Stock Analysis

- South Korea

- /

- Communications

- /

- KOSDAQ:A178320

Techwing And Two More KRX Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

The South Korean market has shown robust performance, gaining 1.3% over the past week and 8.4% over the last year, with earnings expected to grow by 30% annually. In such a thriving environment, stocks like Techwing that combine high insider ownership with significant growth potential stand out as particularly compelling opportunities for investors looking to benefit from aligned interests and strong market insights.

Top 10 Growth Companies With High Insider Ownership In South Korea

| Name | Insider Ownership | Earnings Growth |

| ALTEOGEN (KOSDAQ:A196170) | 26.6% | 73.1% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.3% | 36.4% |

| Global Tax Free (KOSDAQ:A204620) | 18.1% | 72.4% |

| Seojin SystemLtd (KOSDAQ:A178320) | 26.2% | 48.1% |

| Park Systems (KOSDAQ:A140860) | 33.1% | 35.6% |

| UTI (KOSDAQ:A179900) | 34.1% | 122.7% |

| Vuno (KOSDAQ:A338220) | 19.5% | 105% |

| HANA Micron (KOSDAQ:A067310) | 20% | 96.3% |

| INTEKPLUS (KOSDAQ:A064290) | 16.3% | 77.4% |

| Techwing (KOSDAQ:A089030) | 18.7% | 77.8% |

Here we highlight a subset of our preferred stocks from the screener.

Techwing (KOSDAQ:A089030)

Simply Wall St Growth Rating: ★★★★★★

Overview: Techwing, Inc., a company based in South Korea, operates globally in the development, manufacturing, sale, and servicing of semiconductor inspection equipment with a market capitalization of approximately ₩2.39 trillion.

Operations: The company generates revenue primarily from the development, manufacturing, sale, and servicing of semiconductor inspection equipment across both domestic and international markets.

Insider Ownership: 18.7%

Techwing, a South Korean company, showcases a volatile share price but holds promising growth prospects with its revenue expected to increase by 47.2% annually, outpacing the market's 10.7%. Despite challenges in covering interest payments with earnings, Techwing is anticipated to turn profitable within three years, featuring an exceptionally high forecasted Return on Equity of 43.4%. No insider trading activity has been reported recently, indicating stable insider confidence amidst significant growth trajectories.

- Unlock comprehensive insights into our analysis of Techwing stock in this growth report.

- Our valuation report here indicates Techwing may be overvalued.

Seojin SystemLtd (KOSDAQ:A178320)

