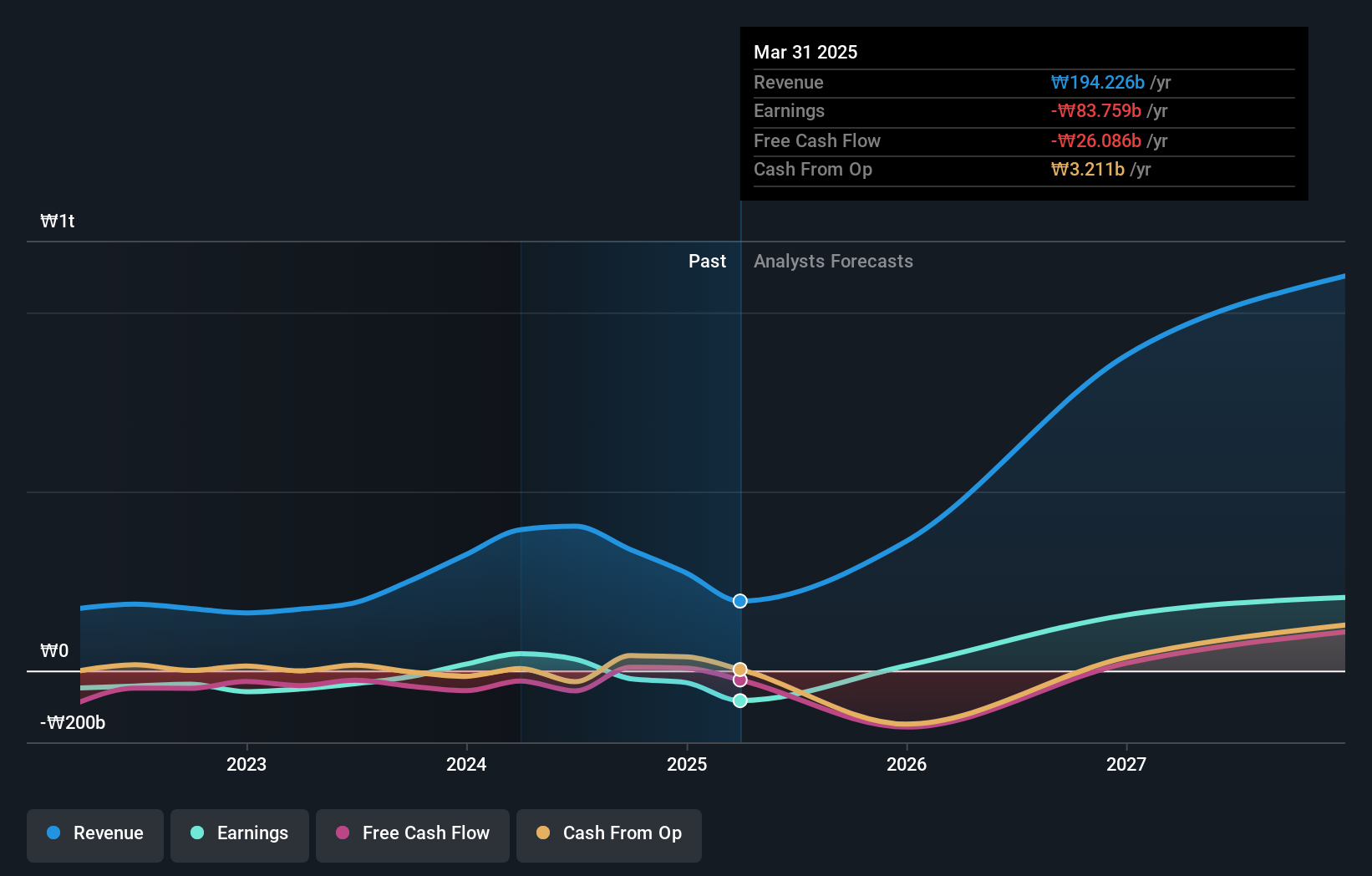

JNTC, amidst evolving market dynamics, is positioned intriguingly within South Korea's tech sector. With a projected revenue growth rate of 18.1% annually, JNTC outstrips the broader market forecast of 10.5%, reflecting its effective adaptation to industry trends such as the shift towards more integrated software solutions. The company has also demonstrated a commitment to innovation with R&D expenses climbing to KRW 5 billion last year, representing an increase of 20% year-over-year. This investment fuels advancements in AI and software technologies that are critical for maintaining competitive edge in fast-paced markets. Additionally, JNTC's earnings are expected to surge by 51.9% annually over the next three years, suggesting robust future prospects despite a highly volatile share price recently observed over the past three months.

- Get an in-depth perspective on JNTC's performance by reading our health report here.

Gain insights into JNTC's historical performance by reviewing our past performance report.

HYBE (KOSE:A352820)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: HYBE Co., Ltd. engages in music production, publishing, and artist development and management businesses, with a market cap of ₩7.20 trillion.

Operations: HYBE Co., Ltd. generates revenue primarily through its Label segment (₩1.28 trillion) and Solution segment (₩1.24 trillion), with additional contributions from its Platform segment (₩361.12 billion). The company focuses on music production, publishing, and artist management while handling internal transactions amounting to -₩732.08 billion.

HYBE, navigating through the dynamic tech landscape of South Korea, has shown a promising trajectory with an expected annual revenue growth of 14.0%, outpacing the broader market's 10.5%. This growth is underpinned by strategic R&D investments which have notably increased, fostering innovation and maintaining its competitive edge in entertainment technology. Moreover, HYBE's recent share repurchase program underscores its commitment to shareholder value, having completed the buyback of 150,000 shares for KRW 26.09 billion. Despite facing challenges like significant one-off losses impacting financials this year, earnings are projected to surge by an impressive 42.2% annually over the next three years, reflecting robust future prospects in a highly competitive sector.

- Dive into the specifics of HYBE here with our thorough health report.

Explore historical data to track HYBE's performance over time in our Past section.

Turning Ideas Into Actions

- Explore the 50 names from our KRX High Growth Tech and AI Stocks screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A204270

JNTC

Provides connector, hinge, and tempered glass products in South Korea.

Reasonable growth potential with questionable track record.