- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A323280

Discovering Soulbrain Holdings And 2 Other Hidden Small Cap Gems In South Korea

Reviewed by Simply Wall St

The South Korea stock market has recently experienced fluctuations, finishing lower in two of the last three trading days after a six-day winning streak. The KOSPI index now sits just beneath the 2,650-point plateau amidst mixed performances from various sectors and a lack of significant global catalysts. In this environment, identifying promising small-cap stocks becomes crucial for investors looking to capitalize on potential growth opportunities. This article highlights three such hidden gems in South Korea, starting with Soulbrain Holdings.

Top 10 Undiscovered Gems With Strong Fundamentals In South Korea

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Samyang | 49.49% | 6.68% | 23.96% | ★★★★★★ |

| Korea Airport ServiceLtd | NA | 3.97% | 42.22% | ★★★★★★ |

| NOROO PAINT & COATINGS | 13.99% | 5.04% | 7.74% | ★★★★★★ |

| Korea Ratings | NA | 1.13% | 0.54% | ★★★★★★ |

| Namuga | 14.47% | 0.88% | 38.25% | ★★★★★★ |

| ONEJOON | 10.13% | 35.30% | -5.78% | ★★★★★☆ |

| iMarketKorea | 28.53% | 5.35% | 1.30% | ★★★★★☆ |

| ASIA Holdings | 34.98% | 8.43% | 16.17% | ★★★★★☆ |

| Daewon Cable | 30.50% | 8.72% | 60.28% | ★★★★★☆ |

| THINKWARE | 36.75% | 21.25% | 22.92% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Soulbrain Holdings (KOSDAQ:A036830)

Simply Wall St Value Rating: ★★★★★☆

Overview: Soulbrain Holdings Co., Ltd. develops, manufactures, and supplies core materials for the semiconductor, display, and secondary battery cell industries in South Korea and internationally with a market cap of ₩1.21 billion.

Operations: Soulbrain Holdings generates revenue primarily from product manufacturing (₩428.42 billion) and distribution and service activities (₩105.34 billion).

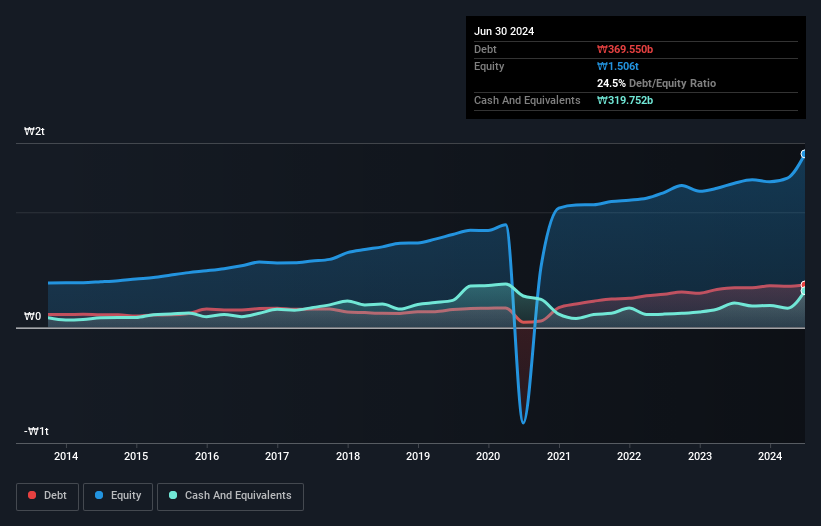

Soulbrain Holdings seems promising with its recent earnings growth of 2.4%, outpacing the Chemicals industry, which saw a 5.6% decline. The company repurchased shares in 2024, indicating confidence in its future prospects. Trading at 68% below estimated fair value, it offers significant potential for investors. Despite a net debt to equity ratio of 3%, considered satisfactory, the firm has high-quality past earnings and well-covered interest payments (7.6x EBIT).

- Click here to discover the nuances of Soulbrain Holdings with our detailed analytical health report.

Examine Soulbrain Holdings' past performance report to understand how it has performed in the past.

People & Technology (KOSDAQ:A137400)

Simply Wall St Value Rating: ★★★★★★

Overview: People & Technology Inc. (KOSDAQ:A137400) specializes in providing coating, calendaring, slitting, automation, and other machinery services with a market cap of ₩1.36 billion.

Operations: The company generates revenue primarily from its Machinery & Industrial Equipment segment, which contributed ₩792.60 million.

