- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A089030

Techwing And Two More KRX Growth Stocks With High Insider Ownership

Reviewed by Simply Wall St

The South Korean market has shown promising growth, with a 2.2% increase over the last week and an impressive 11% rise over the past year, alongside forecasts predicting annual earnings growth of 30%. In this robust economic environment, stocks like Techwing that combine high insider ownership with substantial growth potential are particularly compelling.

Top 10 Growth Companies With High Insider Ownership In South Korea

| Name | Insider Ownership | Earnings Growth |

| ALTEOGEN (KOSDAQ:A196170) | 26.6% | 73.1% |

| Global Tax Free (KOSDAQ:A204620) | 18.1% | 72.4% |

| Seojin SystemLtd (KOSDAQ:A178320) | 27.9% | 54% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.3% | 36.4% |

| Vuno (KOSDAQ:A338220) | 19.5% | 105% |

| Park Systems (KOSDAQ:A140860) | 33.1% | 35.6% |

| UTI (KOSDAQ:A179900) | 34.1% | 122.7% |

| HANA Micron (KOSDAQ:A067310) | 20% | 96.3% |

| INTEKPLUS (KOSDAQ:A064290) | 16.3% | 77.4% |

| Techwing (KOSDAQ:A089030) | 18.7% | 77.8% |

Let's explore several standout options from the results in the screener.

Techwing (KOSDAQ:A089030)

Simply Wall St Growth Rating: ★★★★★★

Overview: Techwing, Inc. operates in the semiconductor industry, focusing on the development, manufacture, sale, and servicing of inspection equipment both domestically in South Korea and internationally, with a market capitalization of approximately ₩2.40 trillion.

Operations: The company generates revenue primarily from the development, manufacture, sale, and servicing of semiconductor inspection equipment across various international markets.

Insider Ownership: 18.7%

Return On Equity Forecast: 43% (2027 estimate)