Simply Wall St Growth Rating: ★★★★★★

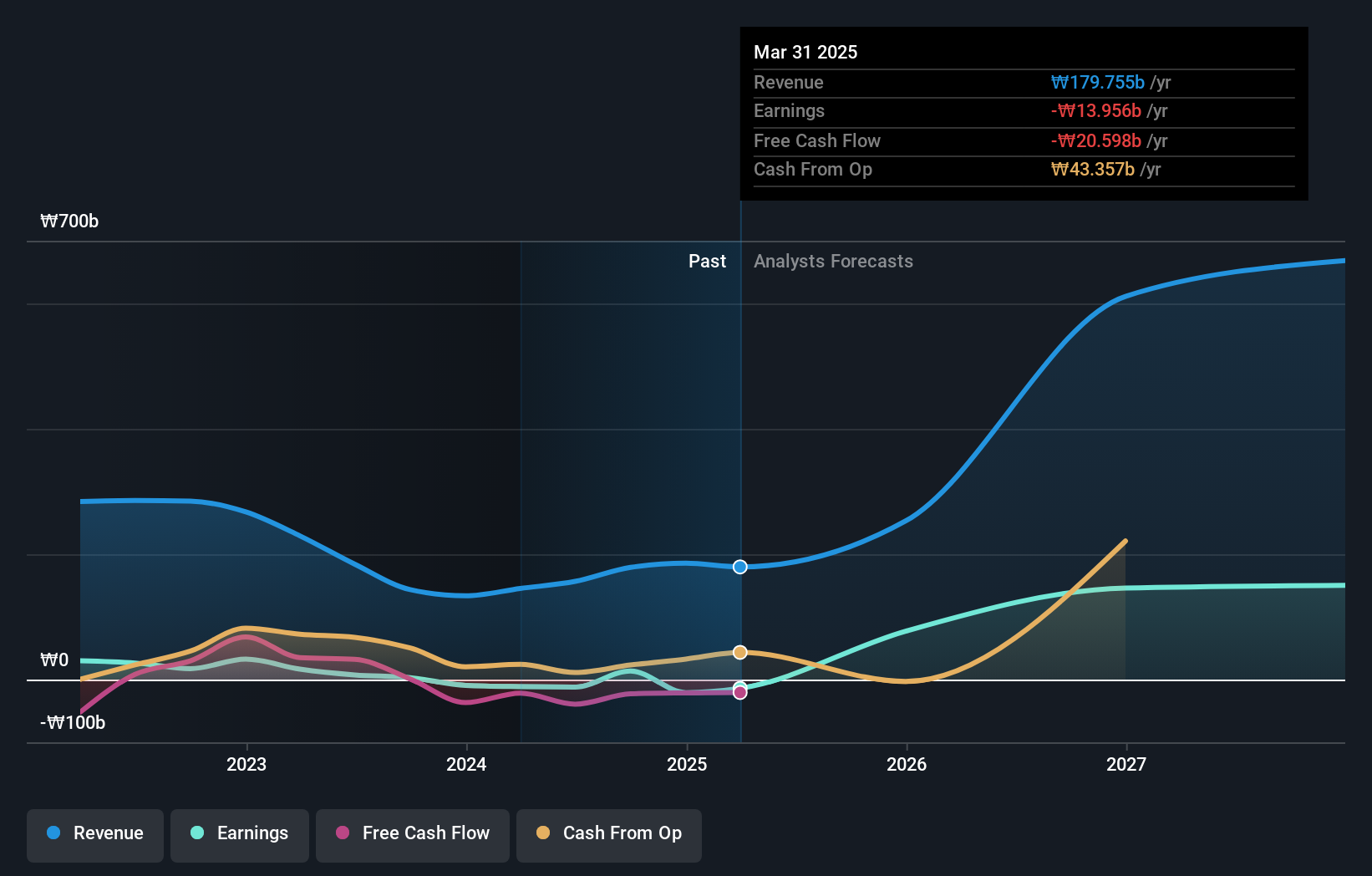

Overview: Seojin System Co., Ltd specializes in manufacturing telecom equipment, repeaters, mechanical products, and LED and other equipment, with a market capitalization of approximately ₩1.81 billion.

Operations: Seojin System's revenue is primarily derived from its EMS segment, generating ₩1.22 billion, followed by semiconductor sales at ₩0.16 billion.