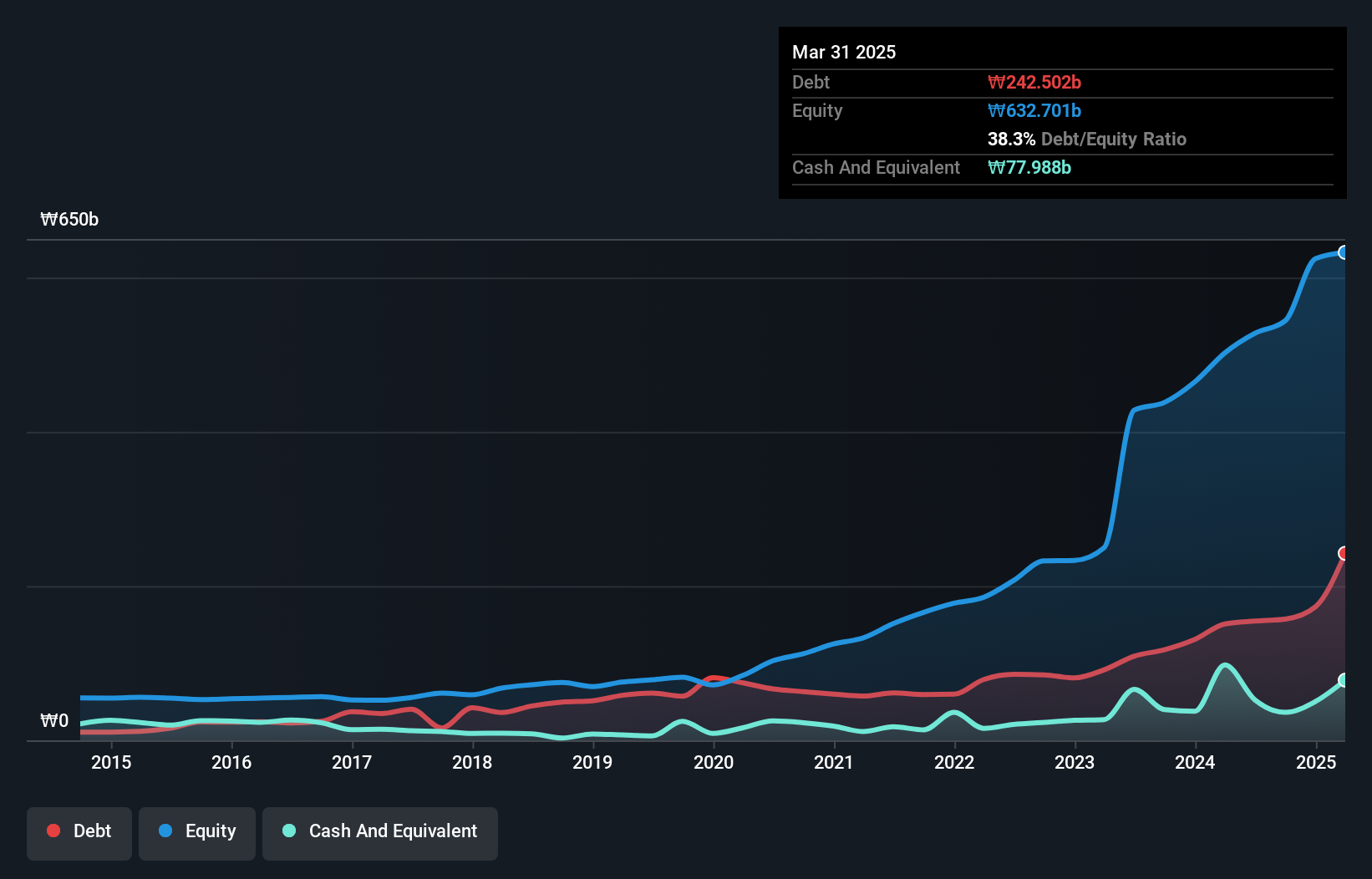

People & Technology, a small cap in South Korea, has shown remarkable growth with earnings up 50.9% over the past year, outpacing the Machinery industry’s 5.4%. The company's debt to equity ratio has improved significantly from 78% to 29.3% over five years, and its net debt to equity ratio stands at a satisfactory 19.4%. Trading at nearly half its estimated fair value (54.9%), it offers an attractive proposition for investors seeking undervalued opportunities in the region.

- Delve into the full analysis health report here for a deeper understanding of People & Technology.

Gain insights into People & Technology's past trends and performance with our Past report.

TaesungLtd (KOSDAQ:A323280)

Simply Wall St Value Rating: ★★★★★☆

Overview: Taesung Co., Ltd. develops, manufactures, and sells PCB automation equipment in South Korea and internationally, with a market cap of ₩626.15 billion.

Operations: Taesung generates revenue primarily from the manufacture and sale of PCB automation equipment, totaling ₩45.68 billion. The company's net profit margin stands at 15.23%.