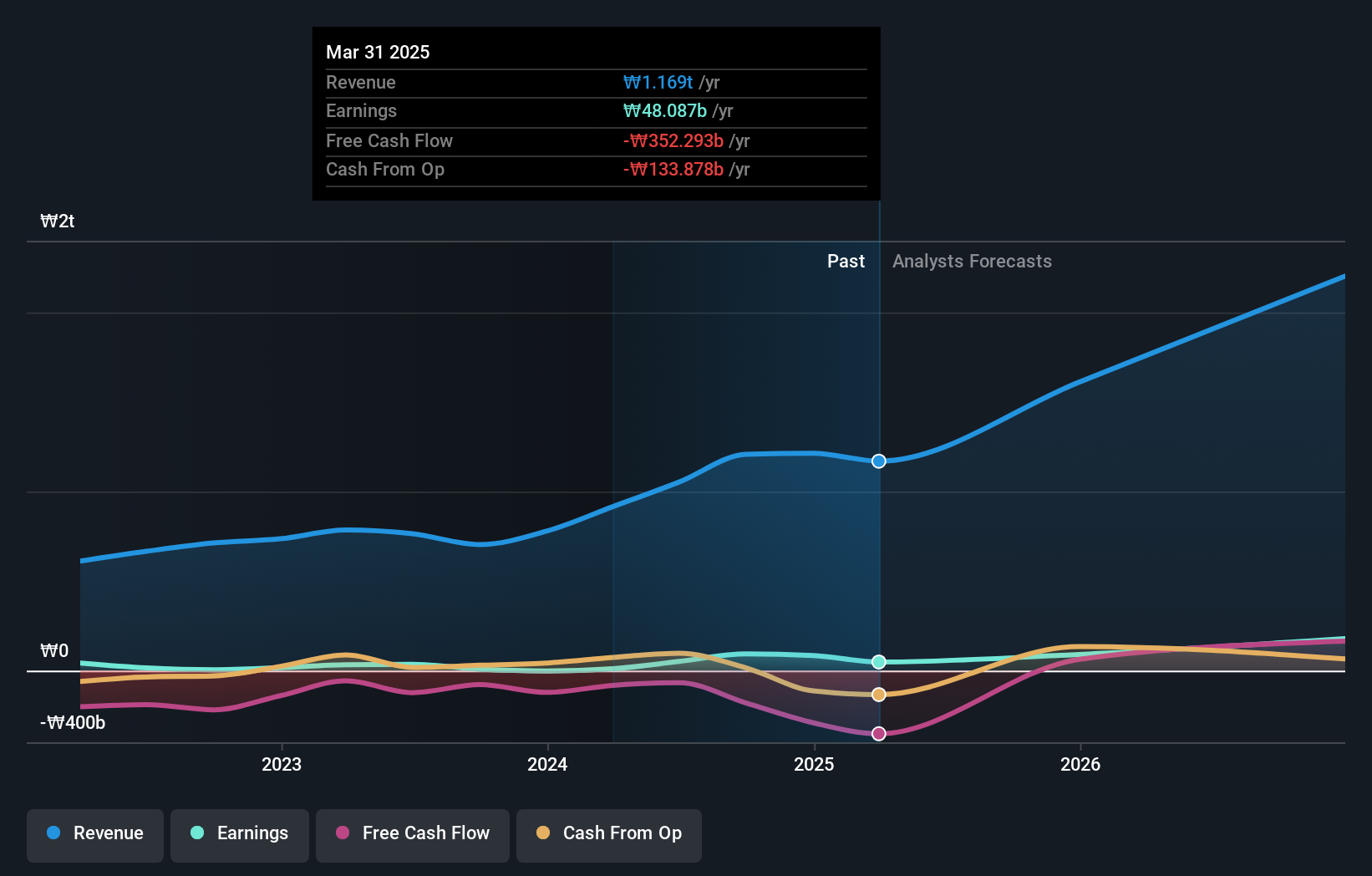

Techwing, a South Korean company, is poised for significant growth with its revenue expected to increase by 47.2% annually, outpacing the local market's 10.7%. Although profitability is on the horizon within three years, financial challenges persist as earnings barely cover interest payments. Despite this, Techwing's return on equity could reach a very high 43.4%, signaling potential efficiency gains. However, investors should note its share price has been highly volatile recently.

- Click here to discover the nuances of Techwing with our detailed analytical future growth report.

- The analysis detailed in our Techwing valuation report hints at an inflated share price compared to its estimated value.

Seojin SystemLtd (KOSDAQ:A178320)

Simply Wall St Growth Rating: ★★★★★★

Overview: Seojin System Co., Ltd. specializes in manufacturing telecom equipment, repeaters, mechanical products, and LED equipment, with a market capitalization of approximately ₩1.80 billion.

Operations: Seojin System's revenue is primarily generated from its EMS segment, which brought in ₩1.22 billion, and its semiconductor operations, contributing ₩0.16 billion.

Insider Ownership: 27.9%

Return On Equity Forecast: 25% (2027 estimate)

Seojin System Ltd, a South Korean company, is forecasted to experience robust earnings growth of 54% annually, significantly outstripping the local market's 29.6%. This growth is supported by an anticipated revenue increase of 30.5% per year. Despite these positives, the company faces challenges with a reduced profit margin of 1.2%, down from last year's 4.2%, and a share price that has shown considerable volatility over the past three months. Moreover, there has been shareholder dilution in the past year which might concern investors looking for stable ownership stakes.

- Get an in-depth perspective on Seojin SystemLtd's performance by reading our analyst estimates report here.

- According our valuation report, there's an indication that Seojin SystemLtd's share price might be on the cheaper side.

Doosan (KOSE:A000150)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Doosan Corporation operates in heavy industry, machinery manufacturing, and apartment construction across various regions including South Korea, the United States, Asia, the Middle East, and Europe with a market cap of approximately ₩3.40 billion.

Operations: The company's revenue is derived from heavy industry, machinery manufacturing, and apartment construction activities across several regions including South Korea, the United States, Asia, the Middle East, and Europe.

Insider Ownership: 38.9%

Return On Equity Forecast: 22% (2027 estimate)

Doosan Corporation, trading at a significant discount to its estimated fair value, is poised for substantial earnings growth with forecasts predicting a 72.89% annual increase. Despite this optimistic profit outlook and expectations of becoming profitable within three years, its revenue growth projection of 3.6% lags behind the South Korean market average of 10.7%. Additionally, the company's share price has been highly volatile recently. Recent financials show a turnaround from last year's losses to profits and an improved earnings per share.

- Click to explore a detailed breakdown of our findings in Doosan's earnings growth report.

- Our valuation report unveils the possibility Doosan's shares may be trading at a discount.

Where To Now?

- Unlock our comprehensive list of 84 Fast Growing KRX Companies With High Insider Ownership by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Techwing might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A089030

Techwing

Develops, manufactures, sells, and services semiconductor inspection equipment in South Korea and internationally.

Exceptional growth potential with imperfect balance sheet.