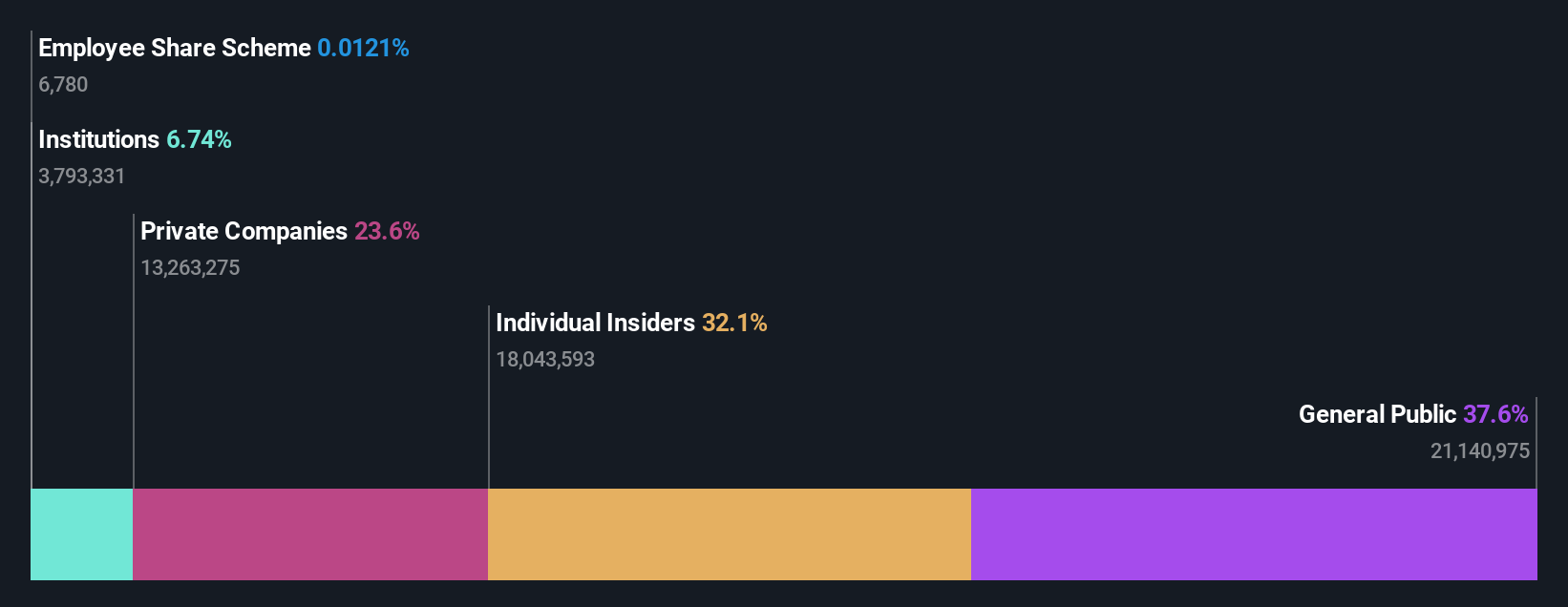

Insider Ownership: 26.2%

Seojin System Ltd, despite a decline in profit margins from 4.2% to 1.2%, is poised for substantial growth with earnings expected to rise by 48.06% annually and revenue forecasted to grow at 28.5% per year, both well above the South Korean market averages. The stock is currently trading at a significant discount of 49.6% below its estimated fair value, suggesting potential undervaluation. However, financial challenges persist as interest payments are not sufficiently covered by earnings, coupled with high share price volatility over recent months.

- Click here to discover the nuances of Seojin SystemLtd with our detailed analytical future growth report.

- Our valuation report unveils the possibility Seojin SystemLtd's shares may be trading at a discount.

Doosan (KOSE:A000150)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Doosan Corporation operates in heavy industry, machinery manufacturing, and apartment construction across regions including South Korea, the United States, Asia, the Middle East, and Europe, with a market capitalization of approximately ₩3.49 billion.

Operations: The company's revenue is derived primarily from heavy industry, machinery manufacturing, and apartment construction activities across various global regions.

Insider Ownership: 38.9%

Doosan Corporation, significantly undervalued at 57.1% below its fair value, is on a trajectory to profitability within three years with earnings expected to surge by 72.89% annually. Despite slower revenue growth at 3.6% per year compared to the South Korean market average of 10.7%, recent financials show a strong recovery from previous losses, reporting KRW 180.97 billion in sales and KRW 4.98 billion in net income for Q1 2024—a substantial improvement from last year's net loss.

- Get an in-depth perspective on Doosan's performance by reading our analyst estimates report here.

- In light of our recent valuation report, it seems possible that Doosan is trading behind its estimated value.

Taking Advantage

- Navigate through the entire inventory of 84 Fast Growing KRX Companies With High Insider Ownership here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Seojin SystemLtd is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A178320

Seojin SystemLtd

Provides telecom equipment, repeaters, mechanical products, and LED and other equipment.

Exceptional growth potential and good value.