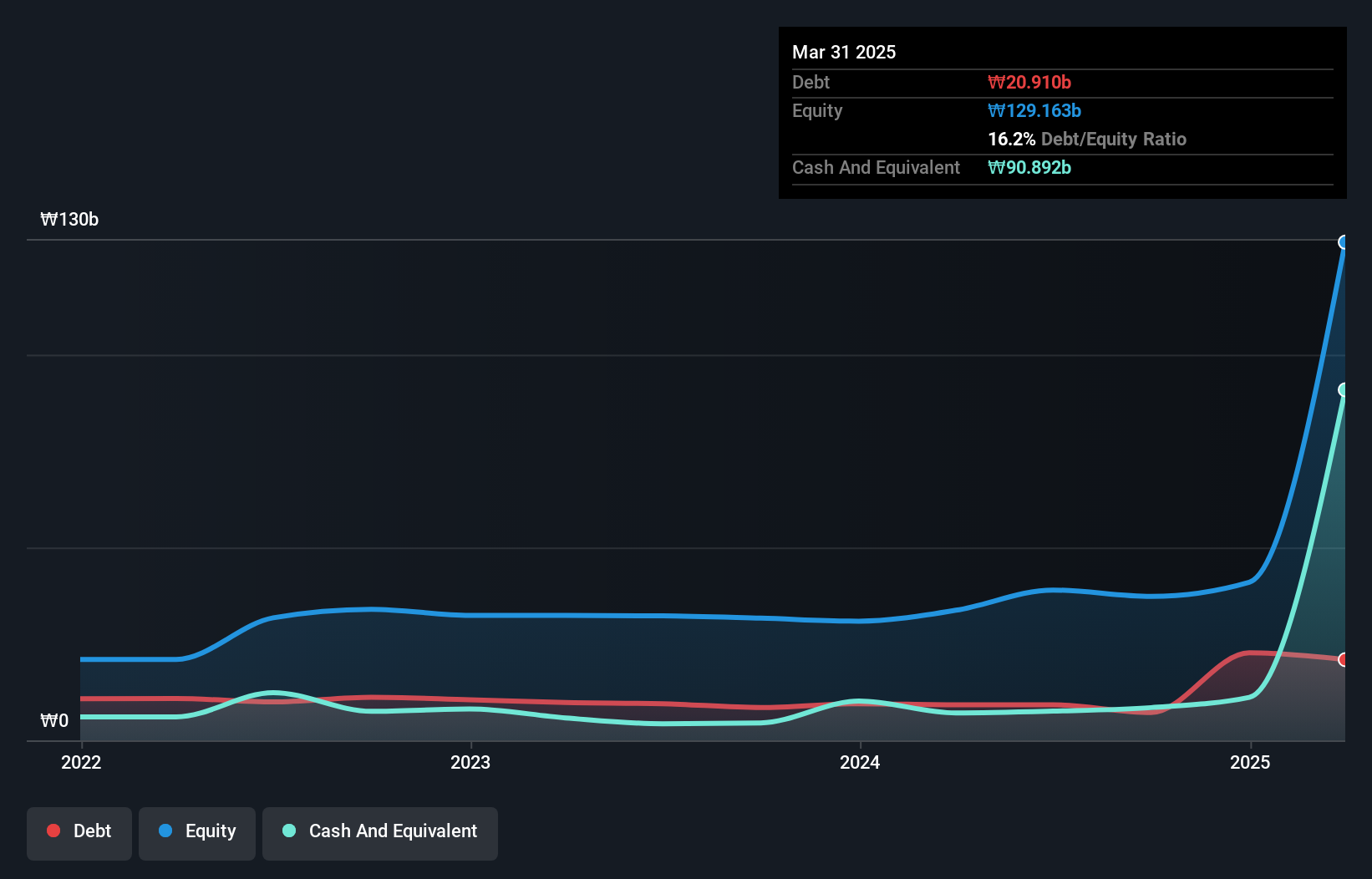

Taesung Ltd. has demonstrated impressive earnings growth of 1482.3% over the past year, significantly outpacing the Semiconductor industry’s -10%. The company's net debt to equity ratio stands at a satisfactory 4.2%, and its interest payments are well covered by EBIT with a coverage ratio of 17.5x. Despite this, shareholders experienced dilution last year, and its share price has been highly volatile over the past three months. Recently added to the S&P Global BMI Index, Taesung remains profitable with no immediate cash runway concerns.

- Click here and access our complete health analysis report to understand the dynamics of TaesungLtd.

Explore historical data to track TaesungLtd's performance over time in our Past section.

Next Steps

- Get an in-depth perspective on all 193 KRX Undiscovered Gems With Strong Fundamentals by using our screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TaesungLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A323280

TaesungLtd

Develops, manufactures, and sells PCB automation equipment in South Korea and internationally.

Excellent balance sheet with acceptable track record.