- South Korea

- /

- Electronic Equipment and Components

- /

- KOSDAQ:A181340

Is isMedia's (KOSDAQ:181340) Share Price Gain Of 214% Well Earned?

Unless you borrow money to invest, the potential losses are limited. But if you pick the right business to buy shares in, you can make more than you can lose. For example, the isMedia Co., Ltd. (KOSDAQ:181340) share price had more than doubled in just one year - up 214%. It's up an even more impressive 283% over the last quarter. Also impressive, the stock is up 178% over three years, making long term shareholders happy, too.

See our latest analysis for isMedia

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Over the last twelve months isMedia went from profitable to unprofitable. While this may prove temporary, we'd consider it a negative, so we would not have expected to see the share price up. We might get a clue to explain the share price move by looking to other metrics.

Unfortunately isMedia's fell 70% over twelve months. So the fundamental metrics don't provide an obvious explanation for the share price gain.

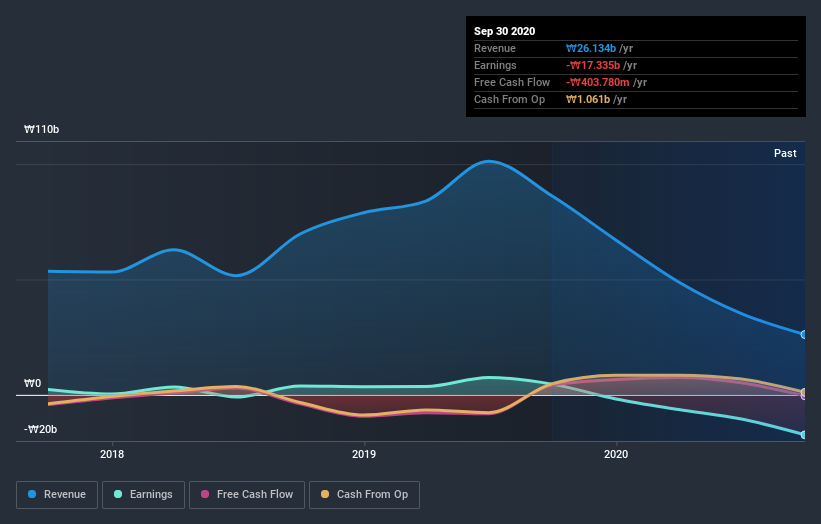

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

If you are thinking of buying or selling isMedia stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

It's nice to see that isMedia shareholders have gained 214% (in total) over the last year. That's better than the annualized TSR of 41% over the last three years. The improving returns to shareholders suggests the stock is becoming more popular with time. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should learn about the 3 warning signs we've spotted with isMedia (including 2 which are a bit unpleasant) .

But note: isMedia may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

When trading isMedia or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if isMedia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A181340

isMedia

Researches, develops, manufactures, and sells process and automatic inspection systems for compact camera module (CCM) mounted on mobile phones.

Excellent balance sheet and good value.

Market Insights

Community Narratives